-

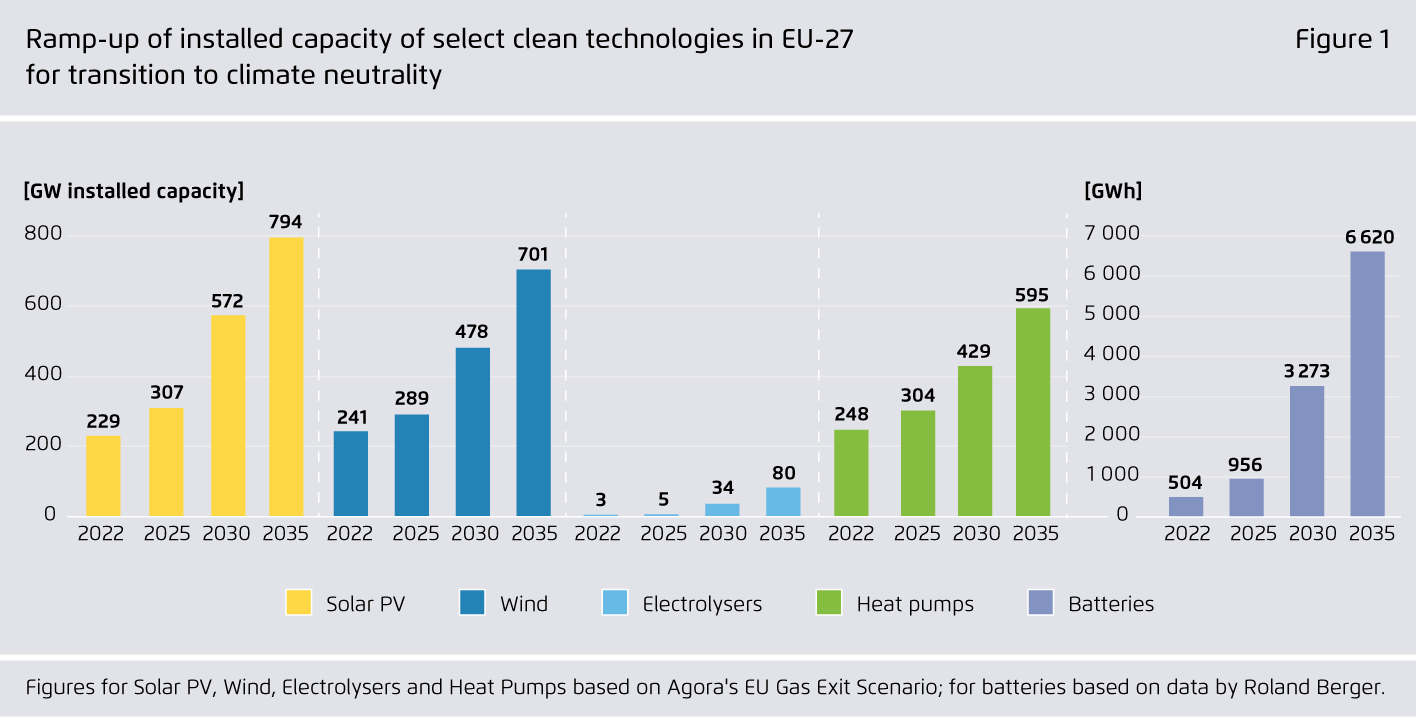

Europe’s transition to climate neutrality requires a fast increase in the annual deployment of clean technologies, in particular solar PV, onshore and offshore wind, batteries, heat pumps and electrolysers.

