-

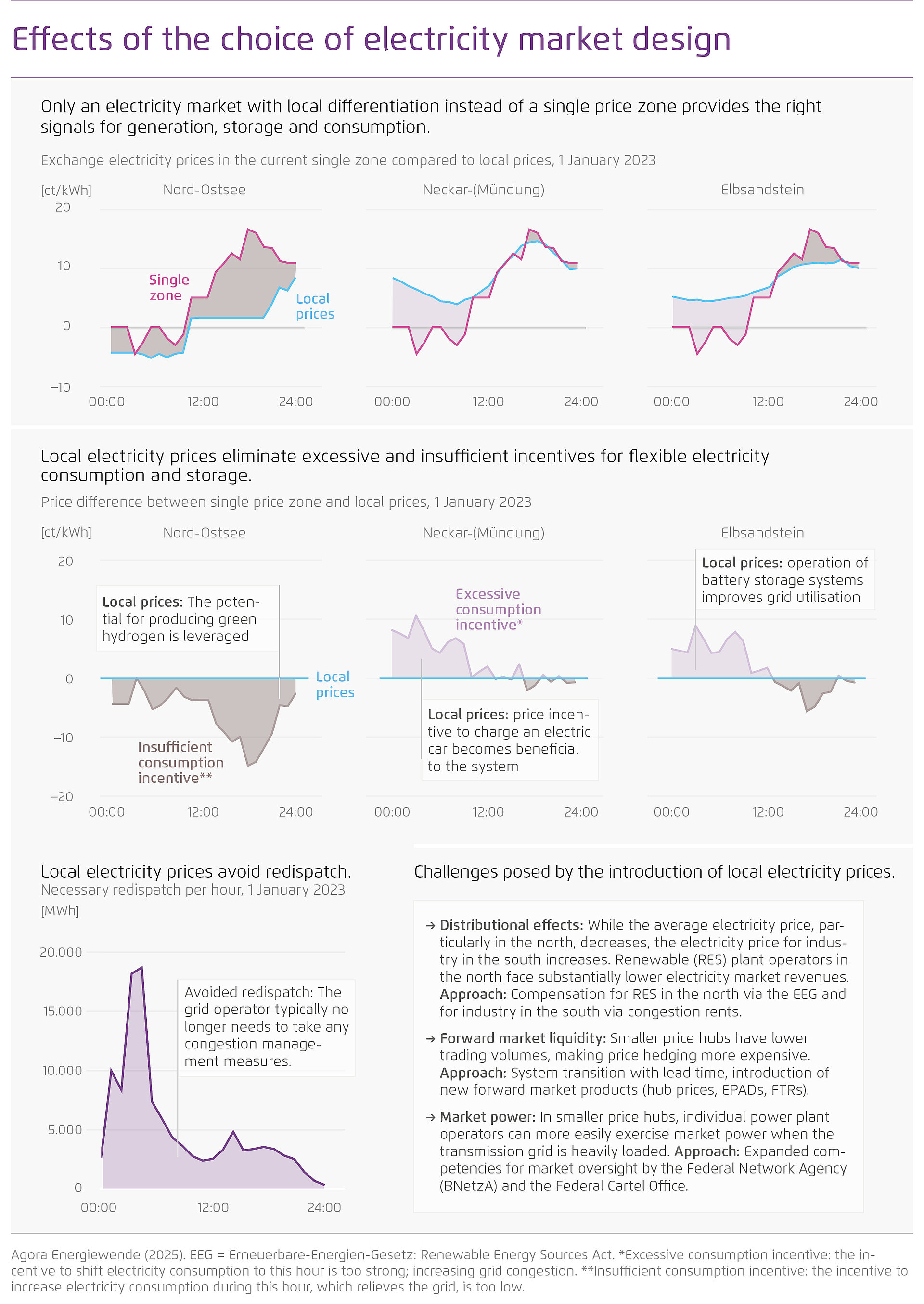

Germany’s single electricity price ignores transmission bottlenecks, sending increasingly misleading signals to investors, generators and consumers.

Grid operators must correct these misallocations for example by reducing wind output in the north and increasing conventional generation in the south (“redispatch”). The cost of such interventions rose to 3.2 billion euros in 2023 and is expected to keep rising as more flexible consumers and storage systems connect to the grid and react to false price signals.

-

Local electricity prices would render most interventions by grid operators superfluous.

They put a price on grid congestion, creating market signals for generation, consumption and storage when electricity is locally abundant and inexpensive. This enables the efficient integration of electric vehicles, batteries, electrolysers and heat pumps. In the long run, only truly granular prices can provide the right incentives.

-

Introducing local electricity prices would lower costs for most consumers, while disadvantaged industrial consumers in the south could be compensated without extra public funds.

In 2023, electricity prices would have been six euros per megawatt-hour (MWh) lower on average. Congestion rent revenues could finance compensation for southern industries facing higher costs. However, lower market prices increase the need for financial support for renewables mainly generated in the north.

-

A locally organised electricity market would make a climate-neutral power system more cost-efficient.

Despite the coalition agreement’s commitment to a single bidding zone, Germany should work with European partners on a roadmap towards local pricing. A first step could be adding local investment signals to the current price zone. Before moving to full local pricing, liquid forward markets and nationwide investment viability for renewables should be secured.

This content is also available in: German

Local electricity prices in Germany

How integrating grid realities into the electricity market saves costs

Summary

Germany’s single price zone is straining the power system, driving up redispatch and distorting electricity market signals, also impacting neighbouring countries. The European transmission system operators' (ENTSO-E) assessment and the related opinion of the Agency for the Cooperation of Energy Regulators (ACER) found clear gains from smaller price zones in Germany.

Against this backdrop, an Agora Energiewende study – with a summary now available in English – argues for a shift to more granular local pricing. Redispatch costs rose from 1.3 billion euros in 2019 to 3.2 billion in 2023 in Germany; local prices could cut these costs, strengthen security of supply and in 2023 would have lowered average German power costs by around 6 euros/MWh for households and businesses. Local prices better align regional supply and demand, use the grid more evenly and incentivise flexibility (batteries, EVs, heat pumps, electrolysers).

The study compares 1 national zone, 3 split zones and 22 local zones and found: more granular pricing reduces redispatch and repeated zone redrawing. Generator market revenues – notably northern wind – would dip, raising renewables support needs, but system-wide efficiency gains outweigh subsidies. Congestion revenues could average around 1.2 billion euros per year and help cushion energy-intensive industry in the south. A roadmap coordinated with EU partners should cover phasing in local signals, building liquid forward markets and adding market-based hedging.

Key findings

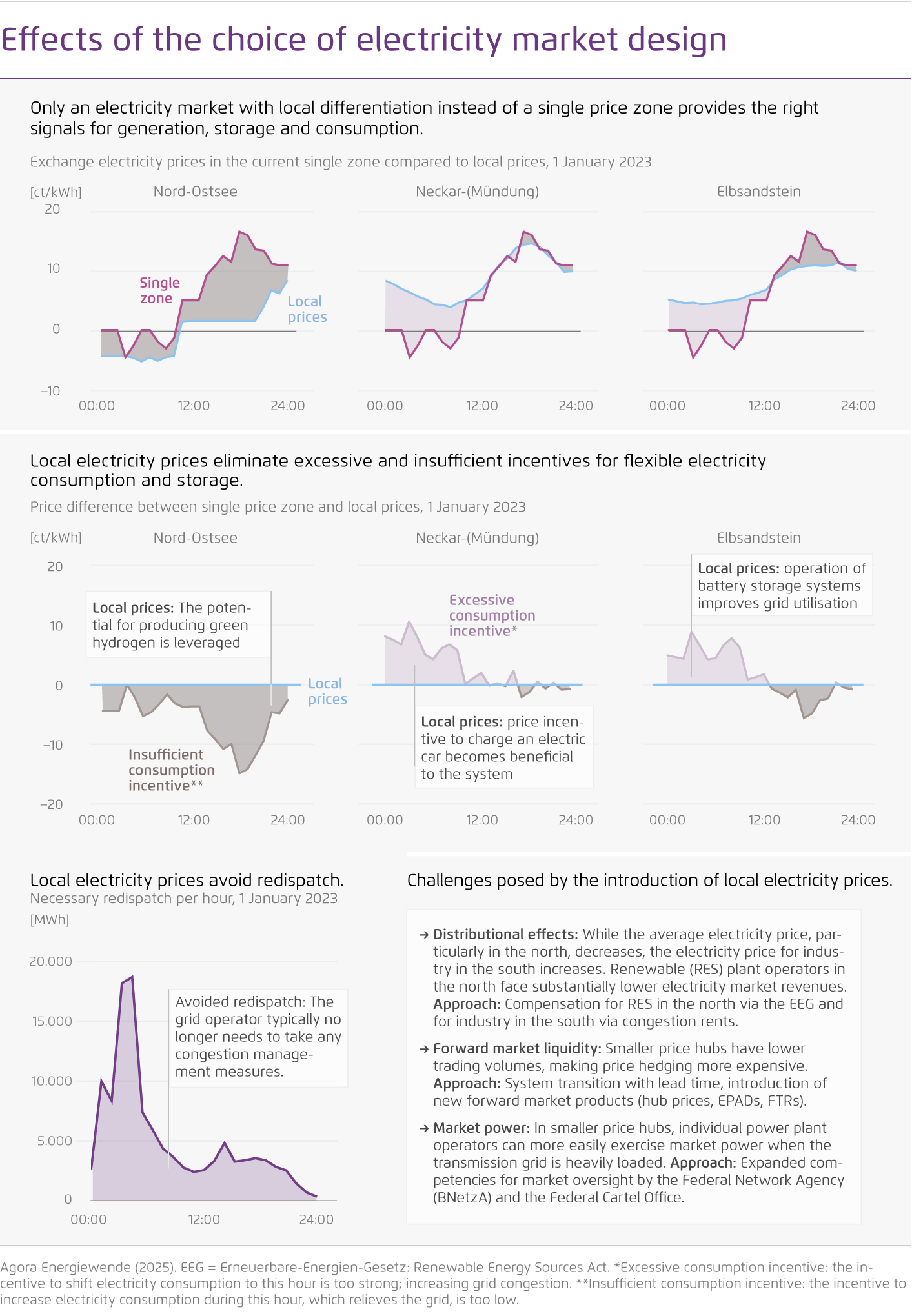

Effects of the choice of electricity market design

Introduction

Many OECD countries are currently searching for an electricity market design that takes the physical constraints of grid infrastructure into account. The core idea is that, instead of uniform nationwide signals, locally differentiated signals should influence the locational choice and operation of power plants and storage systems, as well as consumer behaviour. More than half of electricity markets in OECD countries are now organised into multiple price zones or based on local prices [1] – a growing trend.

