-

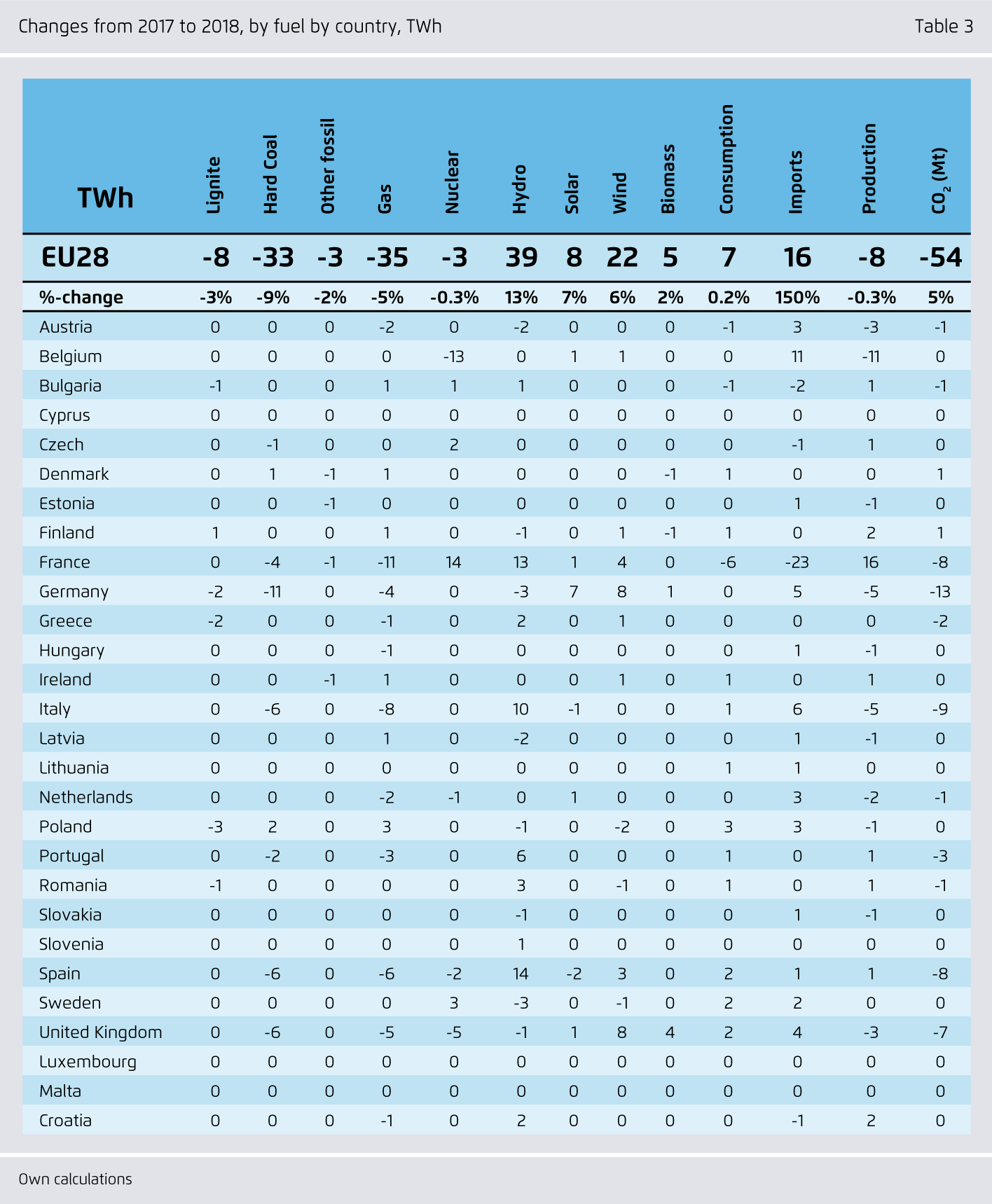

