-

Onshore wind and ground-mounted solar parks, with annual investments of 15 billion euros, are particularly important for achieving Germany’s statutory climate targets for 2030.

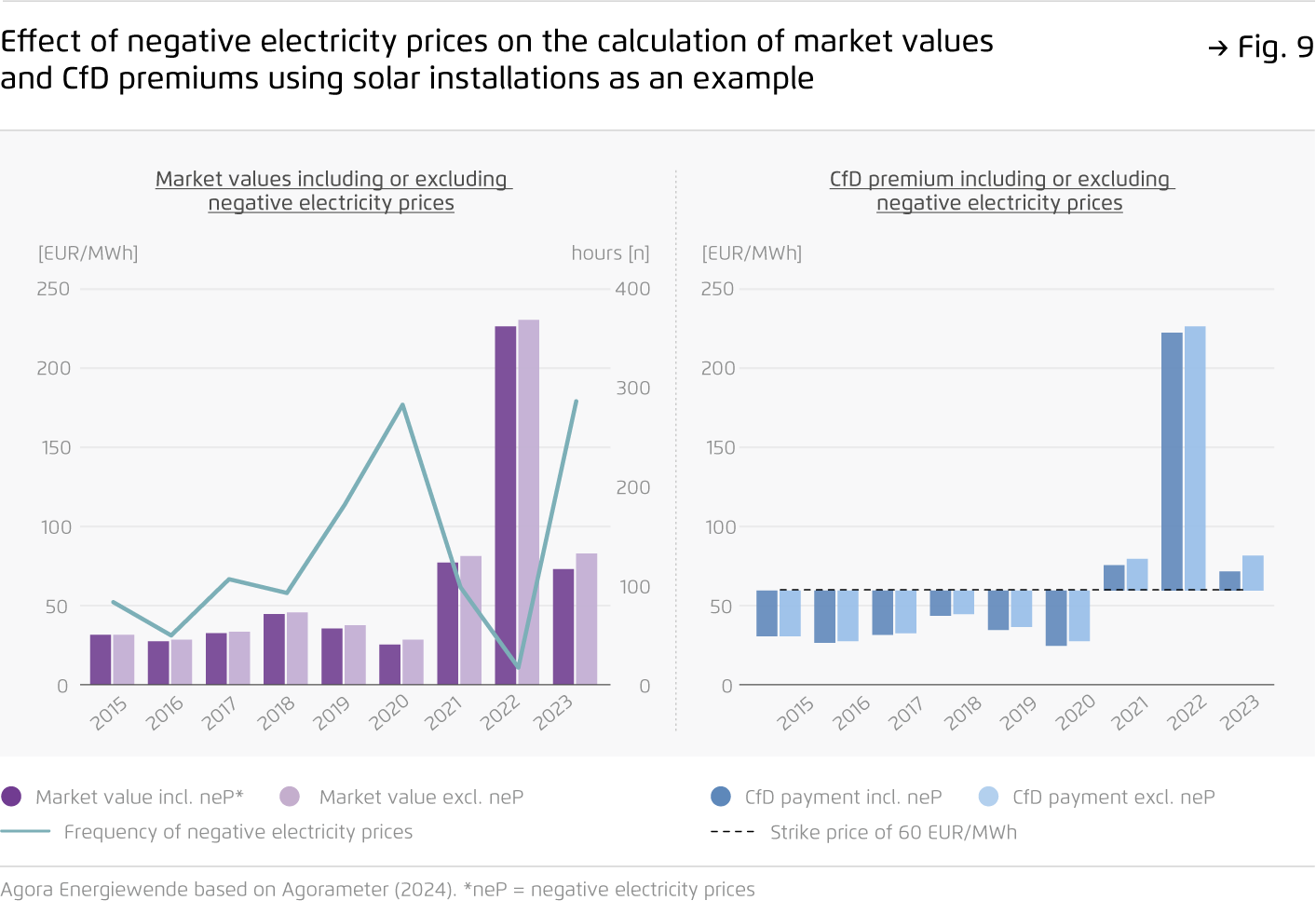

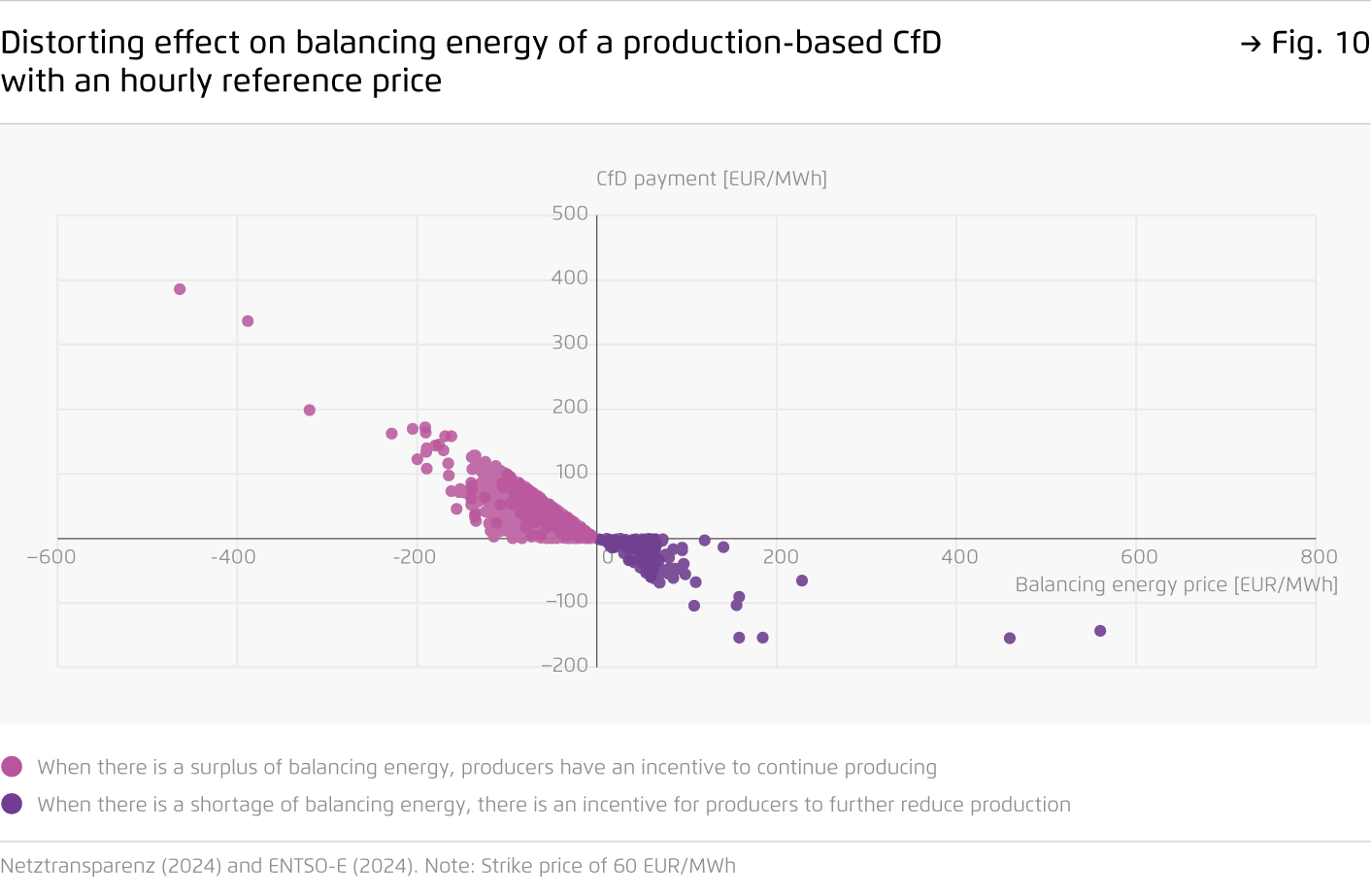

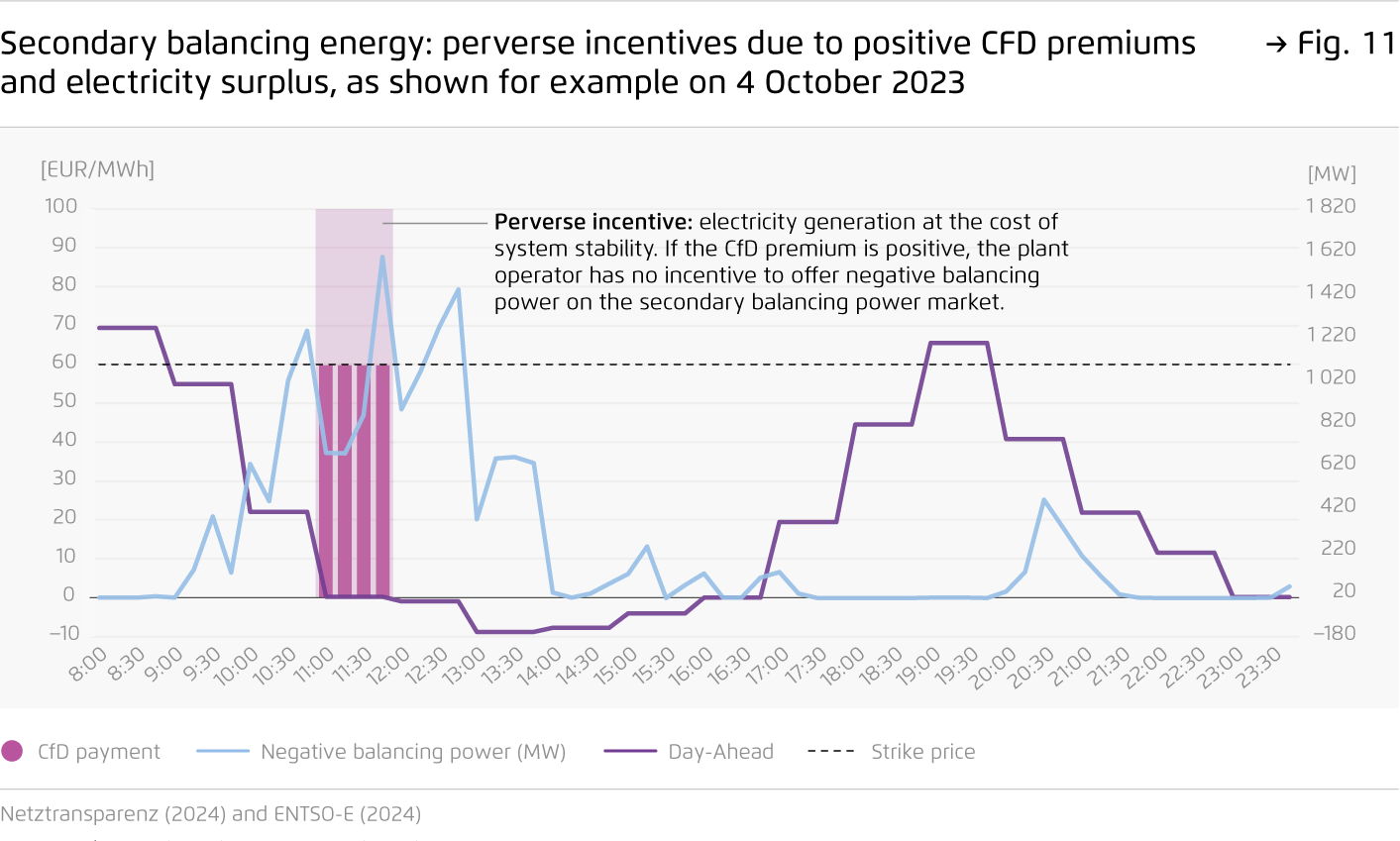

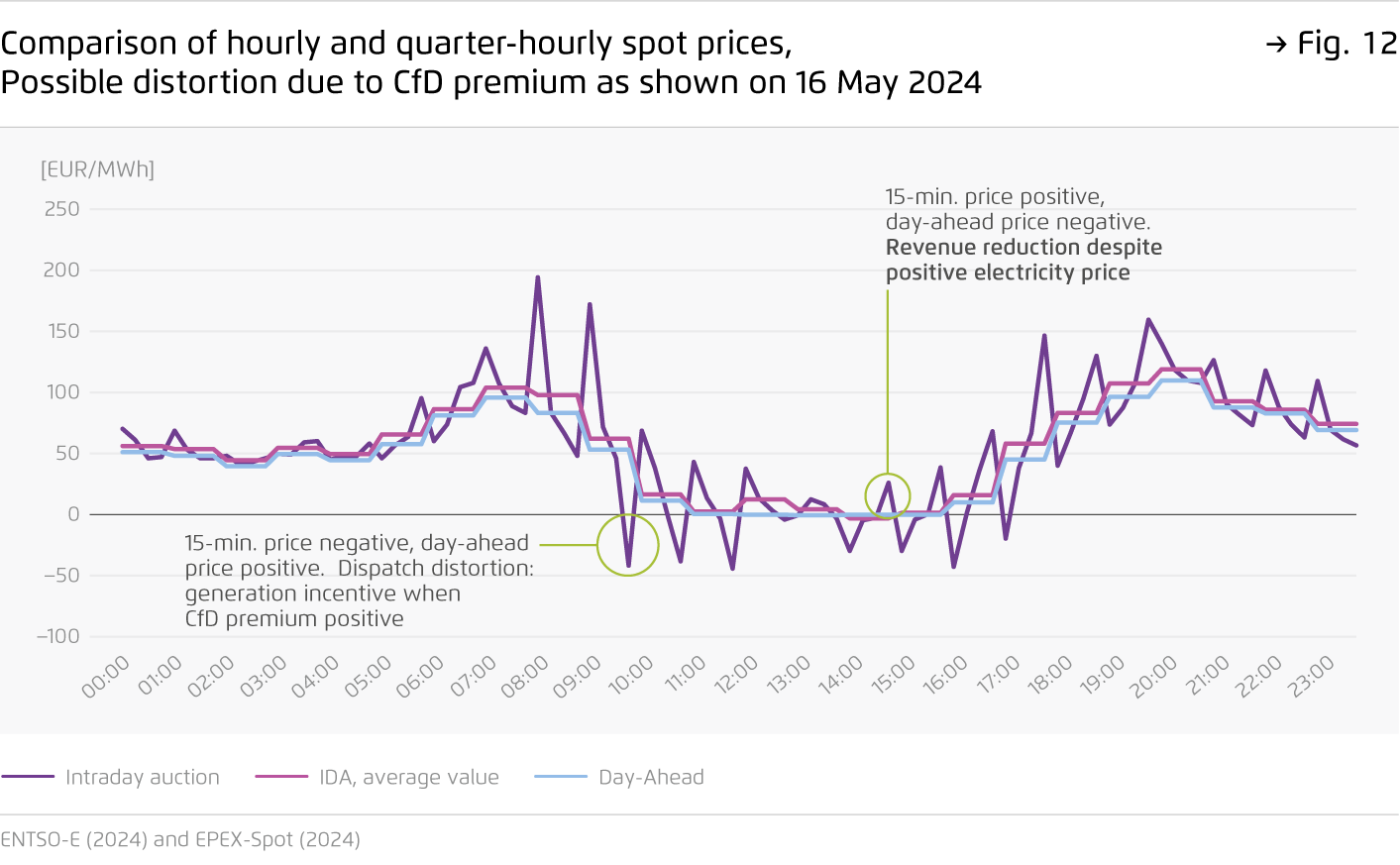

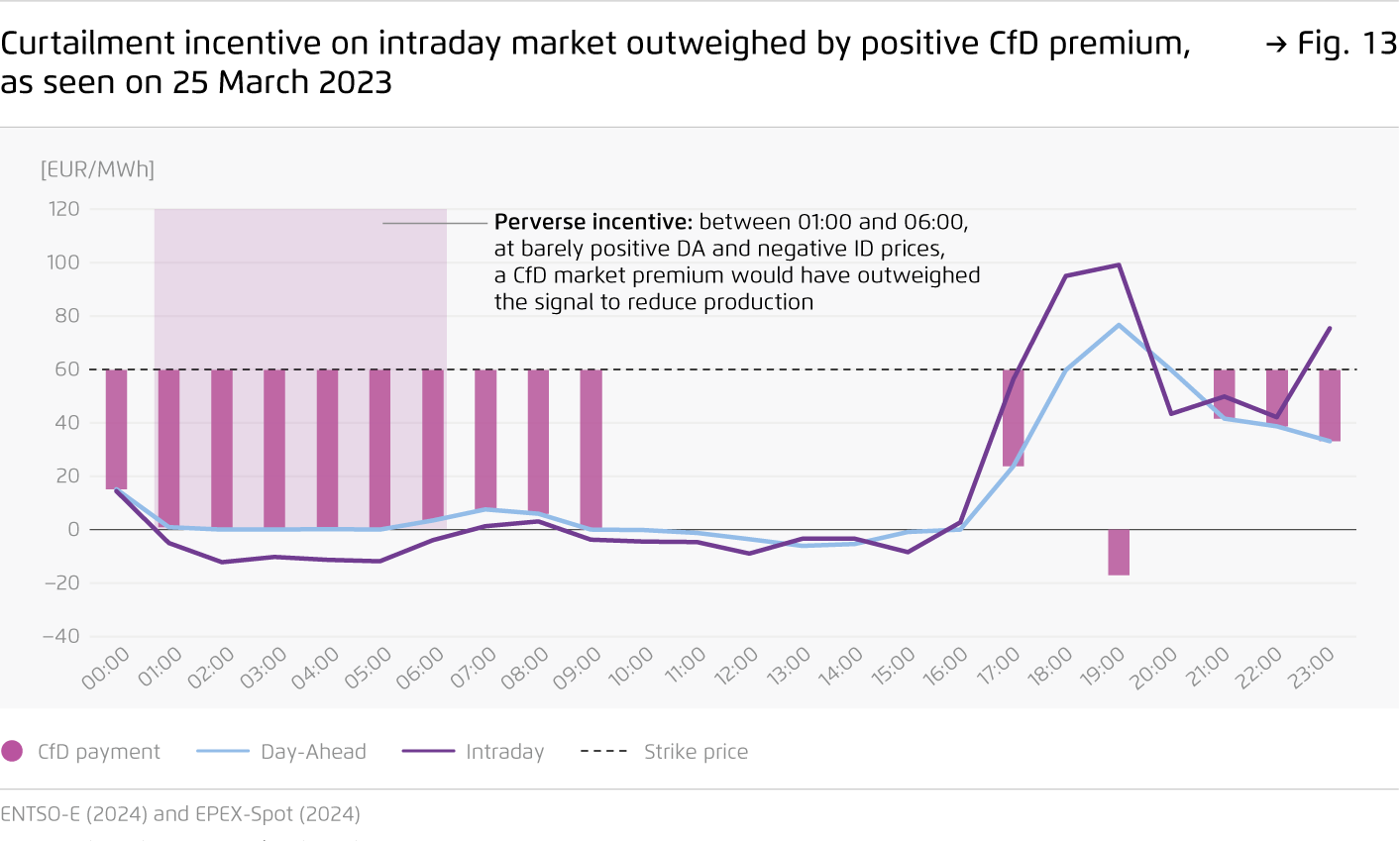

Without state backing, risks and capital costs would increase, the necessary expansion would be delayed and the climate targets would be jeopardised. At the same time, however, the current volume-based market premium model in the German Renewable Energy Sources Act (EEG) is increasingly undermining the efficiency of the electricity market by obscuring short-term price signals.