In Europe, the European regulatory agency ACER has tasked transmission system operators (TSOs) with analysing alternative price zone configurations, among other things, for the current Germany–Luxembourg bidding zone. ACER questions whether a single price zone remains efficient from a European market perspective. While acknowledging certain challenges, the European TSOs highlighted in their bidding zone review the economic benefits of dividing Germany’s single bidding zone into smaller entities. Among the configurations assessed – ranging from two to five zones – the option with the greatest number of zones delivered the biggest economic benefit. By contrast, none of the alternative configurations examined for Sweden, Italy and France offered increased economic efficiency, while the proposed Dutch split into two smaller zones showed a slight positive effect [2]. In its opinion on the review, ACER found that the benefits of reshaping Europe’s bidding zones had been significantly underestimated. It emphasised that the Central European TSOs’ coordination level for solving network congestion was probably exaggerated, leading to an undervaluation of the efficiency gains from splitting the Germany–Luxembourg zone combined with a Dutch reconfiguration. While TSOs estimated the annual benefits at around 250–340 million euros, ACER expects them to be closer to 450–540 million if the current operational practices for congestion management are taken into account“. [3]

In Germany, opinions on local electricity market design are divided: many energy economists emphasise the efficiency of local price incentives, while industrial consumers – especially in southern Germany – fear higher electricity costs and wind farm operators in the north fear lower revenues. Against this backdrop, the government recently stated its intention to stick to the single bidding zone in its coalition agreement and in the key measures announced in response to the publication of energy transition monitoring report [4]. However, it is clear that the current configuration has significant disadvantages: grid operators must increasingly intervene in market outcomes through so-called redispatch measures – ramping up some power plants and curtailing the output of others due to insufficient transmission capacity. This leads to unwanted European “loop flows” in neighbouring countries caused by internal German bottlenecks and increases unapt price incentives for consumers and generators. This raises the pressure to seriously consider alternatives for a more efficient electricity system.

Current situation

Germany’s current single-price market design is driving an increasing need for redispatch. Power plant and storage operators plan their operations a day ahead based on prices on the electricity exchange. The same day-ahead price currently applies everywhere in Germany – it contains no information about potential grid bottlenecks. However, the transmission grid is increasingly unable to fully transport electricity from the north and east to the south and west. Grid operators are forced to intervene in the power plant dispatch and adapt it to grid constraints. The costs of redispatch have more than doubled since 2019 and averaged 6.8 euros per MWh of net electricity consumption in 2023 (including network reserve and countertrading). Although preliminary figures indicate that the volume and costs of redispatch measures decreased in 2024, this is likely to be merely a temporary effect: despite several planned high-voltage transmission lines connecting the north and south of Germany, TSOs anticipate that redispatch volumes will rise again in the coming years and that redispatch costs will remain high as the share of renewables increases. By 2030, grid congestion management costs are expected to have stabilised at around 3 billion euros, compared to 1.3 billion euros in 2019 and 3.2 billion euros in 2023 [5]. Investments of 328 billion euros – including offshore grid connections – are planned for transmission grid expansion by 2045 to reduce the extent of the required grid interventions. Nevertheless, efficient use of the current infrastructure until such time as new investments materialise is vital to ensure affordable end-user electricity prices.

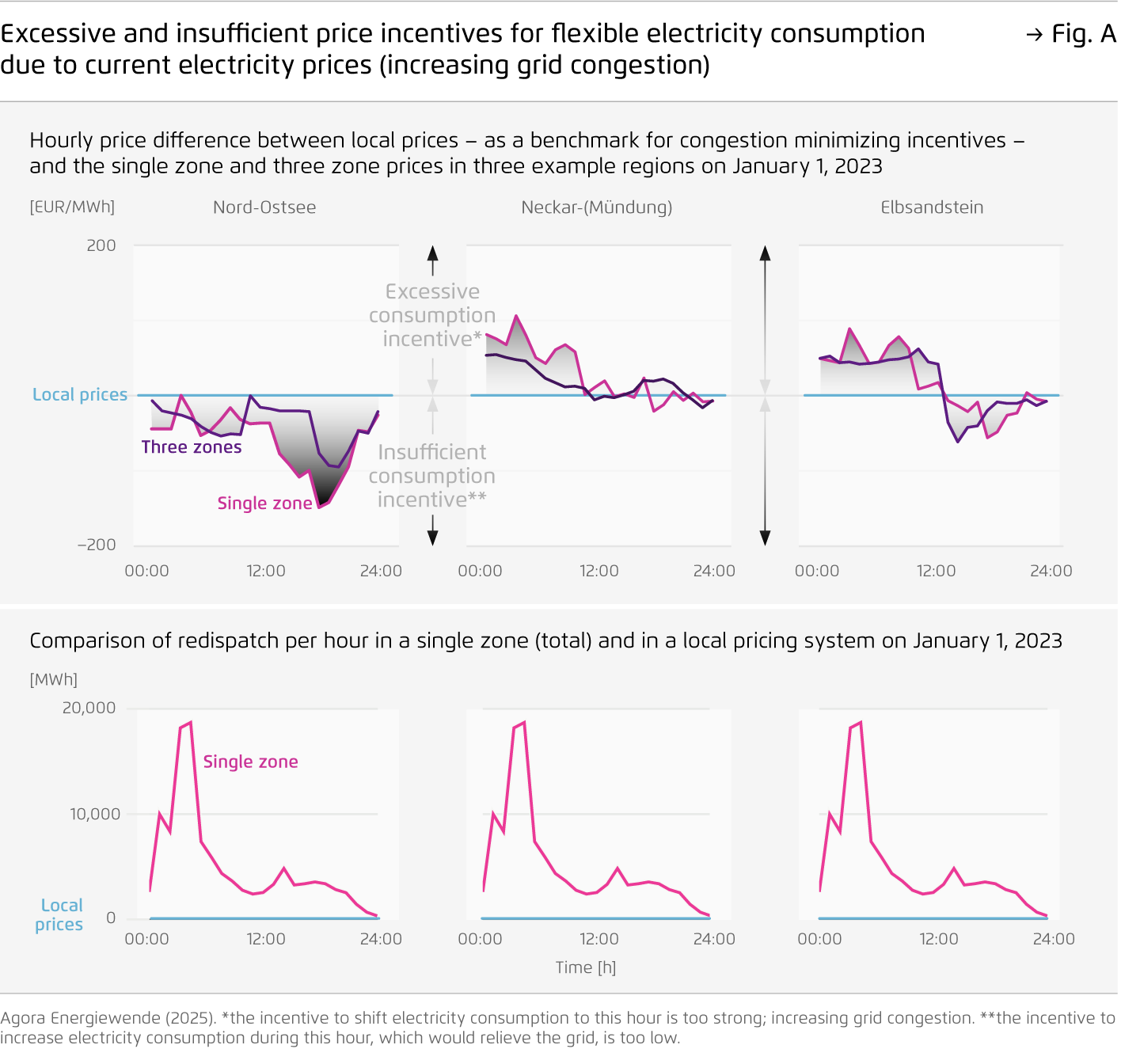

Appropriate price incentives for flexible demand responses from electric vehicles, heat pumps, electrolysers, industrial heat generation and electricity storage are crucial for a climate-neutral energy system. They enable more efficient use of the cheapest energy sources – wind and solar. However, the current single price zone often has the opposite effect because it doesn’t reflect whether electricity is available locally: downstream of grid bottleneck, it creates overly strong incentives for consumption, triggering additional flexible demand that strains the grid unnecessarily and requires expensive additional congestion management. Conversely, insufficient consumption incentives upstream of bottlenecks and near renewable energy generation centres lead to less electricity being used than would be the case at lower prices – leaving renewable power underutilised.

In concrete terms, this means that a pumped storage plant in the south might draw electricity in response to low wholesale prices, while gas-fired power plants have to be ramped up simultaneously due to a transmission bottleneck and the subsequent redispatch. Electric vehicles in the south might be charging their batteries with what appears to be wind power, but an upstream grid bottleneck means that this wind power cannot actually reach the charging point. In the north, incentives for flexible demand response are insufficient when the electricity price appears high, yet grid operators instruct power plant operators to reduce generation ahead of a bottleneck. During this period, a battery storage operator may decide not to store electricity because the price is too high. As demand-side flexibility grows – which is important and desirable in a weather-dependent renewable electricity system – the inefficiencies inherent in a single-price zone become increasingly pronounced.

The toolbox for grid operators to deal with congestion consists of redispatch, countertrading and network reserve power plants; the German “use instead of curtailment” instrument for connectable electricity consumption is not suitable for orchestrating decentralised flexibility as connectable loads need to be registered and located in a “relief region”. To take advantage of all decentralised flexibilities without any price zone reconfiguration, the regulatory influence of grid operators would have to be greatly expanded so that they could either regularly intervene in electricity consumption on the end-consumer side or be allowed to calculate and charge prices similar to those on local electricity prices.

Large electricity price zones mean a partial loss of the market’s coordination function. This affects the increasing number of hours during which renewable generation exceeds local demand and transmission capacity. Wind, hydro and solar plants offer electricity at prices of around zero euros per MWh on the electricity exchange due to their negligible short-term marginal costs [6]. It is not possible on the basis of these short-term marginal costs to determine a sensible ranking of renewable plants to meet electricity demand. In situations where renewable generation exceeds local demand, the market in a large price zone does not signal which plants should have their output curtailed, even though this – i.e. which plant is curtailed – can make a big difference in terms of relieving the grid. The smaller the price zones, the better the local electricity price will reflect the local value of generation: If generation in zone A can be consumed in the same zone, the electricity price will remain positive; if technically available renewable generation cannot reach certain consumers because they are located in a different zone B downstream of a bottleneck, the electricity price in zone A will fall and generation will be reduced locally, unless local consumption increases to benefit from the now lower price (local value of flexibility).

In the coming decades, prevailing grid bottlenecks will continue to result in a high need for redispatch. On the path to climate neutrality in 2045, the need to transport electricity over longer distances is expected to grow faster than the transmission grid (based on current investment expectations). By 2030, a doubling of wind and solar capacity compared to 2024 is planned. The growing surplus of generation in the north and east will increase transmission needs: the currently approved onshore wind pipeline of 25 gigawatts [7] to be realised in the next two to three years is highly concentrated in North Rhine-Westphalia (7 GW) and across the east and north of Germany. Wind farms for which permits have been applied for are disproportionately located in Brandenburg (7 GW) and Mecklenburg-Western Pomerania (5 GW). At the same time, growing electrification will continuously drive up electricity demand. Grid bottlenecks will therefore continue to result in some wind or solar power generation being structurally unable to reach consumers during periods of high renewable electricity feed-in. This is why adequate price incentives are needed to enable flexible consumers, dispatchable power plants, storage systems and imports to react efficiently.