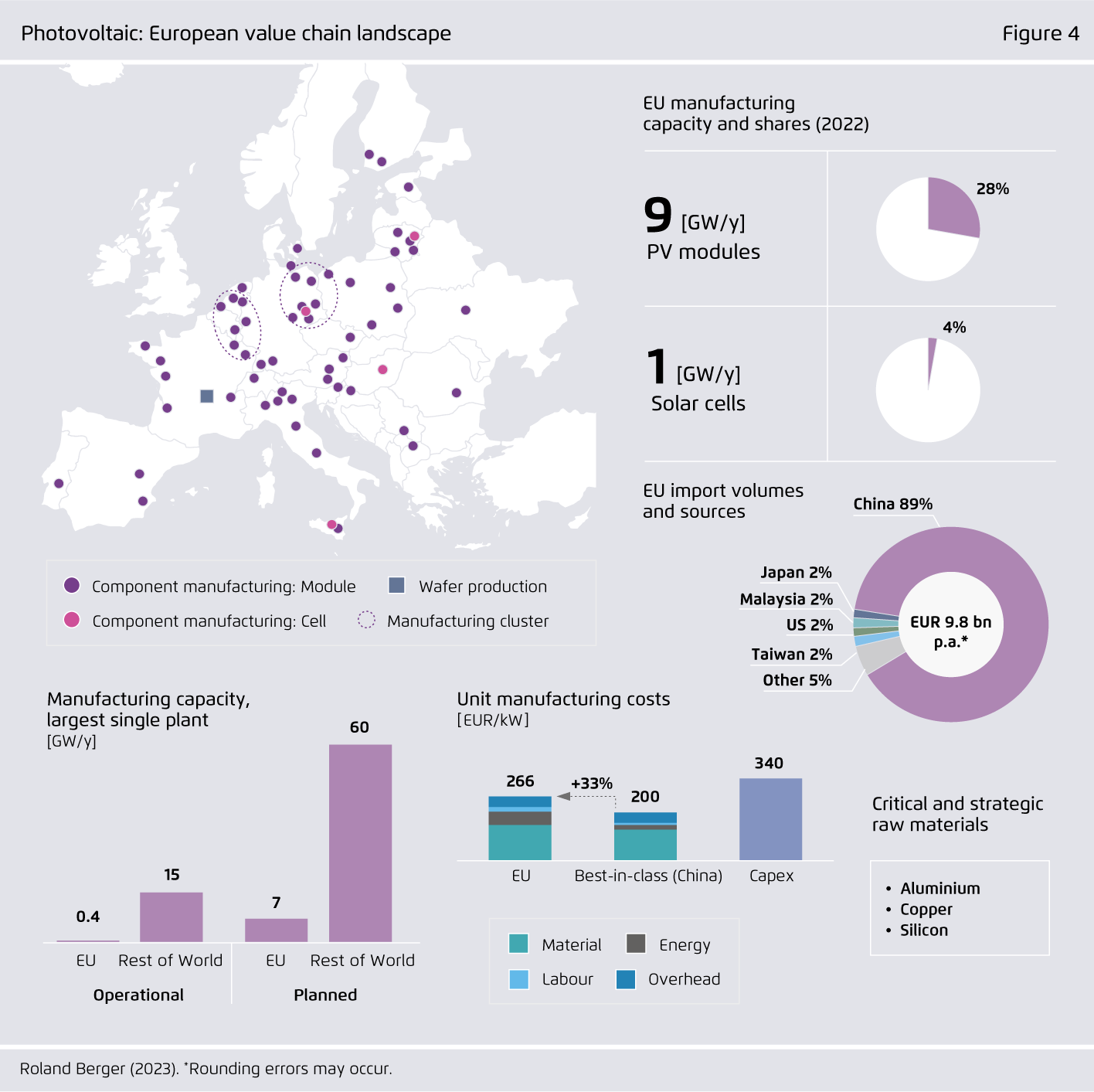

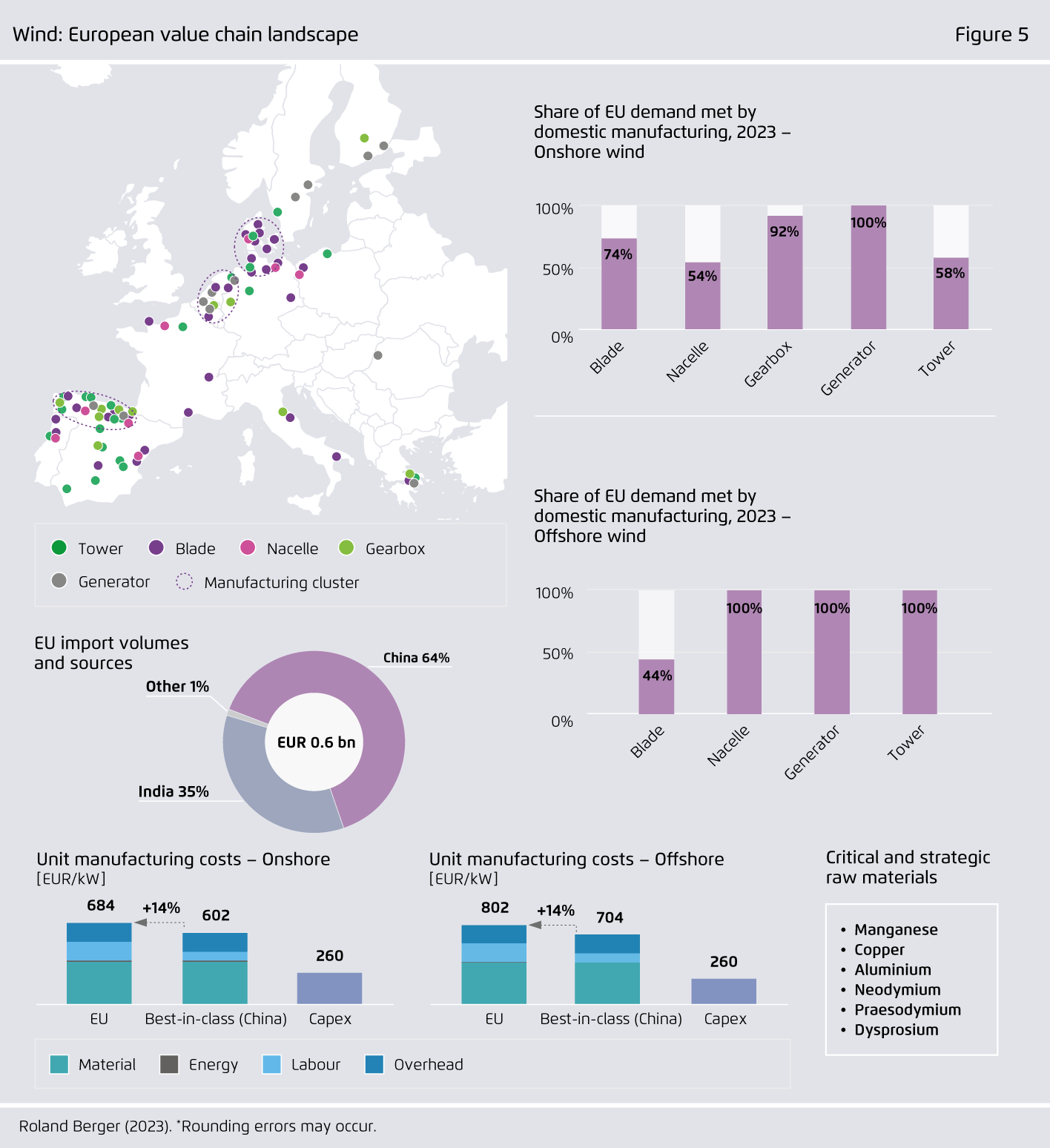

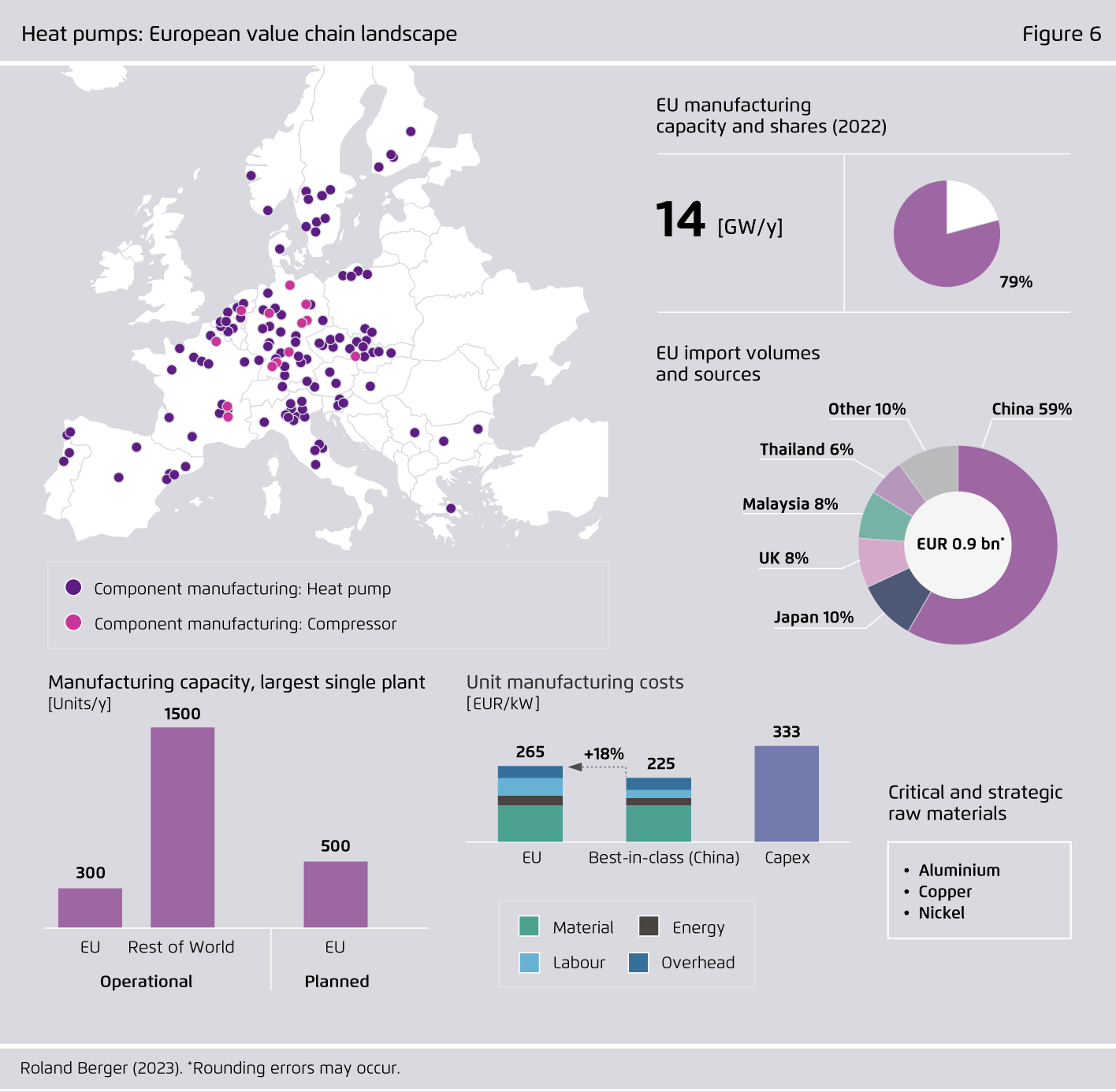

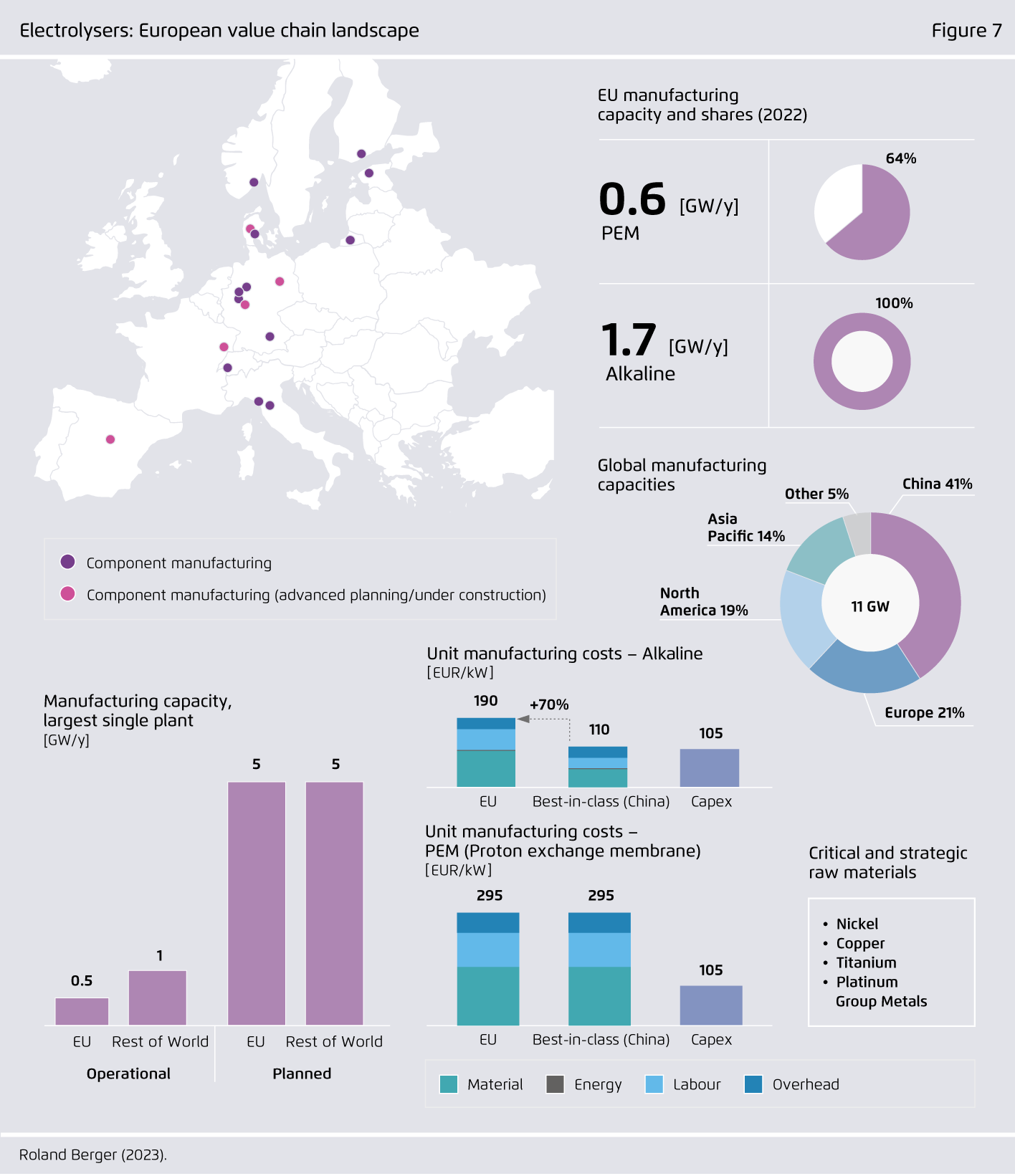