-

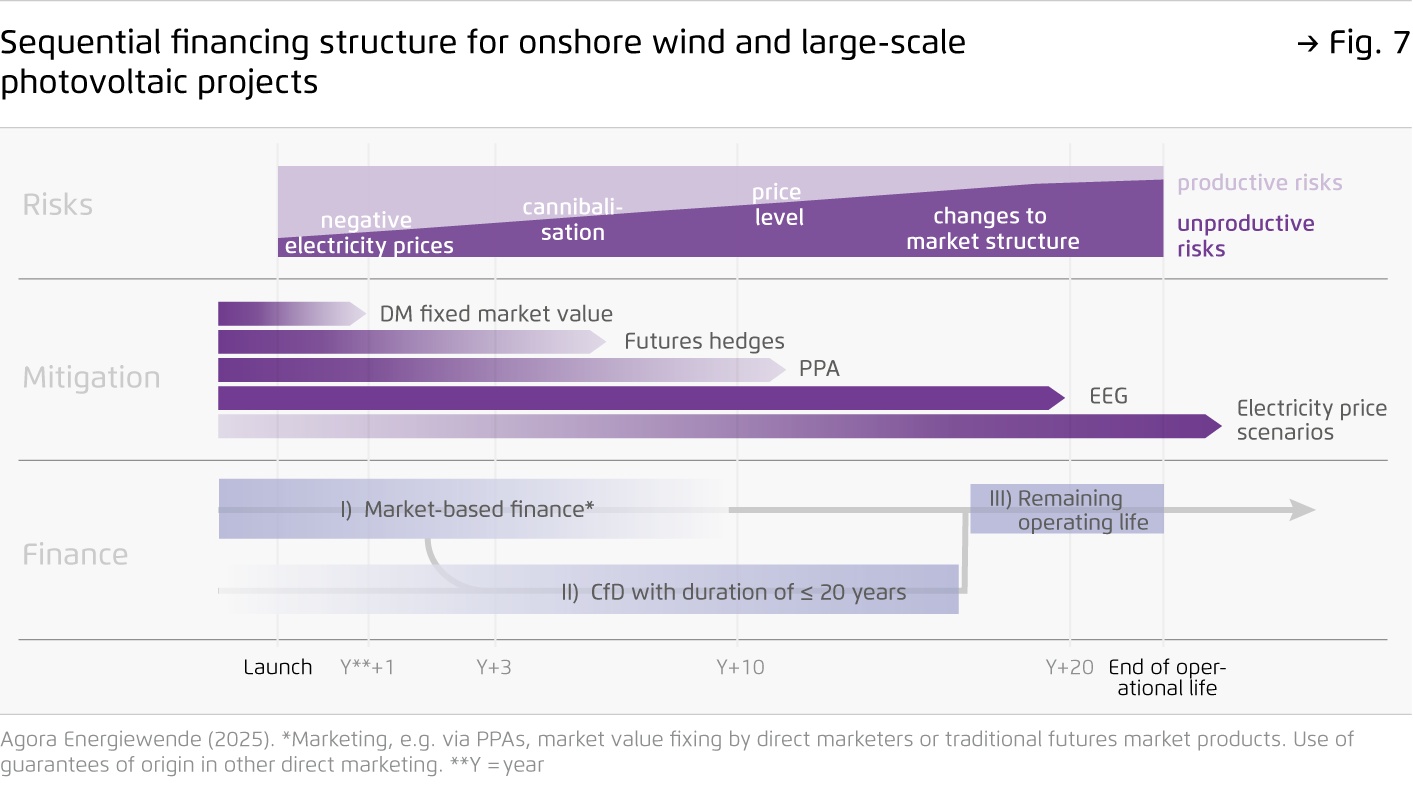

Reforming the EEG by combining financial contracts for difference (CfDs) with partial financing through long-term power purchase agreements (PPAs) balances protection against risks with strong market-based components.

Linking these CfDs to a suitable reference plant – rather than to individual wind or solar photovoltaic generation facilities – strengthens the price signal, thereby aligning configuration and operation to market value. The PPA element creates incentives to combine market-based financing in the early years of operation with state support in later years.

-

The flexibility between state guarantees and market-based PPA financing stablises the pace of expansion of renewable energy and leads to a fair allocation of risks and opportunities between investors and the state.

At the point when investments are made, investors choose the duration of the state guarantee phase; additional revenues that arise during periods of high prices then accrue to the state. For investments with longer PPA components, the state’s obligations are reduced and the scope for greater expansion in the overall EEG account is increased.

-

In addition to PPAs and financial CfDs, further instruments are needed for a cost-effective, climate-neutral energy system.

It is important to provide incentives for electrification and market signals to encourage the flexible use of renewable electricity through power-to-heat systems, storage, electric vehicles and heat pumps. This will stabilise the market value of wind and solar installations, enhance their attractiveness in the financial markets and reduce costs to the federal budget.

This content is also available in: German

A new investment instrument for onshore wind and solar PV

How market incentives and state guarantees can pave the way to a climate-neutral electricity system in Germany