The question that remains is who will manage grid bottlenecks efficiently and cost-effectively in the future: the market by making electricity prices more local, or transmission system operators via a regulatory framework that needs further development?

In the current market design, cross-border transmission lines (interconnectors) and internal German transmission and distribution lines – both of which are crucial resources for the European internal electricity market – are not being used efficiently. If a country’s market price signal does not reflect the current transport capacity of its grid, this causes distortions in neighbouring countries, such as overly high electricity prices near northern German generation centres (Scandinavia, Poland) or the use of neighbouring grids via “loop flows” due to national grid bottlenecks. There is growing pressure on the European internal electricity market to coordinate electricity markets in line with grid bottlenecks. To ensure that the most cost-effective power plants in Europe generate electricity for European consumers, national bottlenecks must not lead to any preferential treatment of domestic power plants. Grid operators must therefore reserve a growing share of grid capacity for European electricity exchange (minimum remaining available margin, minRAM).

However, this static minRAM requirement is a rather imprecise instrument and not best-suited to achieving optimal European dispatch. For example, when there is a lot of wind in the north and at sea but a grid bottleneck occurs in the south, the systemic question arises as to whether it is more cost efficient to reduce feed-in in Scandinavia or in northern Germany. The minRAM criterion gives categorical priority to Scandinavian electricity; without this criterion, electricity from northern Germany would have priority. In contrast, a local electricity market could provide situation-adapted dynamic incentives by optimising European dispatch regardless of national borders.

It is not only northern European dispatch that is affected by Germany sticking to the single price zone and the minRAM criterion, however. Consumers in southern neighbouring countries – such as France, Austria and Switzerland – generally benefit from low wholesale prices when they import electricity from southern Germany, even in situations when grid congestion prevents renewable power from the north from reaching these regions. At the same time, electricity generators in these countries lose out compared to a system with more local pricing in Germany, as they receive lower revenues when selling electricity to German consumers.

Conversely, consumers in northern neighbours – including Denmark and Sweden – face the opposite effect, as artificially elevated prices in northern Germany spill over when they import electricity. This imbalance has already led to political disputes. A notable example is the Swedish–German disagreement over the proposed “Hansa Power Bridge” interconnector: the Swedish government denied approval, arguing that “the German power market doesn’t function in a way that gives correct price signals to power market players, mainly because Germany, unlike Sweden, isn’t divided into electricity areas in a way that corresponds to the significant bottlenecks” [8]. These dynamics illustrate that Germany’s electricity price zone configuration is not only a domestic matter but also a question of European fairness and market efficiency.

The debate over price zone configurations has also arisen in the UK, where a shift towards zonal electricity pricing was discussed but ultimately rejected in favour of a broader reform package, set out in the reformed national pricing delivery plan due at the end of 2025. In the UK, opponents of more granular pricing warned of a ‘postcode lottery,’ with households in some regions facing significantly higher electricity bills. By contrast, the results of this study indicate that such concerns do not necessarily apply to the German context for small zones or local pricing: most households would benefit from local electricity prices, while just a few would experience little or no change to their electricity bills.

In summary, the current German market design with a single price zone leads to an increasing volume of redispatch with correspondingly high costs, distortions in the European electricity market, misguided incentives for consumers that will exacerbate these problems in the future and inefficient – and therefore expensive – utilisation of the valuable transmission grid infrastructure.

Subject of the study

This study examines the effects of local electricity price signals retrospectively, using data from the past five years. The impacts of more localised market configurations are assessed on the basis of real electricity market data from 2019 to 2023. The focus is on electricity prices, revenues and costs for market participants, as well as on the costs of and revenues in grid operation. Choosing an observation period in the past entails both a significant advantage and a disadvantage. The disadvantage is that it does not allow reliable, quantified statements about future system configurations to be made. The advantage of looking back at the past has over predictions of future scenarios is that it is based on empirical data and thus eliminates uncertainties regarding price developments and the expansion of power plants and grids. Identified trends are therefore particularly robust. The live online tool “Local Agorameter”, which has been launched on the Agora Energiewende website alongside the publication of the extended version of this study in German, allows for tracking these effects in real time based on real electricity market data.

Three market configurations are compared for Germany:

- the current single price zone,

- a split into three price zones, and

- local prices, which are defined as 22 largely congestion-free areas (equivalent to small price zones or the hubs of a potential future nodal electricity pricing system).

For each market zone configuration, power plant dispatch and electricity prices are first calculated using real power plant availability, weather and load data in the European interconnected system with a dispatch model. In the second step, the transmission grid is modelled to quantify bottlenecks and the respective redispatch needs. Further price zone configurations were evaluated on the basis of the results of the local pricing simulation (22 areas). However, indirect effects, such as the impact of different configurations on forward market liquidity and market power, cannot be assessed with the electricity system models used and would require further analysis.

Study results

Local prices are necessary to ensure the cost-efficient coordination of generation and demand in a climate-neutral electricity system when the transmission grid is at least temporarily limited in capacity – this is the primary conclusion of our analysis. Contrary to regularly expressed concerns, a system of local prices in Germany would lead not to higher but rather to lower electricity prices for the majority of consumers. At the boundaries of different price zones, congestion rents [9] arise for grid operators that could be used to compensate specific customer groups facing higher electricity prices due to the price zone split. Especially in northern and eastern Germany, however, the market revenues for renewable energies would decrease due to lower electricity prices – compensation mechanisms would be essential here. At the same time, a lower local electricity price also sends out an important investment signal: for example, by increasing electricity demand in the north, e.g. by investing in electrolysers and large batteries, the market revenues for renewable electricity could be increased. A comparison of system costs from 2019 to 2023 shows that redispatch by grid operators was an economically reasonable approach given that most flexible consumers were not yet responding to electricity prices. This finding suggests that there is still sufficient time to address the underlying issue of lacking market and grid alignment – by developing a roadmap for the introduction of local electricity prices that provides planning certainty and involves all relevant stakeholders.

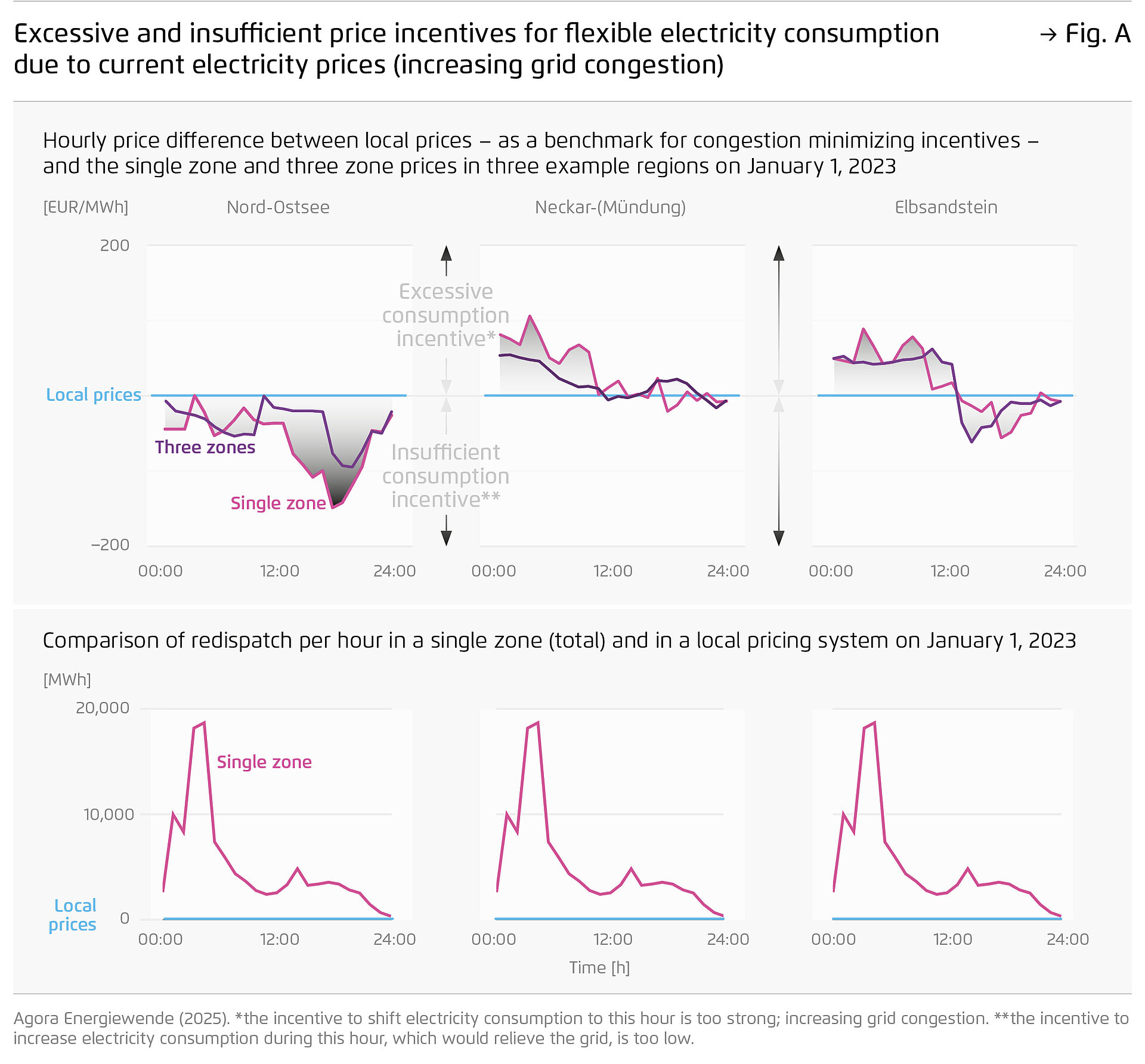

The introduction of local electricity markets can serve as an important tool for reducing electricity prices in Germany: If the market continues to operate within a single bidding zone, the resulting single market price will exacerbate grid congestion by encouraging additional consumption in the south (as this price does not reflect the congestion costs), while failing at the same time to incentivise electricity consumption in the north and thus leaving renewable electricity partly unused. Figure A shows the modelling results for a sample scenario that would become very expensive for the electricity system of the 2030s due to high redispatch requirements if the German electricity market were still being operated with a single price zone or three large price zones at that time. Wind energy feed-in was high on 1 January 2023, prompting grid operators to relocate electricity generation through redispatch from the north (curtailment, including wind power) to the south (ramping up, for the most part of fossil power plants). The modelled local electricity prices take grid congestion into account and thus serve as a benchmark for the most system-friendly consumption incentives. A comparison of the modelled prices in one or three zones shows how well or poorly these one- or three-zonal prices create optimised incentives: in the model region Nord-Ostsee (North-Baltic), local electricity prices were significantly lower than the prices in one zone. Prices in the three zones were also lower – though somewhat less significantly – than the price in one zone. In a single price zone, the electricity price was 50 euros (EUR) per megawatt hour (MWh) higher than would have been the case with local prices. Local prices would have encouraged system-friendly additional consumption, avoided output curtailment of wind and solar plants (which requires compensation) and avoided expensive redispatch, thereby reducing overall system costs. The single-zone price thus provides insufficient incentives in the north to consume locally surplus electricity as the electricity price would be 50 EUR/MWh lower with local pricing. In contrast, in the Neckarmündung (Neckar estuary) model region in the south, electricity prices during the morning hours were over 50 EUR/MWh too low – regardless of whether one or three price zones were considered – resulting in no incentive to shift consumption to later periods despite the absence of grid congestion.