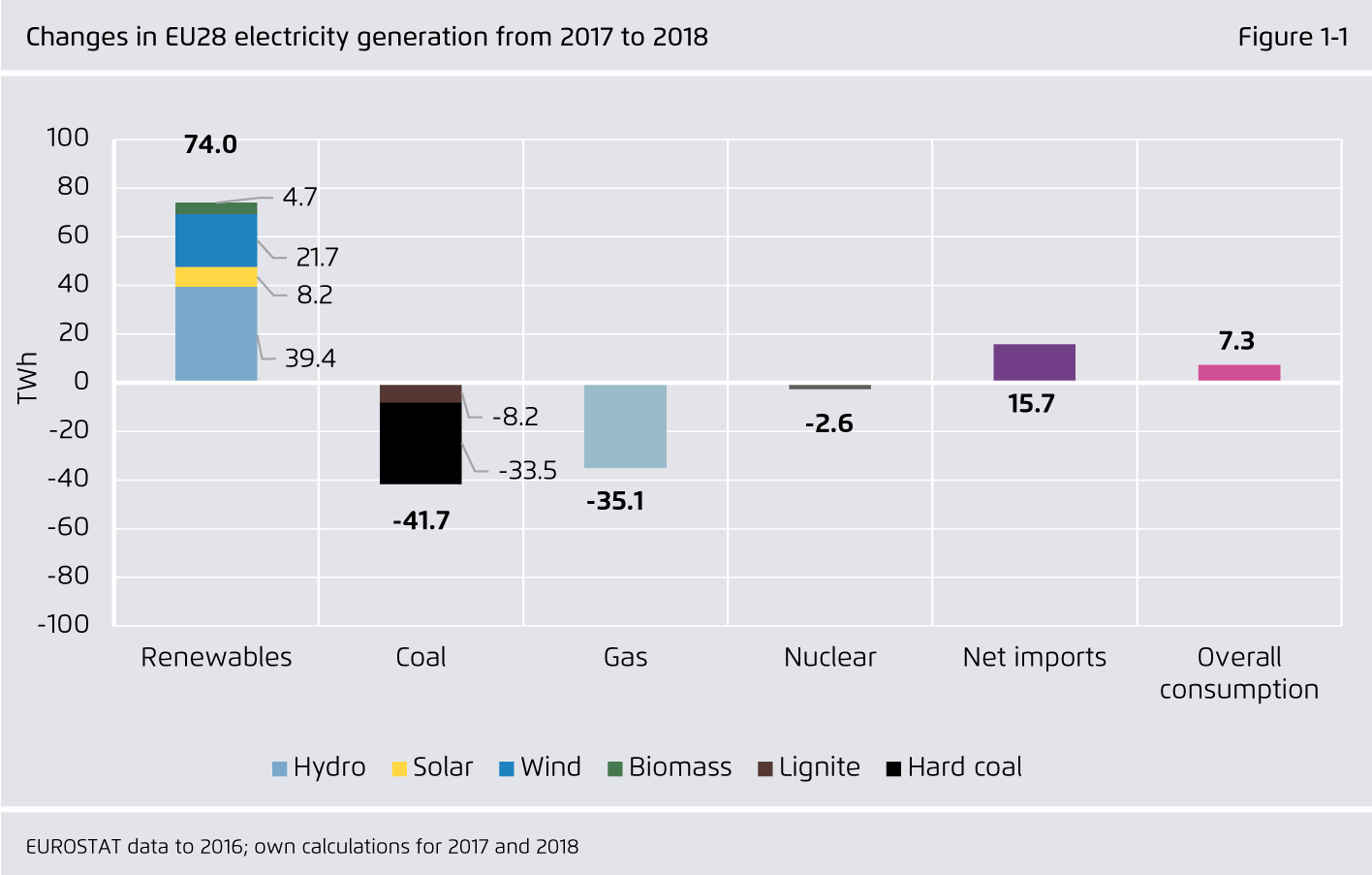