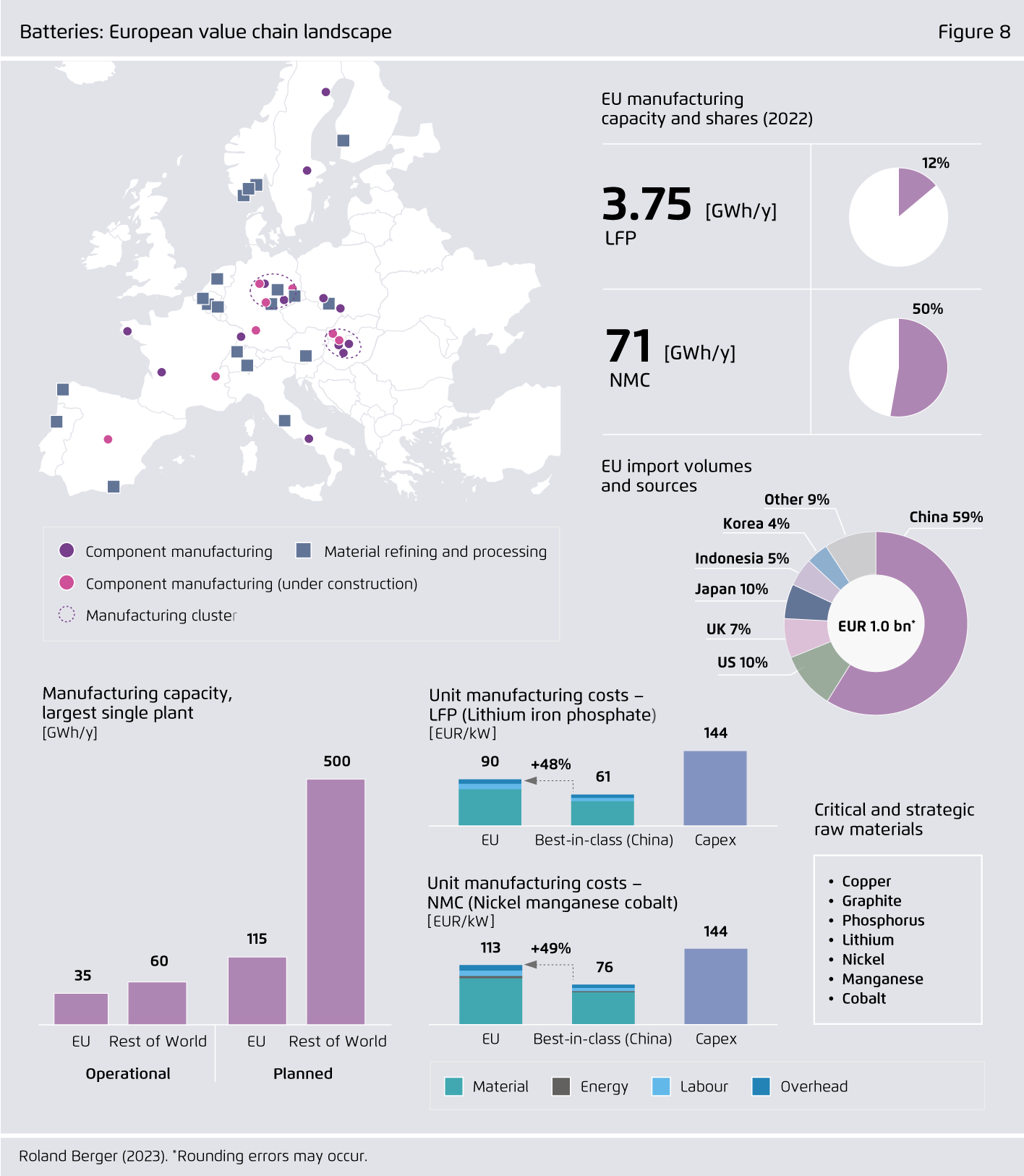

However, Europe cannot take the smooth functioning of international clean-tech value chains for granted but should make them more resilient. More resilience will result from diversifying supplies through domestic mining and strategic international partnerships, by enhancing material circularity and by increasing clean-tech manufacturing in Europe.