These effects can be observed not only on the example day but throughout the year. While the average electricity price in the Nord-Ostsee model region was, on average, 23 EUR/MWh lower than in the single price zone, this difference was 57 EUR/MWh (insufficient incentive to consume) during hours when more than three gigawatts of redispatch were required – i.e. when there was significant grid congestion. In the Neckarmündung region, the local price was 7 EUR/MWh higher than the single zone price over the year, and 24 EUR/MWh higher (exaggerated incentive to consume) during hours with more than three gigawatts of redispatch. The analysis thus shows a significant correlation between the magnitude of misleading incentives and the redispatch requirement.

These misleading price incentives will affect a growing number of flexible electricity consumers: in Agora’s target scenario for a climate-neutral Germany, the capacity of large flexible consumers (electrolysers, large heat pumps and boilers) increases tenfold to 38 gigawatts by 2035, about half of today’s total load. Another 45 gigawatts of large-scale storage will be added in the same scenario, along with many small battery storage systems whose operation can also respond better to market prices. At the same time, 23 million electric vehicles will charge semi-flexibly, while around eight million heat pumps can shift their operating time by several hours. [10]

Study results (continued)

To interpret Figure A, imagine coming home after a New Year’s Eve party in 2035 rather than on 1 January 2023: if electric vehicles in southern Germany responded to seemingly low prices in a single price zone and started charging, the grid operator would need to activate additional, costly power plants due to grid congestion. Introducing local electricity prices would ease the strain on the grid and enhance its resilience. As far as electricity storage and flexible electricity consumption are concerned, Agora’s climate-neutral Germany scenario and this study show two things: flexible electricity consumption and electricity storage are indispensable components of a climate-neutral electricity system in which wind and solar are the main energy sources. However, if their flexible operation follows a price signal that often burdens the grid, this will increase redispatch needs or require large, rarely used transmission grid capacities.

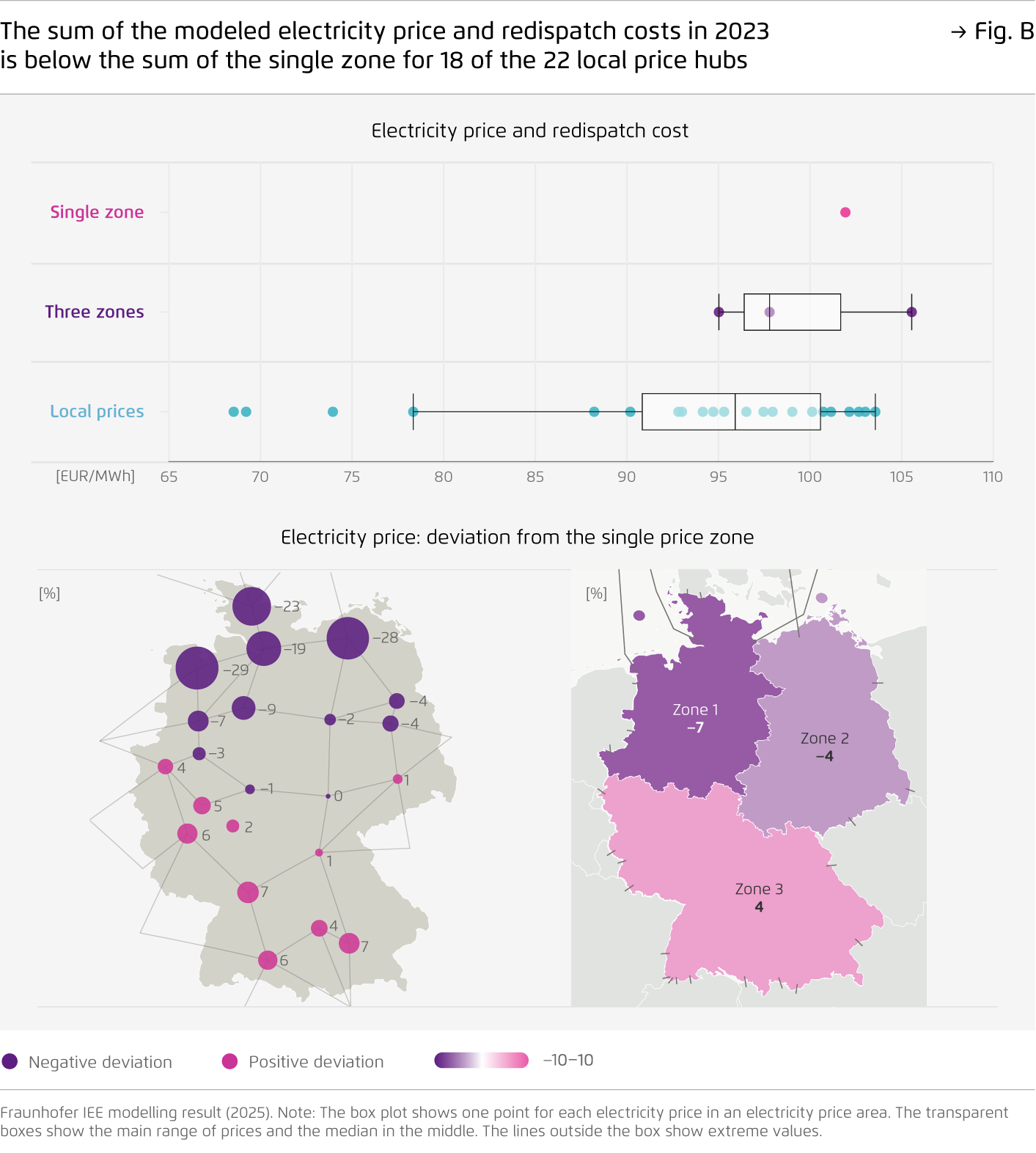

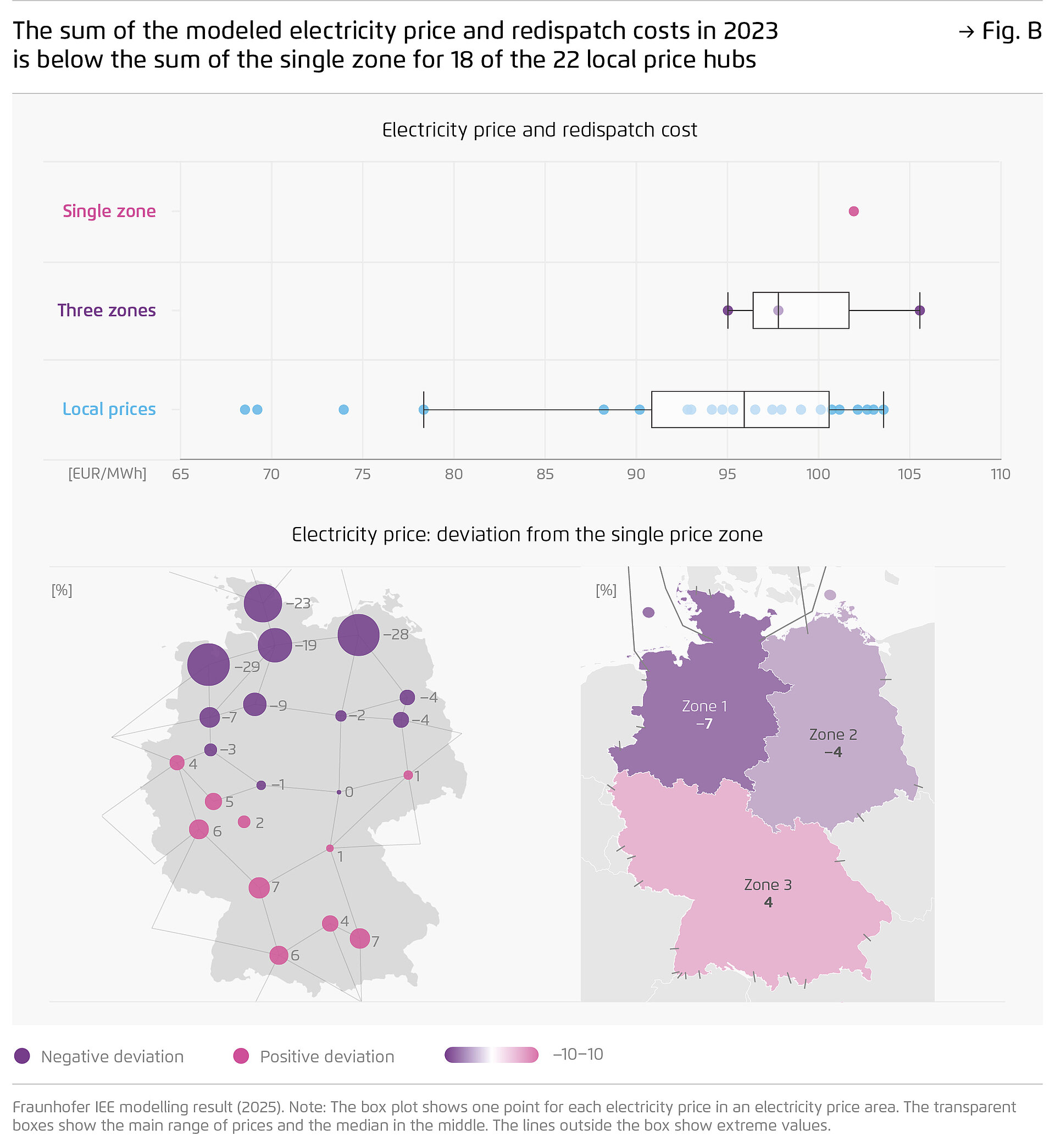

The introduction of local prices would reduce electricity costs for consumers on average. Local prices cause electricity costs to decrease in 18 of the 22 hubs, benefiting the majority of consumers. In this context, electricity costs are defined as the electricity price plus the redispatch costs included in the grid fee; in other words, the electricity procurement costs that take market and grid congestion into account. In 2023, these electricity costs were 102 EUR/MWh, but local prices would bring them down to a consumption-weighted average of 95 EUR/MWh and to a minimum of 69 EUR/MWh in the North Sea-West region. At their maximum level, the costs would rise to 104 EUR/MWh (Neckarmündung) with local prices. The wholesale electricity price itself would have been lower in much of northern Germany from 2019 to 2023; in the four coastal hubs, it would even have been lower by a significant 19 to 29 percent compared to a single price zone. In the south, regional differentiation leads to higher prices than in the current price zone (see Figure B). In many cases, however, this increase is offset by lower redispatch costs and thus lower grid fees. However, not everyone benefits from this: for consumers in the south with reduced grid fees – such as energy-intensive industries, large-scale battery storage systems and electrolysers – the full increase in wholesale electricity prices applies, while the advantage of lower grid fees is only partially felt.