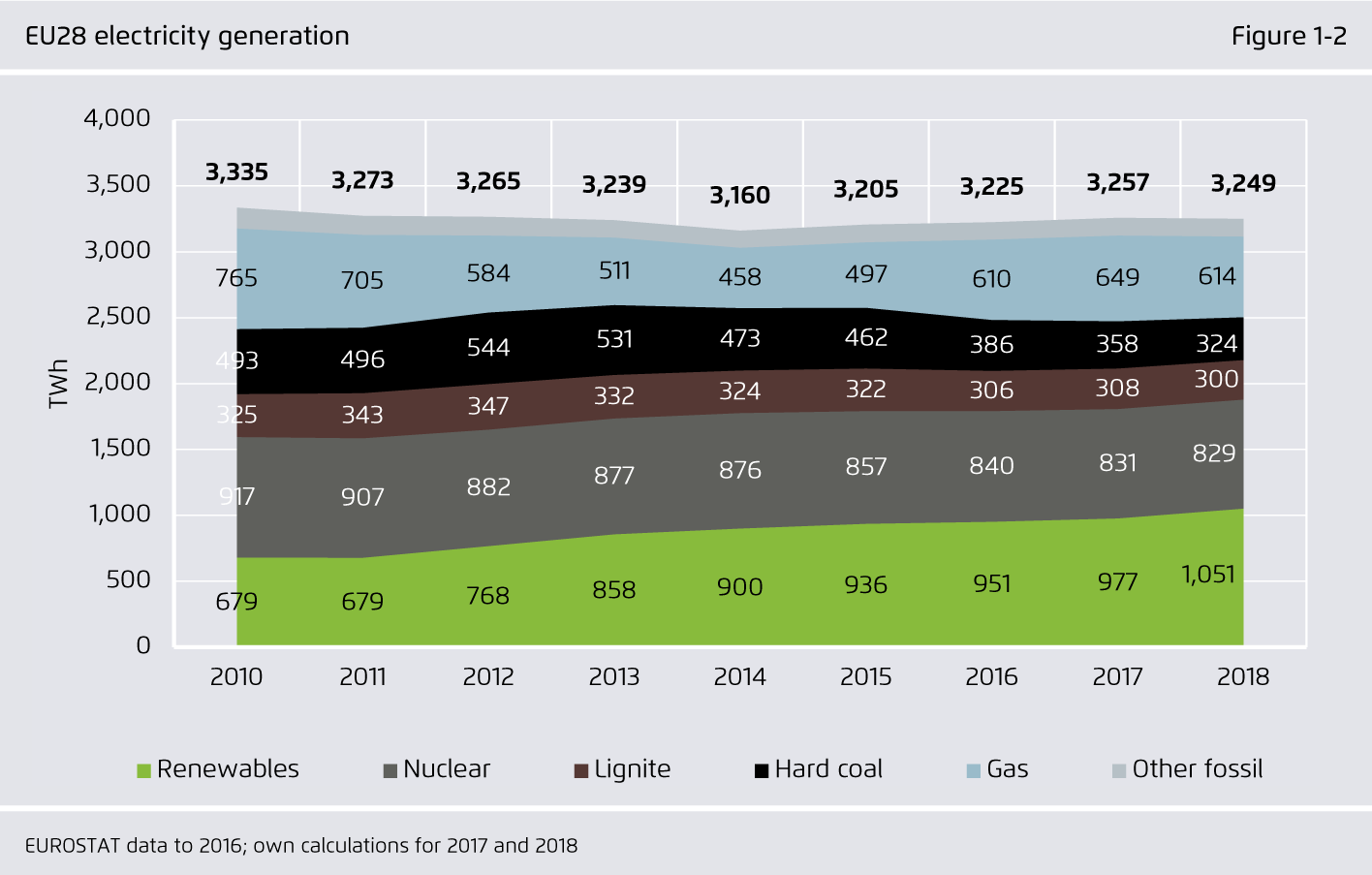