Preface

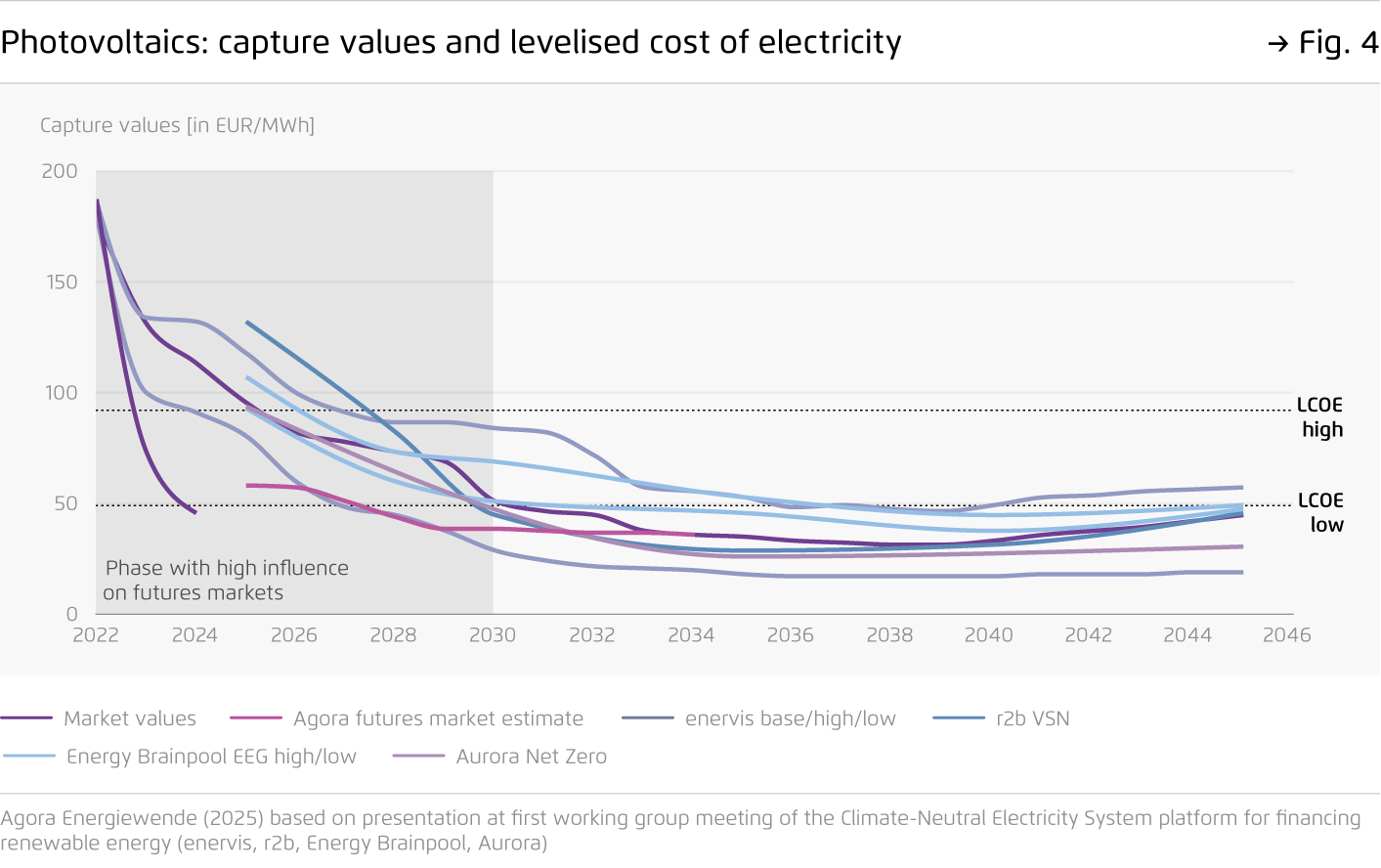

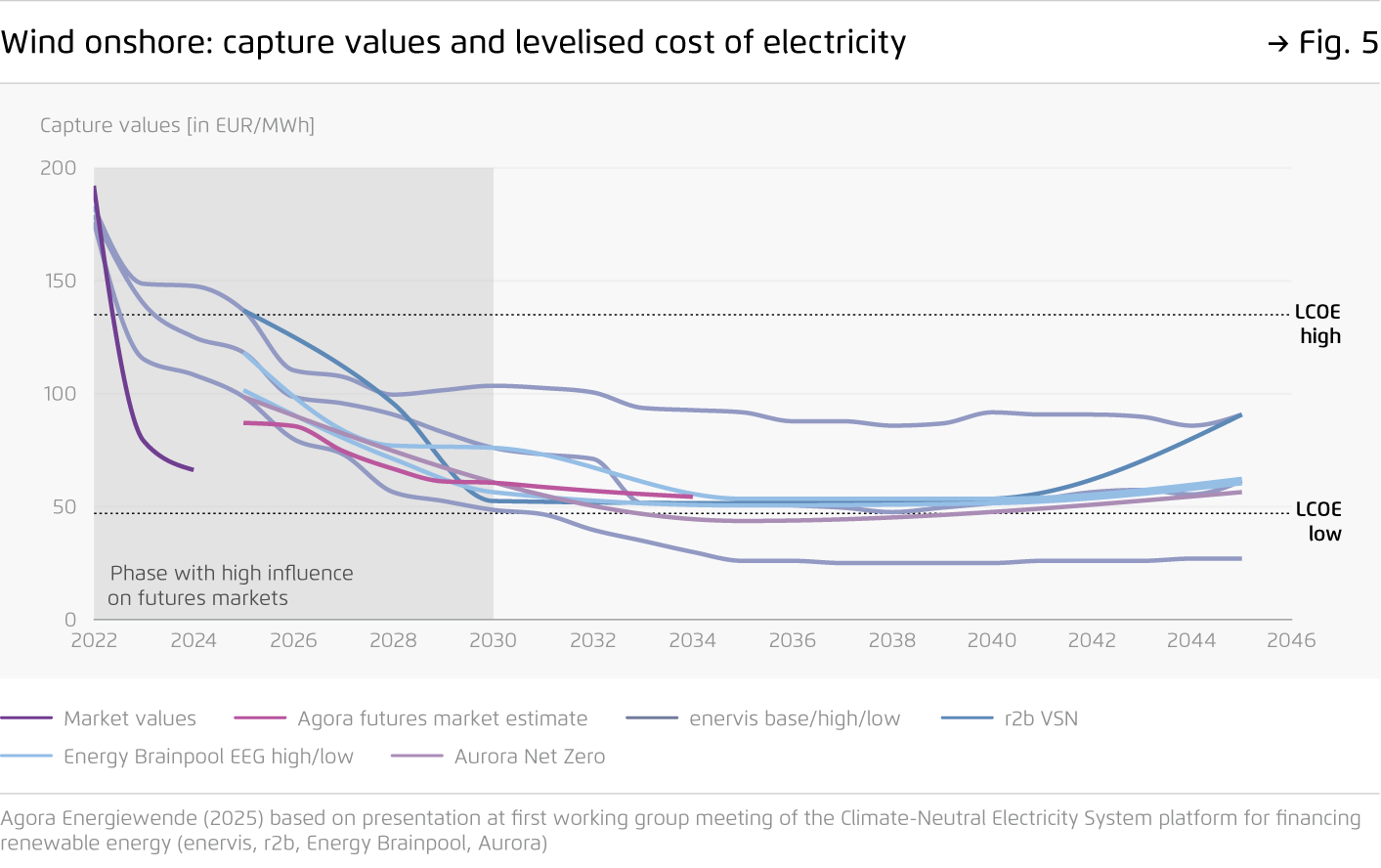

Wind power and solar installations are the foundations of a climate-neutral energy system that will free us from our dependence on fossil fuels. These technologies have developed at a remarkable pace: 20 years ago, the feed-in tariff for solar installations was around 54 cents per kilowatt hour (ct/kWh). Last year, the reference value basis for the market premium for ground-mounted systems was only 5 ct/kWh, and for onshore wind it was around 7 ct/kWh.

With the approval of the German Renewable Energy Sources Act (EEG) under European law set to expire at the end of 2026, some are justifiably questioning whether the current form of financial support from the state is still necessary at all.

In this analysis, we investigate the role of state backing in a cost-effective energy system, focusing in particular on how such support can be combined with incentives that encourage wind and ground-mounted solar installations to respond to the needs of the electricity system.

Based on our analysis, we derive proposals designed to inform the debate on the reform of the Renewable Energy Sources Act with the aim of putting the energy transition on a future-proof footing.

This is a translated version of the original German publication

Key findings

Bibliographical data

Downloads

-

Analysis

pdf 3 MB

A new investment instrument for onshore wind and solar PV

How market incentives and state guarantees can pave the way to a climate-neutral electricity system in Germany