Study results (continued)

These findings reveal that local electricity pricing would not impose a significant additional financial burden on German households; on the contrary, it would ease costs for the majority of them. This contrasts with the UK debate, where concerns over unfair regional cost distribution – dubbed the ‘postcode lottery’ – ultimately shaped the government’s decision against a zonal split.

Splitting the electricity market into multiple price zones generates revenues for transmission system operators (TSOs) – congestion rents – which can be used to offset negative effects. In each year from 2019 to 2023, these revenues – averaging 1.2 billion euros annually – would have been sufficient to fully offset the impact of higher wholesale electricity prices for significant electricity volumes ranging from 110 to 266 terawatt-hours. One targeted approach to mitigating negative distributional effects would be the temporary, discounted allocation of financial transmission rights (FTRs) to disadvantaged industrial consumers in the south that currently benefit from reduced grid fees. FTRs are financial instruments that entitle the holder to receive – or pay – the price difference between two price zones from or to the grid operator. In this way, FTRs can redistribute congestion rents and position FTR holders as if they had access to the wholesale electricity price in a different zone. Whether existing EU regulations would need to be amended to allow such use of congestion rents remains to be examined.

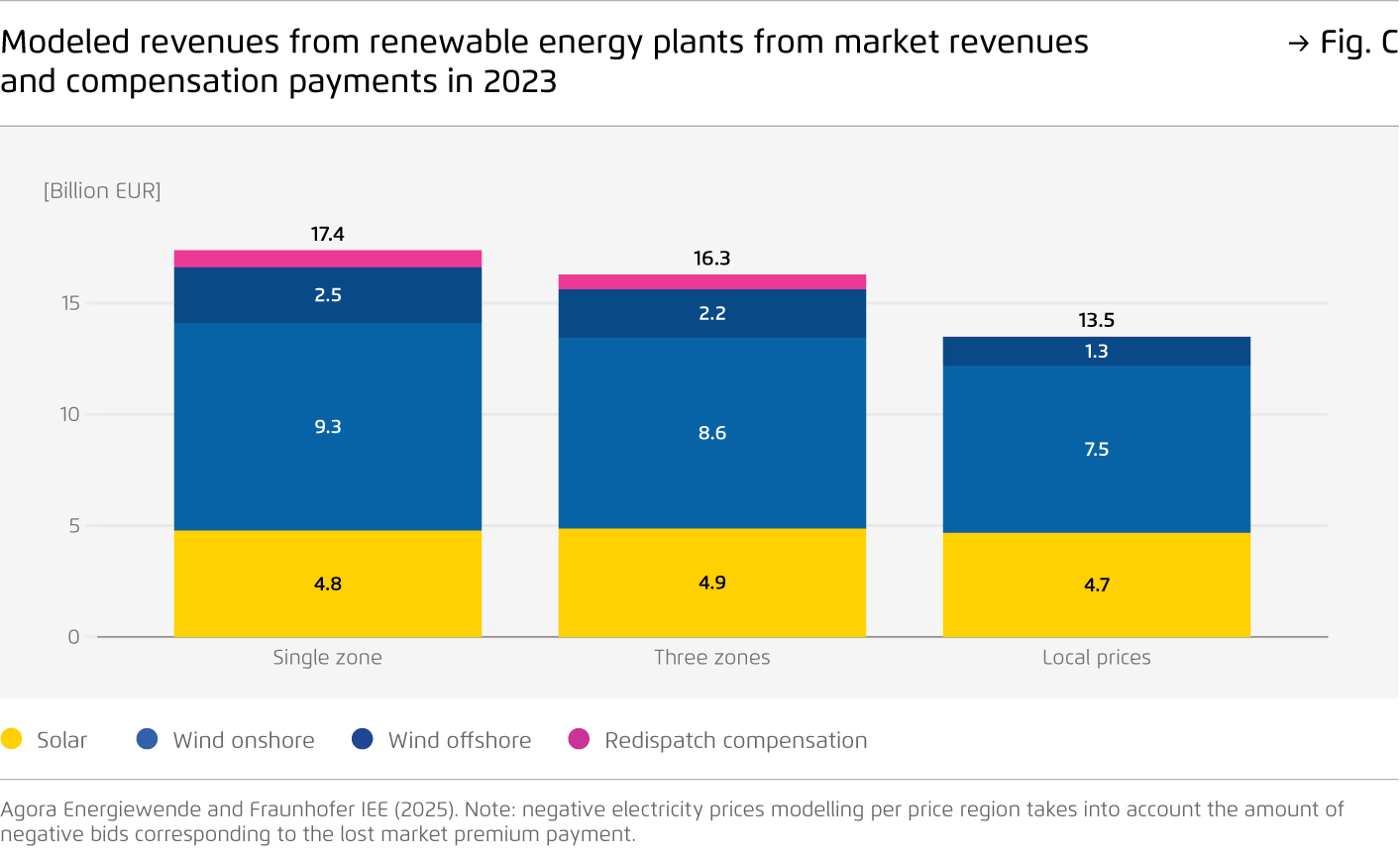

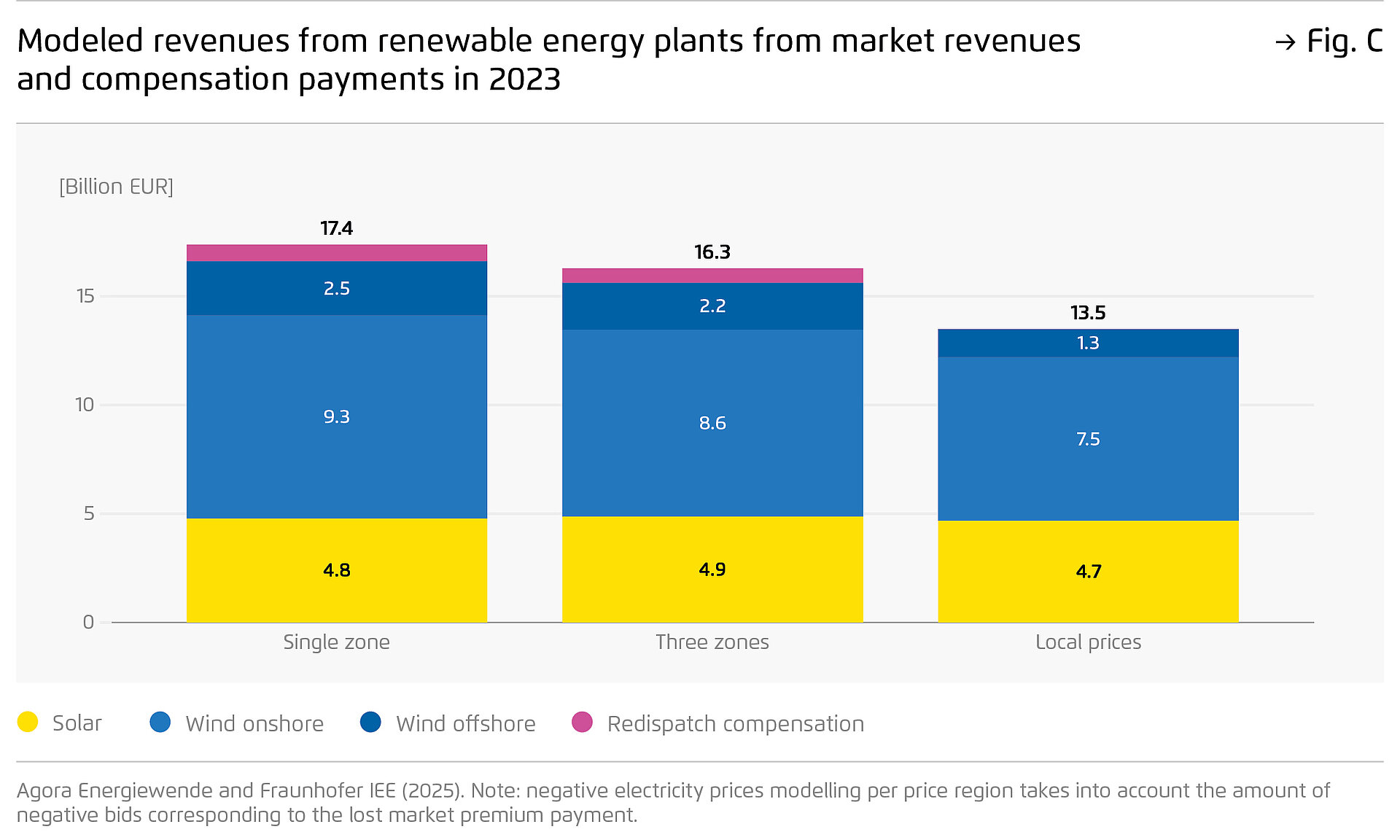

Local electricity prices would however significantly reduce the revenues of wind power operators, especially in regions with high renewable penetration, resulting in increased sliding market premiums for installations working under a support scheme. Operators of existing renewable energy plants in the north would have generated noticeably lower market revenues under local pricing or a three-zone system than in the single price zone during 2019–2023. Figure C shows the total revenues of wind and solar PV plants, including curtailment compensation paid in large price zones due to grid congestion. In contrast, solar PV operators in the south would benefit from higher revenues in a system with local prices, while northern PV installations would see reduced revenues.

On balance, total solar PV revenues across all regions remain roughly unchanged. The situation is different for wind power, which is concentrated in the north, where local electricity prices are lower. Across the entire wind fleet, market revenues would decline – particularly for offshore wind.