-

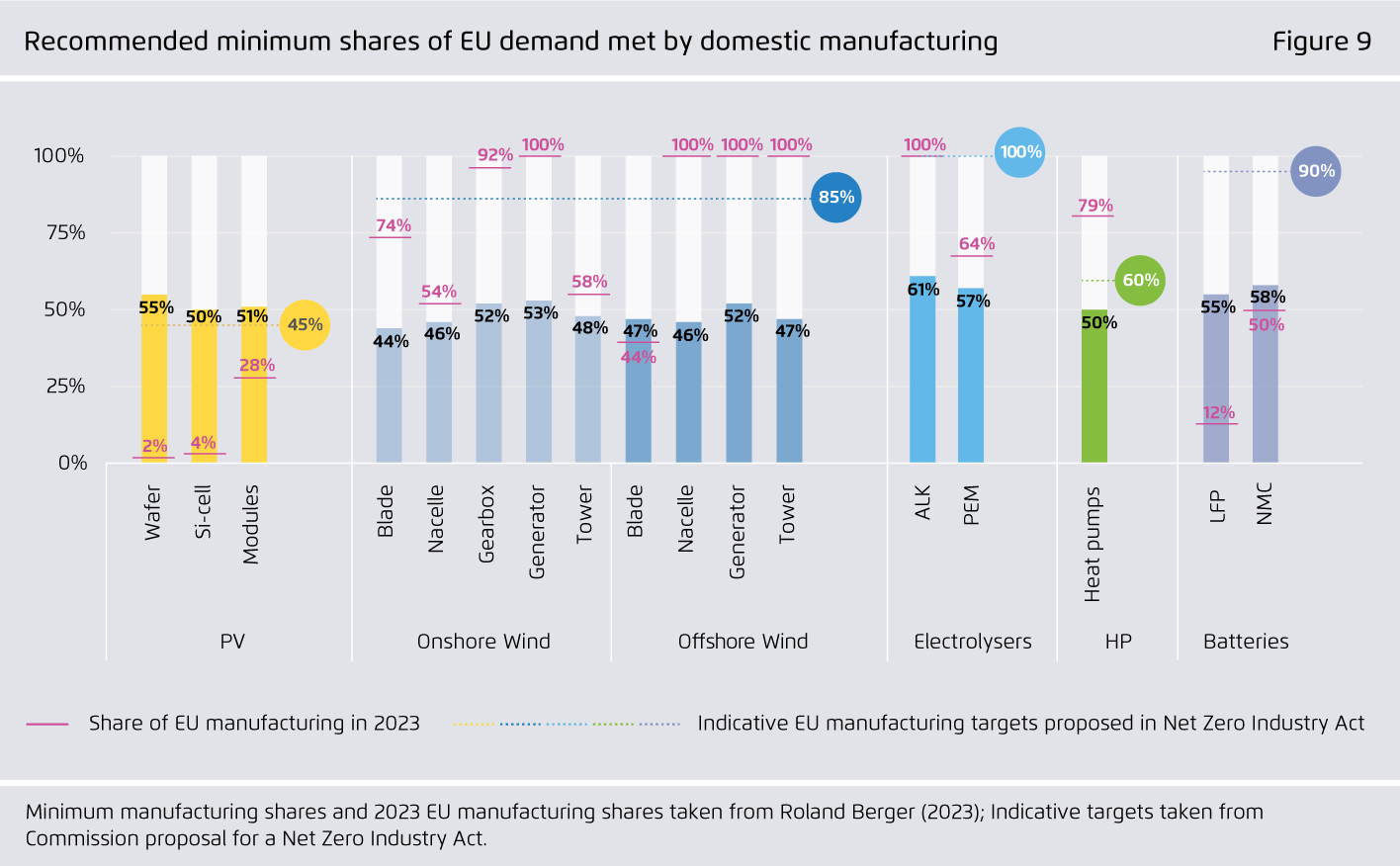

The analysis identifies minimum shares of EU clean-tech manufacturing as an insurance against supply chain risks.