All figures in this publication

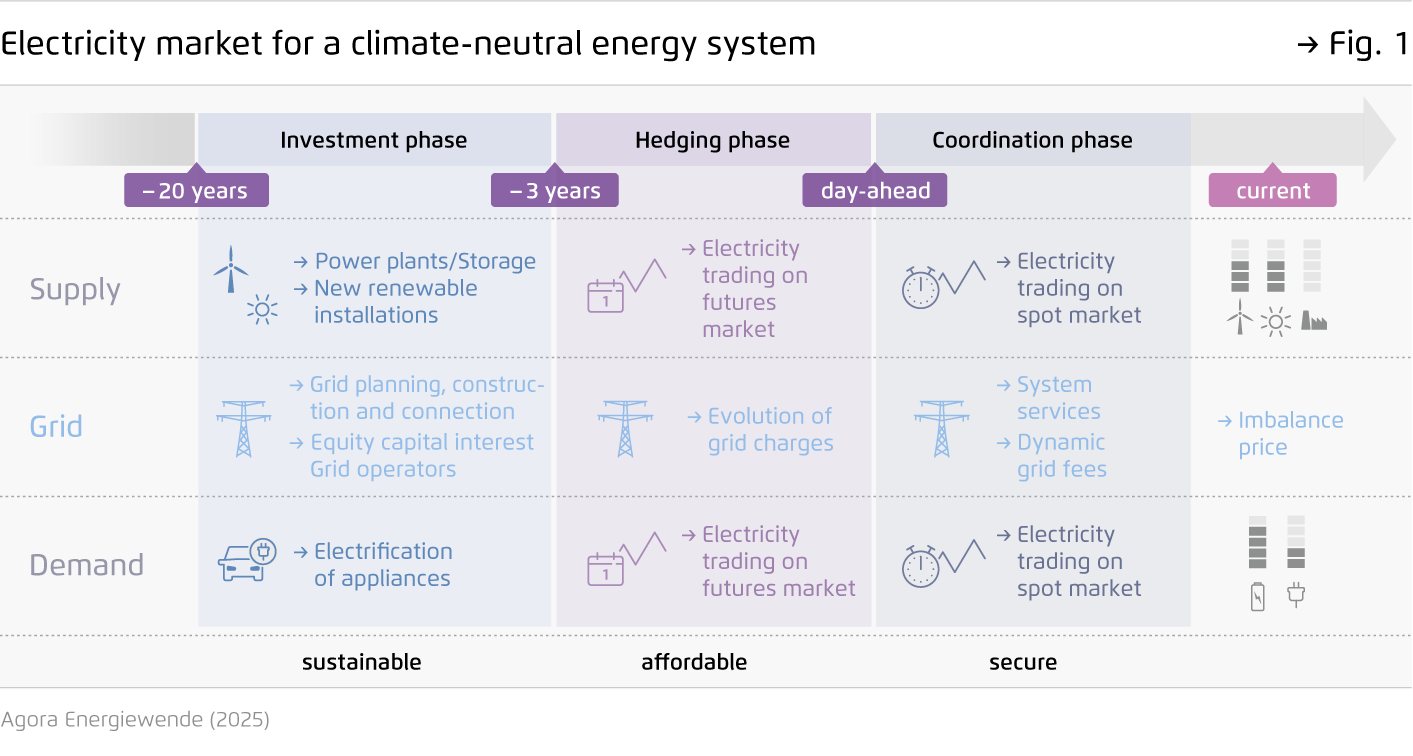

Electricity market for a climate-neutral energy system

Figure 1 from A new investment instrument for onshore wind and solar PV on page 12

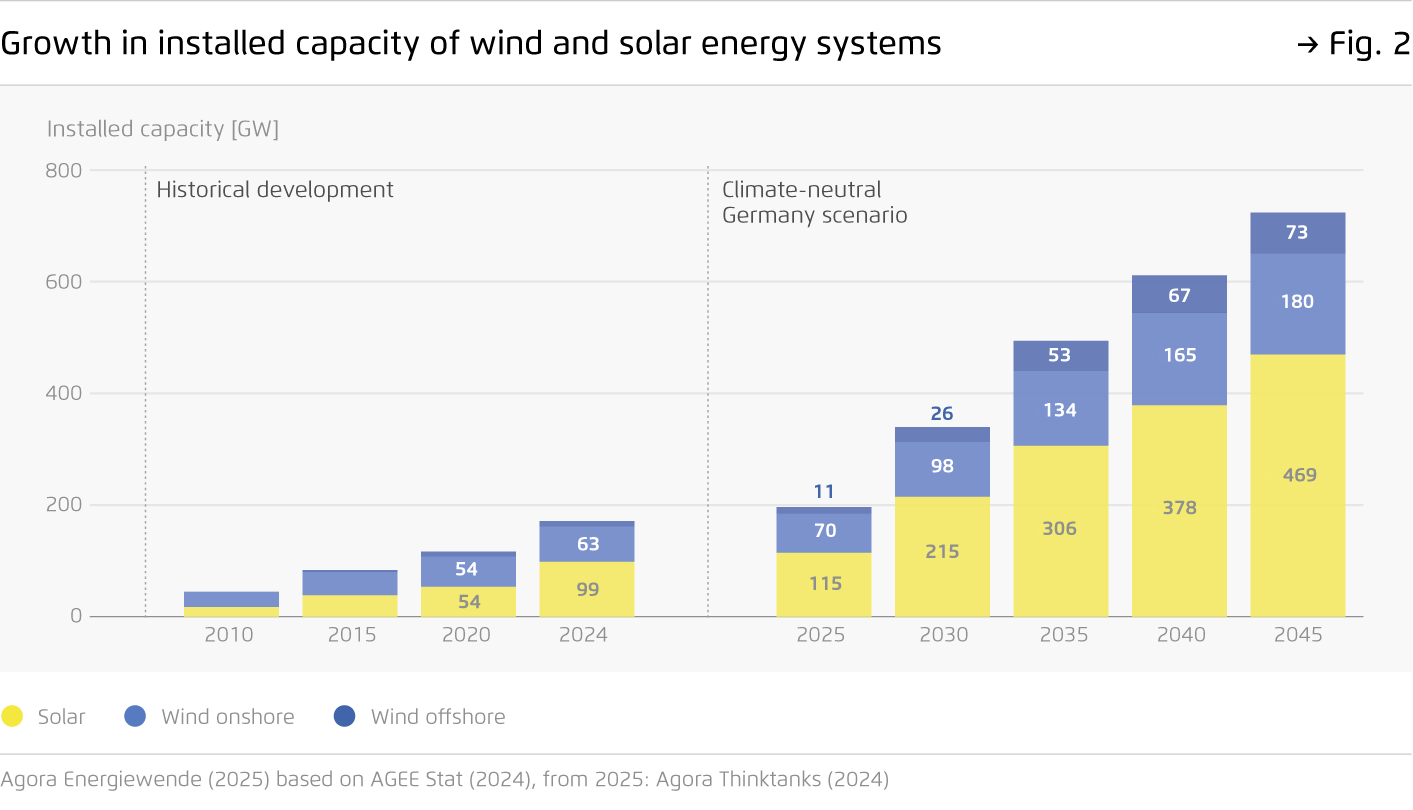

Growth in installed capacity of wind and solar energy systems

Figure 2 from A new investment instrument for onshore wind and solar PV on page 20