Study results (continued)

To safeguard past investments, compensation payments would need to be allowed to increase for installations facing revenue losses. These should be considered as part of the transition costs towards introducing local price signals. For future investments in onshore wind and ground-mounted solar PV, local electricity prices – combined with a new investment support mechanism aligned with the revised market design – could provide incentives for system-efficient site selection. For offshore wind, however, regional price signals are less effectiveas a steering instrument because the choice of location is inherently limited. Consequently, additional measures might be needed to ensure the viability of as yet unbuilt offshore wind farms awarded in a negative bidding process. Adapting the market design to local prices therefore requires the payment structures between plant operators and the state to be revised in order to reflect the impact of new local electricity revenues.

The objectives of this adaptation are threefold:

- to ensure investment certainty for ambitious renewables expansion across diverse locations,

- to create efficiency incentives for site selection through local price signals and

- to protect the value of existing and already awarded but not yet finalised assets. [11]

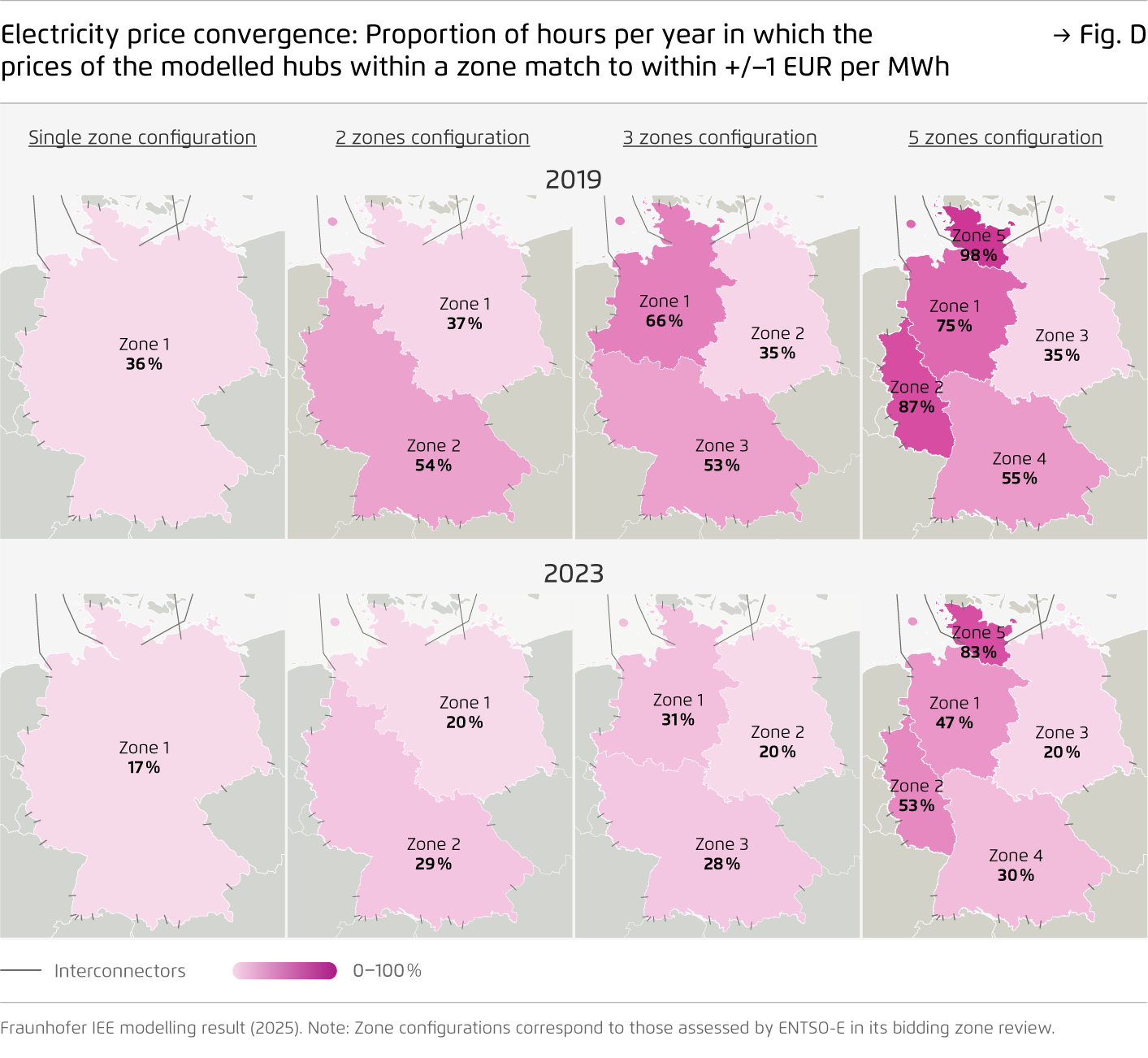

The smaller the price zones, the more precisely redispatch can be avoided – three zones are not sufficient for long-term avoidance. A three-zone split would not have resulted in a reliably lower redispatch volume from 2019 to 2023 and therefore would not ensure reduced grid congestion under current conditions. This holds true even if political decisions were to soften the European obligation to reserve cross-border transmission capacity for electricity trading due to the bidding zone split. [12]

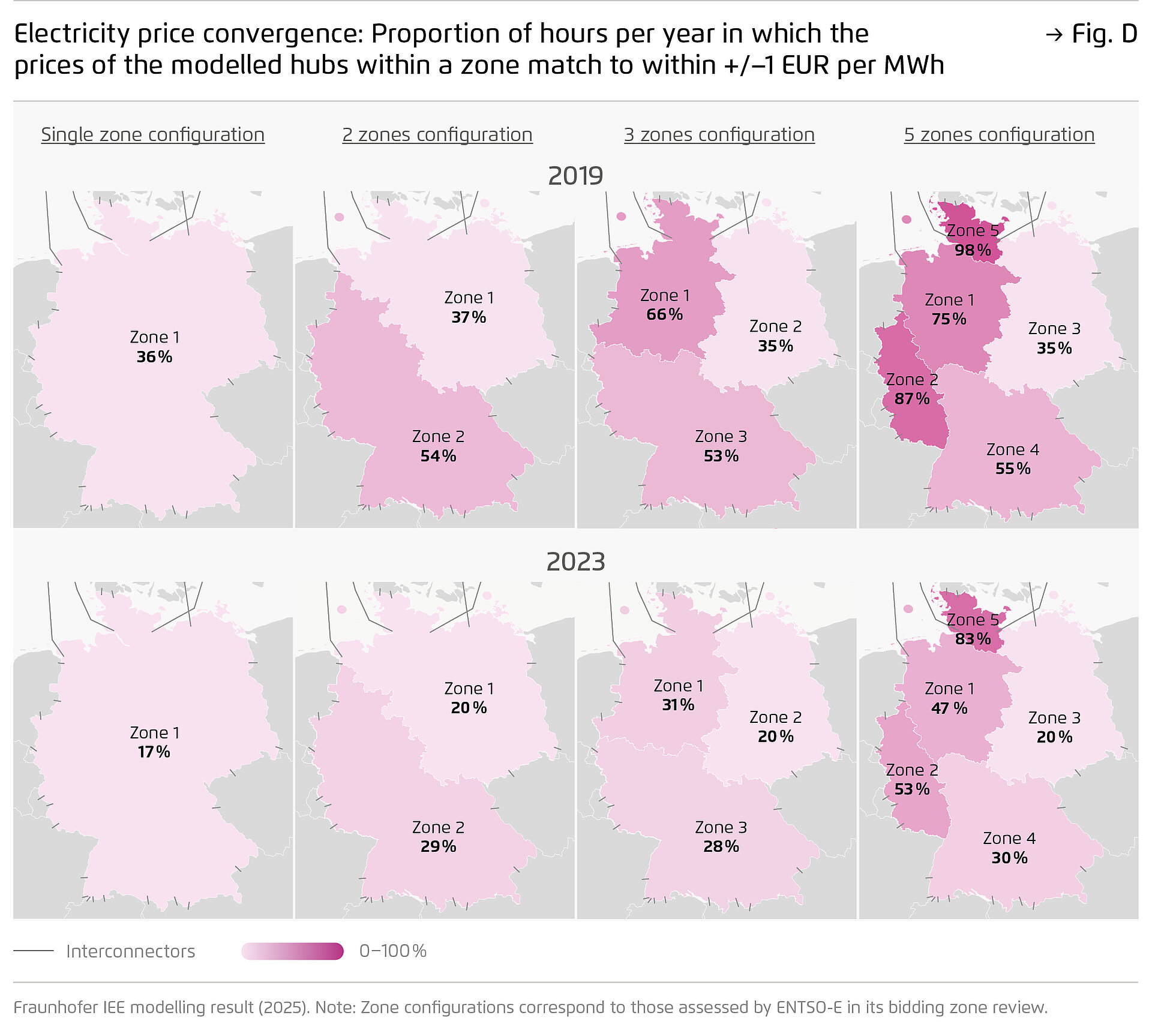

The alternative configurations [13] currently being discussed, which range from two to five price zones but also include the single price zone, have been assessed to determine their ability to produce converging local hub prices within each zone (see Figure D): in a single-zone configuration, the electricity price was a good reflection of the remaining grid capacity during only 36 percent of the hours in 2019 and just 17 percent in 2023 [14]. This percentage improves as price zones become smaller. In 2019, the modelled price zones in northern and western Germany showed price convergence values in more than two thirds of the hours of a year. By 2023, however, the accuracy of zonal pricing declined significantly.

This is because the growing share of renewable energy increased price differences within large zones between 2019 and 2023. This shows that zone configurations with good coordination between market signals and grid conditions are not stable over time. The northeastern price zone consistently showed low convergence values – never exceeding 35 percent. The configurations of up to five zones that were discussed as part of the Bidding Zone Review are therefore not sufficiently granular. Instead, the analysis shows that different degrees of grid congestion arise throughout the year depending on generation and load patterns. Consequently, the areas where local prices converge shift over time.

With further grid expansion, larger areas of price convergence may emerge and form more homogeneous market zones. However, it is not just the grid that is evolving. Electricity generation, demand and storage will also undergo dynamic changes on the path to climate neutrality. Smaller price zones offer greater stability under these conditions and help avoid the need to continually redraw bidding zone boundaries.