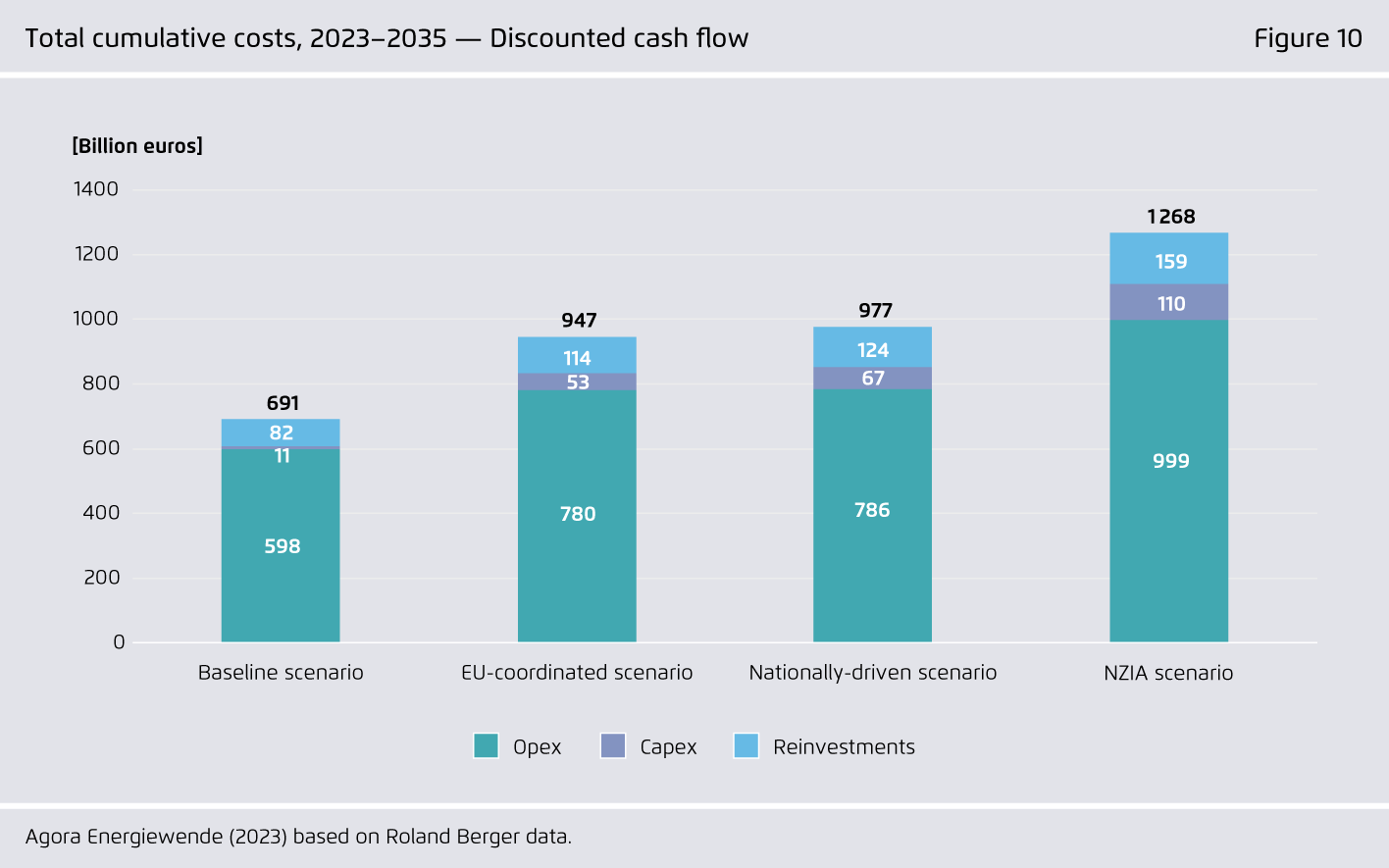

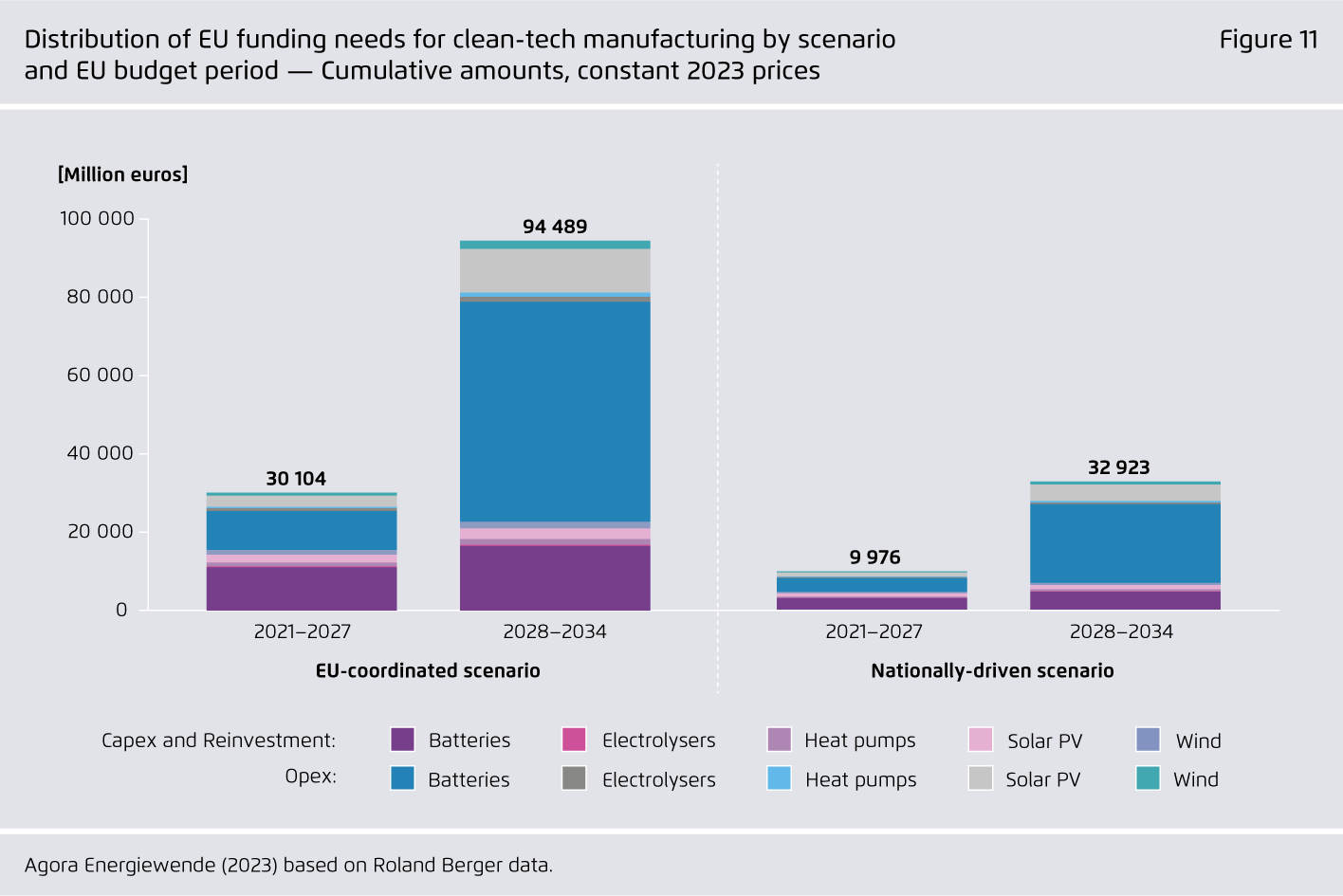

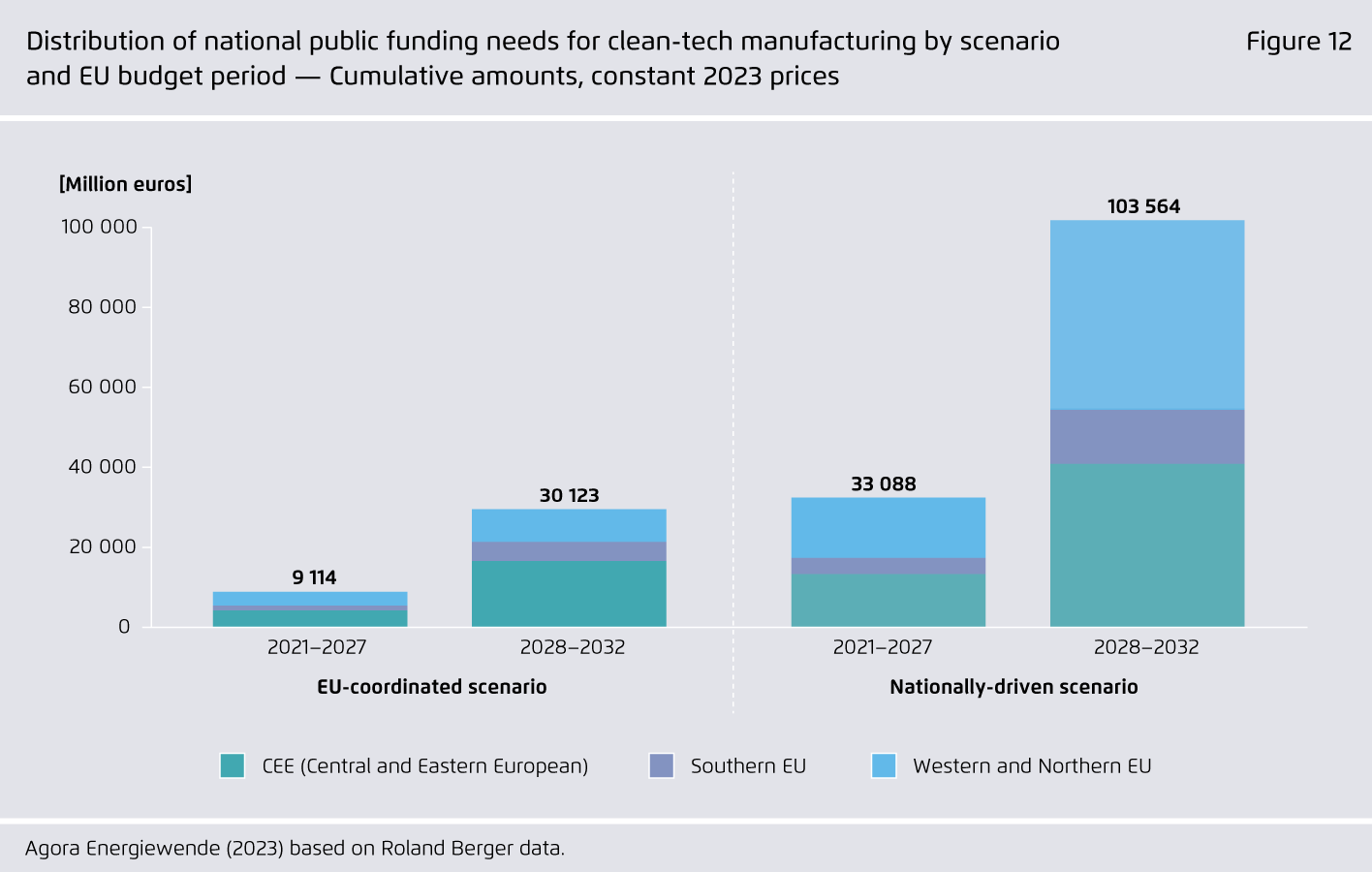

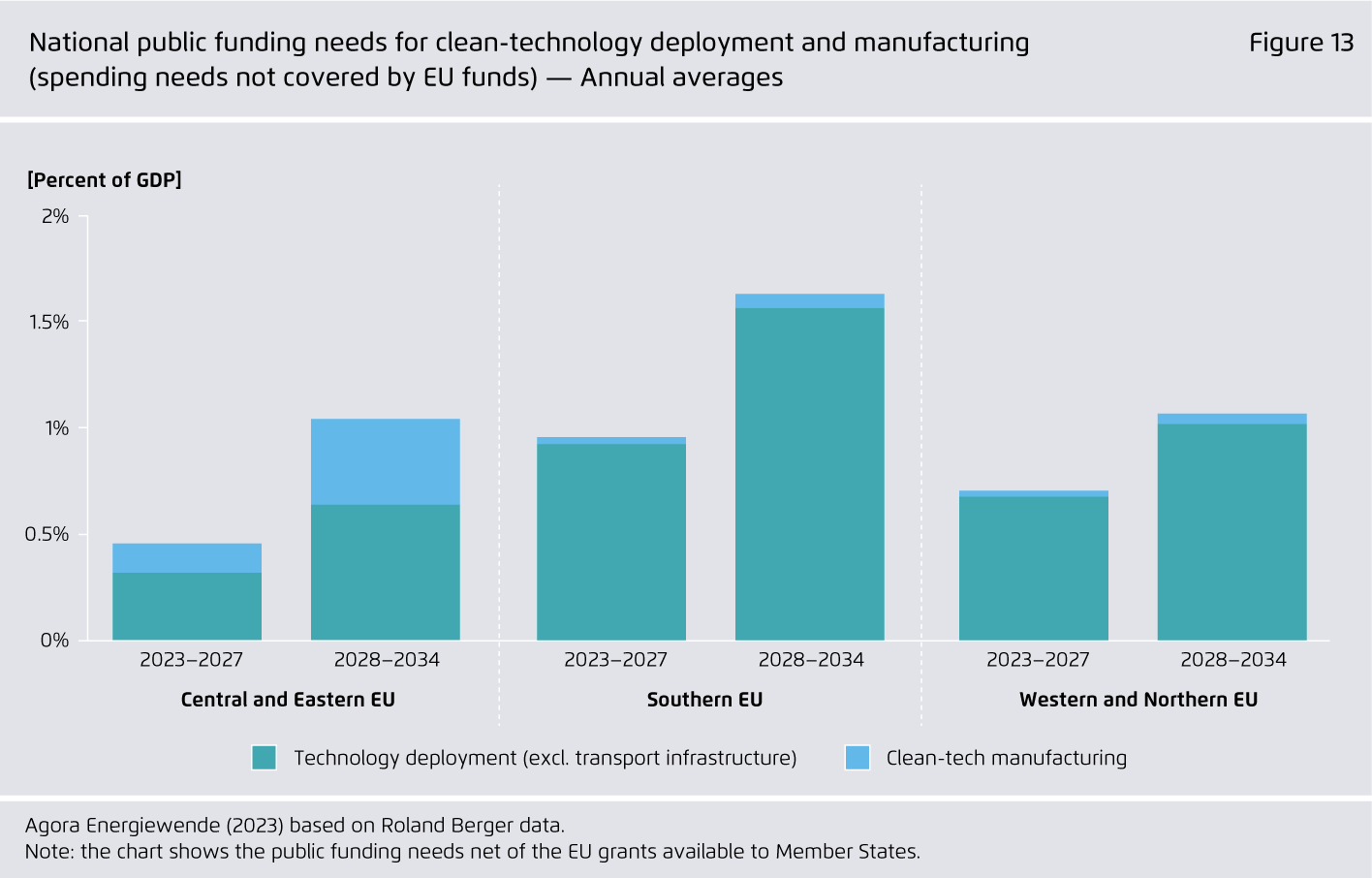

Estimated public funding needs for scaling EU manufacturing to these levels are between 10–30 billion euros until 2027 and 32.9–94.5 billion euros from 2028 until 2034, with a significant share required to reduce operational cost. Indicative technology-specific targets set in the Net Zero Industry Act for batteries, wind and electrolysers are higher and would require more public funding.