Study results (continued)

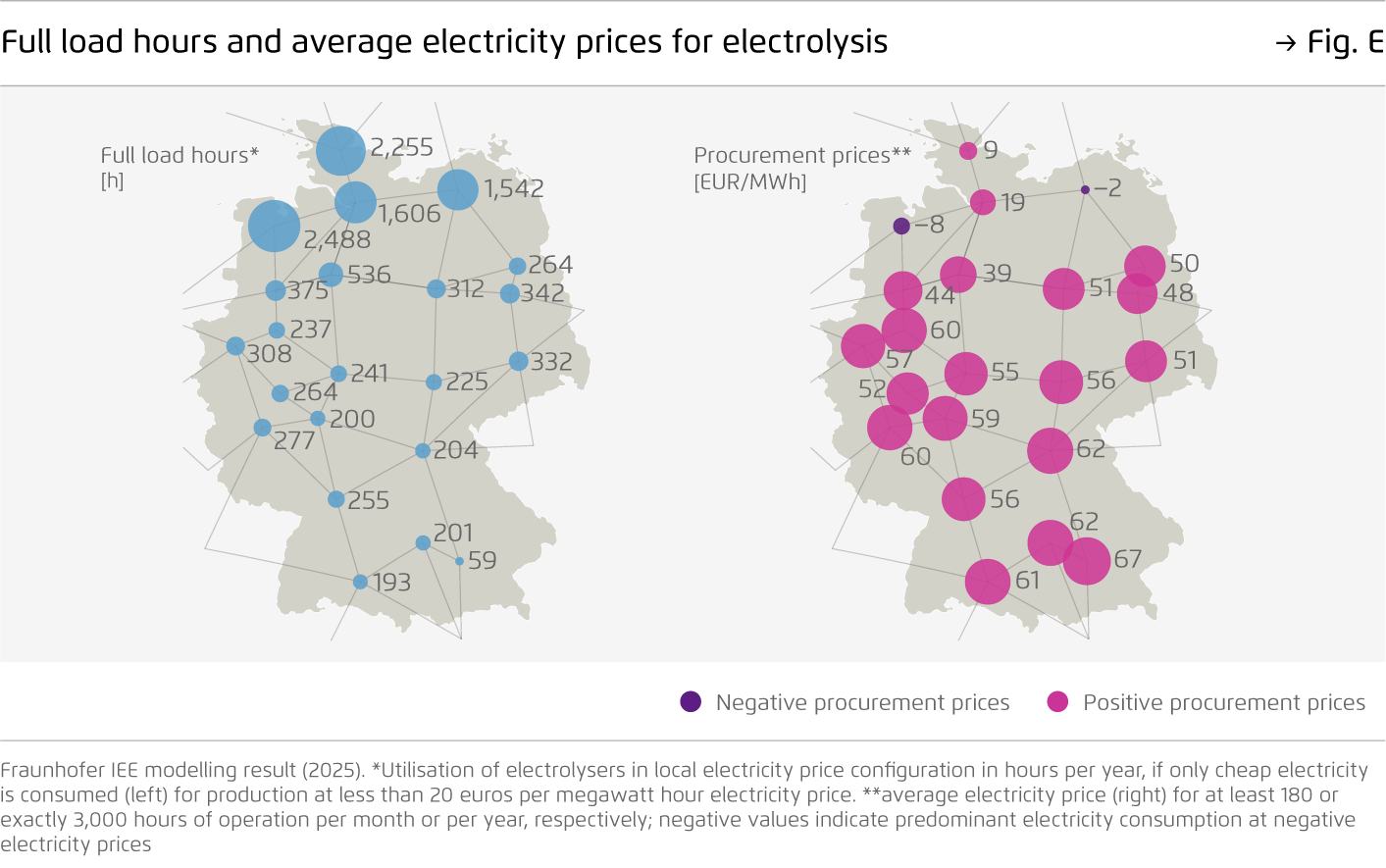

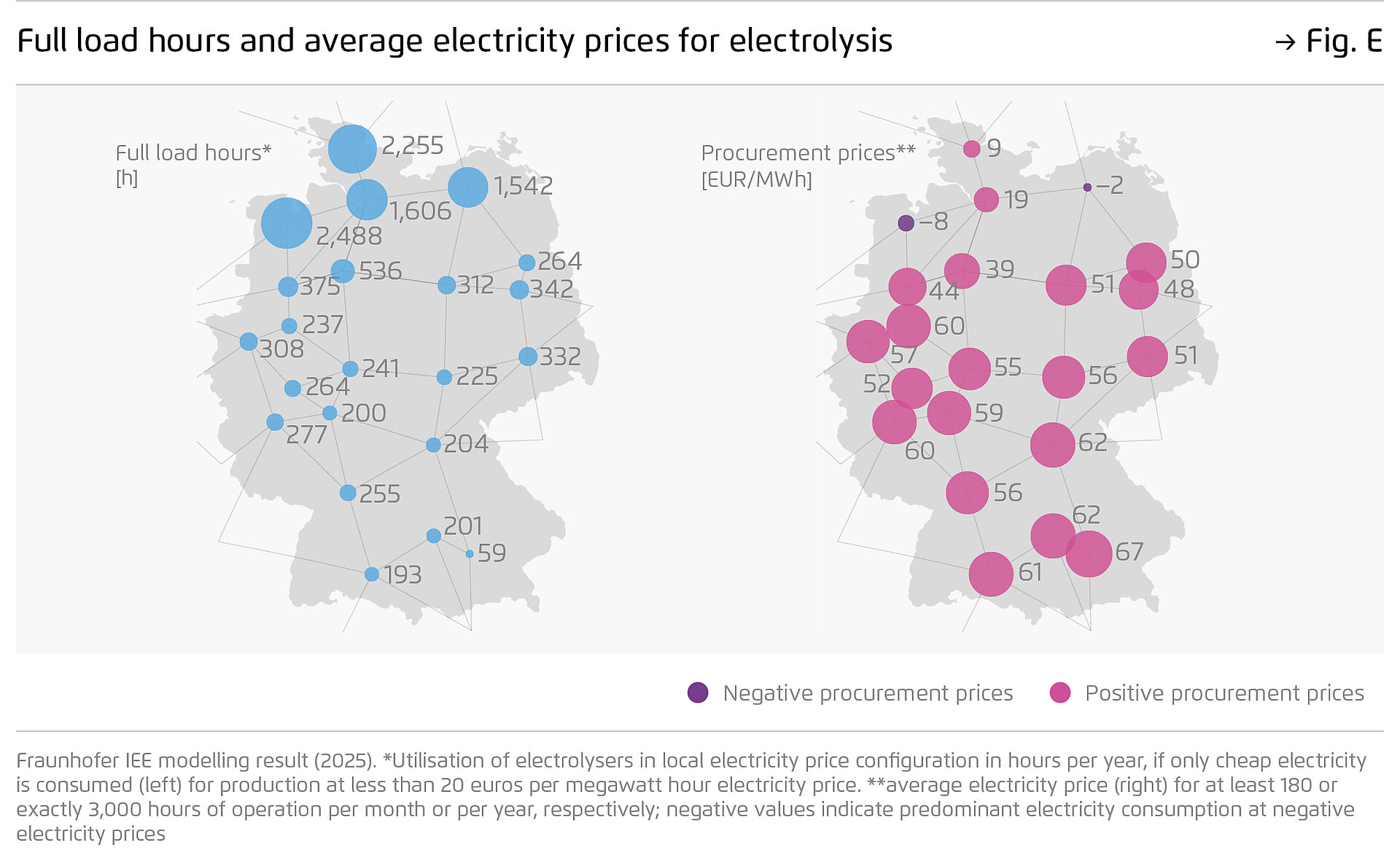

Local electricity prices greatly increase the economic viability of electrolysers located near generation centres in northern Germany, ensuring that low-cost green electricity is used for hydrogen production. In contrast, investments in renewable energy near demand centres in the south become more profitable, as many flexible consumers can be reached without causing grid congestion. Local prices also provide powerful investment signals. Coastal regions, though offering ideal conditions for new flexible electricity consumers, do not stand out in a uniform price zone. In 2023, electrolysers operating only during hours with low local electricity prices would already have been able to achieve up to ten times more full-load hours on the coast than in the south. At an annual utilisation of 3,000 hours, the average electricity procurement price in the North Sea West (-8 EUR/MWh) and Baltic Sea (-2 EUR/MWh) regions would even have been negative because local renewable generation exceeded electricity demand by a factor of two (see Figure E). High shares of renewable electricity also make it easier to certify hydrogen as “green”: under the EU Delegated Act on renewable hydrogen, a 90 percent share of renewables in the electricity mix of a bidding zone qualifies hydrogen production as renewable. At the same time, local electricity prices increase the economic incentive for additional renewable generation in the south: between 2019 and 2023, wind and solar plants in the southern price zones would have achieved 4-14 percent higher revenues compared to a single price zone. This more efficient siting of new renewables requires effective competition in project development and adequate land designation for wind and utility-scale PV across all regions of Germany.

Study results (continued)

Retrospective modelling for the years 2019–2023 shows that the system inefficiencies caused by redispatch measures (compared to local prices) remain manageable provided that grid operators only have to redispatch central conventional power plants and curtail renewables for congestion management. Nonetheless, modelled total power system costs in 2023 would have been about 1.2 billion euros lower under a local price design than under the current uniform pricing system. Roughly half of this cost advantage stems from today’s still suboptimal Redispatch 2.0 mechanism for renewables, which could potentially be improved by reform. The remaining cost savings come courtesy of more efficient European dispatch enabled by local prices, as grid constraints are already considered at the planning stage for generation, storage and consumption – avoiding inefficient investment and costly corrections through congestion management.

However, these modelled savings must be weighed against cost increases not taken into account in the model: these include impacts on forward market liquidity, potential market power and one-time transition costs, which Compass Lexecon (2024a) estimates at 1–2.5 billion euros. The impact of market power and liquidity can currently only be assessed qualitatively: with four or five zones, market concentration is likely to increase in favour of the company with the largest generation fleet if interzonal capacity is constrained (Compass Lexecon 2024b). That same study also finds that smaller zones tend to reduce trading activity on forward markets and widen bid-ask spreads. [15]

The static comparison of system costs changes fundamentally when two additional dynamic factors are taken into account: firstly, the impact of investment decisions on the development of the grid, generation fleet and large consumers. Secondly, the misleading incentives for flexible demand and storage that arise from overly large price zones.

The static comparison of system costs shows that the system is still efficient enough at present. Nonetheless, it is clear that large price zones will lead to high additional costs for avoidable redispatch or transmission grid expansion in the future. We therefore propose a three-stage approach for Germany:

Step 1: Guide investments using local price signals. In the first phase, local prices should be introduced specifically to steer new investment, the goal being to encourage the siting of electrolysers near coastal grid nodes and to incentivise a more geographically balanced expansion of renewable energy. Announcing the future introduction of local prices as early as possible, combined with better regional differentiation of Baukostenzuschüsse [16] and the continued application of the reference yield model, provides investors with planning security and incentivise more grid-friendly expansion of new assets.