-

A credible approach to closing the production cost gap is essential for scaling clean-tech manufacturing in Europe, to reach critical scale and develop local supply networks.

To ensure long-term competitiveness without support, dedicated public funding should be part of a broader policy package that covers access to finance, competition on quality (including sustainability), a robust clean-tech demand pipeline and investment into innovation.

-

EU countries should recognise the necessity to cooperate with technology and value chain leaders and seek to attract leading clean-tech suppliers to establish manufacturing in Europe.

To achieve a gradual de-risking of current value-chain dependencies, support offers should, however, be accompanied by safeguards that ensure a lasting commitment of companies deciding to establish production in Europe.

Ensuring resilience in Europe’s energy transition

The role of EU clean-tech manufacturing

Preface

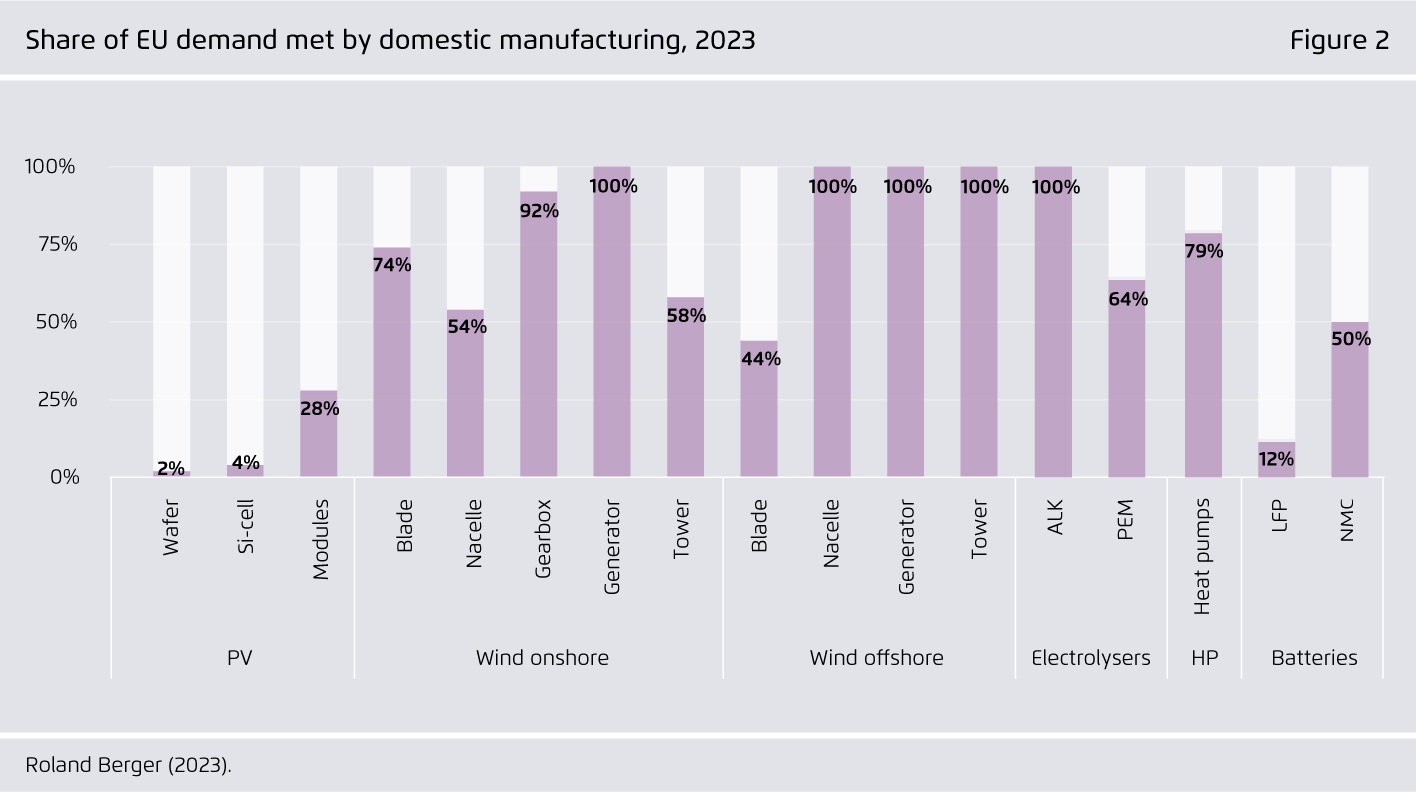

Europe relies to a high extent on imports of clean technologies such as solar PV or batteries. Recent events show that it would be naive to take the secure supply of critical raw materials, of refined materials, of components or final clean-tech products for granted.

Minimum shares of EU clean-tech manufacturing could – next to supply diversification and enhanced recycling – function as insurance in clean-tech value chains.

But what would be appropriate minimum shares of EU manufacturing in different clean-tech value chains? And what measures seem suitable to incentivise the establishment of clean-tech manufacturing in Europe? These questions are currently hotly debated in Europe, in view of the demand pull by the US Inflation Reduction Act and rising trade tensions between the US and China.

Based on an analysis by Roland Berger, we recommend a package of measures for scaling EU clean-tech manufacturing so that it makes a lasting contribution to the resilience of Europe’s clean energy transition.

Key findings

Bibliographical data

Downloads

-

Main Report

pdf 4 MB

Ensuring resilience in Europe’s energy transition

The role of EU clean-tech manufacturing

-

Slide Deck

pdf 4 MB

EU Clean Tech Industry

Market analysis and market modelling by Roland Berger

All figures in this publication

Ramp-up of installed capacity of select clean technologies in EU-27 for transition to climate neutrality

Figure 1 from Ensuring resilience in Europe’s energy transition on page 12

Share of EU demand met by domestic manufacturing, 2023

Figure 2 from Ensuring resilience in Europe’s energy transition on page 13

![[Translate to English:] Janna Hoppe](/fileadmin/_processed_/f/8/csm_Janna_Hoppe_WEB_f627bb79a6.jpg)