Step 2: Develop a roadmap for local electricity pricing. During the 2025–2029 legislative period, a roadmap should be developed with the aim of closing any remaining analytical gaps; it should also outline when and how local prices could be introduced, while considering the impacts on neighbouring countries. This includes adding a scenario to the transmission system development plan that estimates how local prices would affect grid expansion needs. By setting a clear target year beyond the five-year horizon of forward markets, this roadmap paves the way for new long-term market products linked to regional, national or cross-border electricity price indices – including local contracts for difference. Importantly, announcing this transition early reduces the need to compensate market participants (e.g. PPA counterparties) who might otherwise face losses from an abrupt change. The change in market revenues – higher in the south, lower in the north – also requires the calculation of financial flows between plant operators and the state to be adapted.

The goals are:

- to maintain strong investment incentives for renewable expansion at diverse sites,

- to provide signals for system-efficient choice of locations through local pricing

- and to protect the value of existing investments.

Additionally, the roadmap should define how the new revenue source – congestion rents – will be used, for example to temporarily relieve those consumer groups facing higher electricity prices after the transition.

Step 3: Transition to local electricity pricing. The final step would be to fully transition to local pricing in order to eliminate the inefficiencies inherent in a single price zone. This would involve expanding the powers of the Federal Network Agency and the Federal Cartel Office so that they could continuously monitor generator bidding behaviour and prevent market power abuse. Transitional instruments such as “use instead of curtailment” or capex subsidies, which help bridge coordination gaps in earlier phases, could be phased out once local pricing is in place.

Conclusion

To ensure affordable electricity prices for consumers, the transition to a power market with greater local differentiation should be seriously considered for power systems with increasing shares of variable renewables and persistent grid bottlenecks. Local price signals improve system efficiency by encouraging generators, storage operators and consumers to factor grid constraints into their short-term operational decisions. This enables more cost-effective use of flexibility and storage than in a single price zone, which requires costly redispatch by transmission system operators. As the share of renewables grows, demand-side flexibility increases and cross-border electricity trade expands, the cost advantages of local price signals become even more significant due to more frequent grid congestion. At the same time, the ideal borders of large price zones would evolve constantly in such a dynamic system. A high level of local price differentiation from the outset helps avoid constant zone redefinitions. The alternative – relying solely on an improved redispatch framework – involves considerable uncertainties. Designing the transmission grid for inefficient peak transport flows leads to unnecessarily high grid fees for consumers.

At present, large electricity price zones can still achieve a comparable level of efficiency to local prices because the cost-based redispatch performed by TSOs addresses grid congestion fairly accurately. In Germany, the curtailment of renewables takes place in a targeted manner and is minimised through regulation; in the period 2019-2023, the redispatch of central power plants worked nearly as efficiently as a market-driven dispatch based on local prices would have. However, as the energy system advances towards climate neutrality, large price zones would require increasingly complex complementary instruments to influence distributed generation, storage and flexible demand [17]. Even then, a core challenge remains: redispatch decisions are taken after the market outcome [18] and are largely limited to the national portfolio.

A switch to local price signals would reduce the average electricity price for most market participants. Higher prices for industrial consumers in southern Germany could be offset by congestion rents collected by TSOs. Overall, system costs would decrease, and consumers in 18 of the 22 modelled hubs would benefit from lower electricity procurement costs, while household consumers in the remaining four hubs wouldn’t experience any significant change. However, some industrial consumers in the south would face financial disadvantages – especially those currently benefiting from reduced grid tariffs as they would be exposed to higher wholesale prices without benefiting from reduced redispatch costs. Meanwhile, TSOs would collect additional congestion rents as a result of the zonal split, which in the period 2019 to 2023 would have averaged 1.2 billion euros per year. These funds would have been sufficient to fully offset the impact of higher wholesale prices for significant electricity volumes ranging from 110 to 266 TWh per year. Policy solutions should be developed early in the reform process and aligned with EU state aid rules to ensure investment planning certainty.

The UK government recently decided against introducing zonal pricing largely due to public concerns over regional bill disparities – the ‘postcode lottery’ – with projections that consumers, especially those in the southeast, would potentially face substantially higher electricity costs compared to a single zone price. This analysis of a three-zone configuration in Germany indicates that the electricity price in the southern zone would have increased by 3.6 percent in 2023 compared to the single zone. In contrast, the findings for the local pricing configuration show that despite the lack of any notable distributional effects, no household is left worse off – even in locations with rising electricity market prices, as this effect is compensated by reduced network charges thanks to the avoidance of redispatch costs. Overall, residential consumers would benefit, whereas large-scale industry in particular would face higher electricity bills – though these could be offset by compensation financed from congestion rents. This indicates that UK debate’s key concern about fairness, namely the ‘postcode lottery’, isn’t necessarily a factor in the German case.

The introduction of local electricity prices would significantly reduce market revenues for existing renewable installations in northern Germany. Revenue potentials for renewables would diverge sharply in a locally priced system: nodes with strong demand would see higher revenues, while areas with high renewable supply but low local demand – particularly in the north – would face lower revenues, opening up the potential for new (flexible) demand creation (which in turn would reduce the downward pricing trend). As far as solar PV is concerned, these effects would largely cancel each other out due to the balanced geographic distribution. When it comes to wind, especially offshore, average market revenues would decline substantially as much of the generation occurs in low-price regions. In today’s system, these falling market revenues lead to rising requirements for the federal budget to support existing wind installations.

Local price signals provide targeted incentives for stabilising revenues through a more balanced geographic distribution of renewable investments, however. They also greatly encourage system-efficient siting of electrolysers near coastal generation centres. The new price gradients steer investment towards grid-friendly locations: new wind and solar projects are attracted to demand centres, while electrolysers are more viable in regions with consistently low electricity prices and high renewable shares – helping to meet EU rules for certifying hydrogen as green. Base-price differences between a single zone and local pricing are less pronounced for industrial consumers than for electrolysers because of their different load profiles. Scandinavian market studies suggest that other factors beyond electricity prices typically play a larger role in site selection.

A roadmap for gradually implementing local prices should outline a three-step approach, closely coordinated with EU neighbours and institutions. First, it should focus on sending clear investment signals. It should then support region-specific price hedging mechanisms, align grid development planning with the improved market design and, finally, enable efficient system operation with fewer grid bottlenecks by implementing local pricing.

Electricity markets operate in three phases: (I) investment, (II) hedging and (III) daily coordination of supply and demand. This sequence should also guide the introduction of local pricing.

- First, the single price zone would be supplemented with local investment signals for power plants, electrolysers, and renewable energy installations.

- Then, when the introduction of local prices is announced, a hedging market begins to develop (step II). This includes adapting the hedging instruments to renewable energy investments on the basis of local prices. Germany’s large, single price zone currently provides a high degree of planning certainty for many European market participants thanks to its liquidity. In smaller price zones, new instruments will need to be developed to maintain this high hedging quality. Future hedging products could include price hubs or trading based on regional, national or cross-border price indices. These could be complemented by contracts for difference (CfDs or EPADs [19]) between local prices and the national reference price, or by trading financial transmission rights (FTRs) to hedge against price differences.

- Step III is the announced transition to local electricity prices, which enables the cost-efficient and high utilisation of an otherwise expensive grid infrastructure. This will require significant adjustments to electricity market regulation.

Further analysis and testing will be essential to ensure successful implementation. To support this, the Local Agorameter, Agora’s local pricing online tool, provides transparent and up-to-date daily data – free of charge.

Footnotes

[1] In this publication, the term “local prices” refers to a truly granular electricity market design with geographically differentiated pricing – a design based for example on smaller bidding zones or nodal pricing.

[2] ENTSO-E 2025, Bidding Zone Review of the 2025 Target Year.

[4] Bundesministerium für Wirtschaft und Energie, 2025. Klimaneutral werden - wettbewerbsfähig bleiben.

[5] Prognose des Umfangs und der Kosten der Maßnahmen für Engpassmanagement nach § 13 Abs. 10 EnWG, 2025.

[6] This refers to large plants that are directly marketed. Today, small – and in some cases also larger – plants are also influenced by various state financing instruments and marketing contracts in terms of the price – which in some cases may even be negative - at which the plant in question can still produce electricity.

[7] ProjectTogether (2025): Wind Energy Monitor Germany. Available at: goal100.org/monitor (as at: 14.02.2025).

[9] At the borders between price areas with differences, consumers in one price area buy at a higher price than producers in the other price area have offered. The price difference leads to a payment flow in favour of the grid operator, which connects the two price areas and makes trading technically possible. These revenues are called congestion rents.

[10] Agora Think Tanks (2024): Climate-neutral Germany. From target-setting to implementation.

[11] Cf. chapter in 4.4.3 Agora Energiewende (2025): A new investment instrument for wind and solar installations.

[12] The “70% rule” (Minimum Remaining Available Margin, minRAM) is an EU-wide regulation for the use of cross-border transmission capacities in the electricity grid. It was introduced with the EU Internal Electricity Market Regulation (EU) 2019/943 and stipulates that from 2026 at least 70 percent of the technical transmission capacity (Remaining Available Margin, RAM) at the borders between transmission grids must be available for cross-border electricity trading (until 2026 it was an annually increasing percentage value).

[13] ACER (2022): Decision on the alternative bidding zone configurations to be considered in the bidding zone review process.

[14] The convergence criterion of +/- 1 EUR/MWh has an influence on the percentage value, but the effects discussed here occur largely independently of the exact choice of criterion.

[15] The study also points out that the futures market products for the single German price zone are often used by market participants in neighbouring European countries to roughly hedge their risks and it is questionable what influence a change in the price zone would have on this.

[16] Baukostenzuschüsse are one-time payments to grid operators when connecting new consumers to the grid requires the grid to be expanded or reinforced. They are not therefore paid for ongoing grid use – which is covered by grid charges – but for technically enabling the connection itself, for example through stronger lines, larger transformers or additional switching equipment.

[17] Possible starting points are dynamic transmission grid tariffs and further development of the “use instead of curtailment” concept to avoid inc-dec gaming and the redispatch process for renewable energies.

[18] The downstream correction of the market result is due to the limitation caused by the shorter lead times of some processes.

[19] “EPADs (Electricity Price Area Differentials) are financial contracts used to hedge the difference between a local electricity price area and a broader system or reference price. They allow market participants to manage locational price risk in markets with multiple bidding zones, complementing standard futures or forward contracts based on the system price.

Bibliographical data

Downloads

-

Summary

pdf 3 MB

Local electricity prices in Germany

How integrating grid realities into the electricity market saves costs

All figures in this publication

Effects of the choice of electricity market design

Figure Overview graphic from Local electricity prices in Germany on page 4

Excessive and insufficient price incentives for flexible electricity consumption due to current electricity prices (increasing grid congestion)

Figure A from Local electricity prices in Germany on page 11