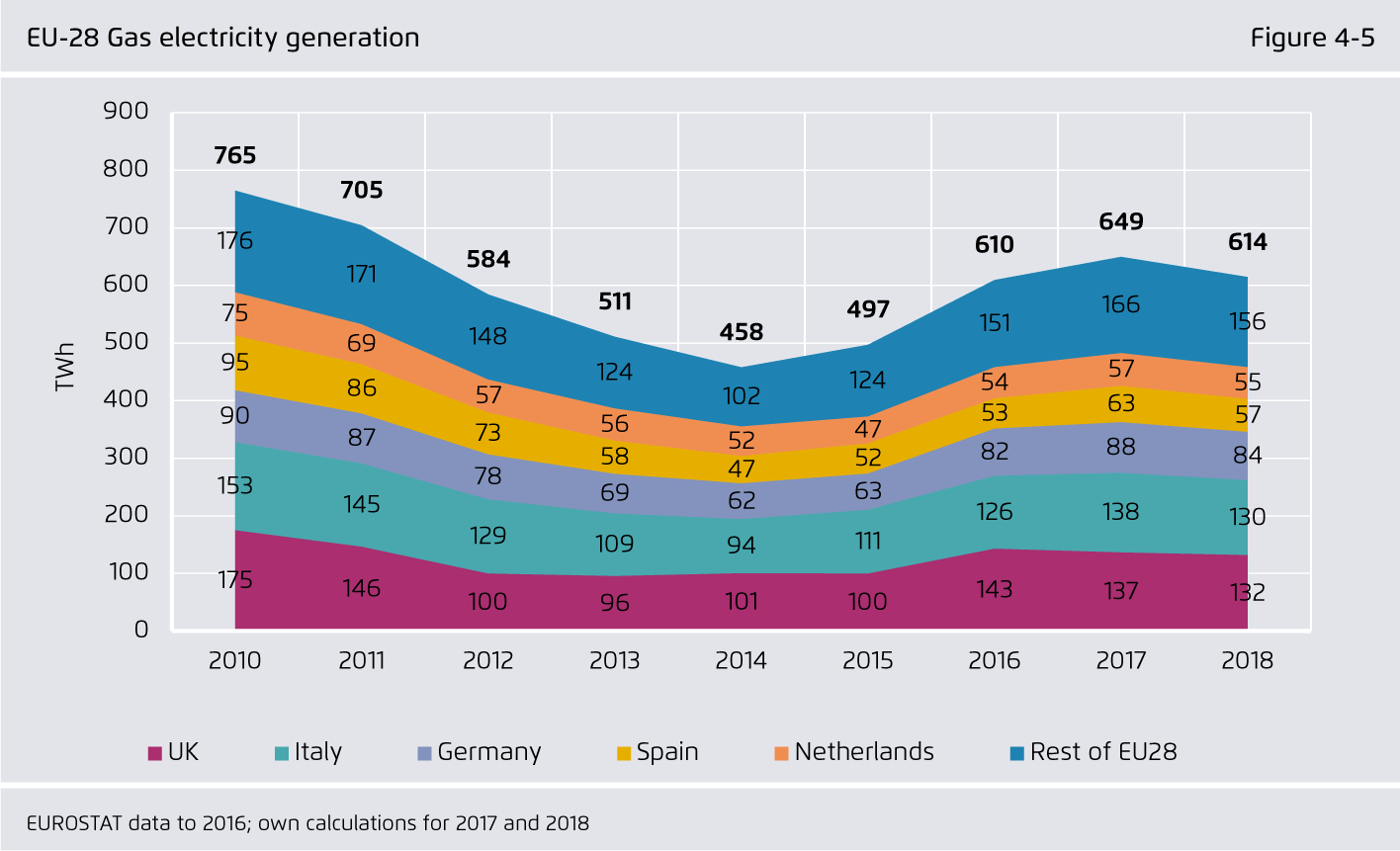

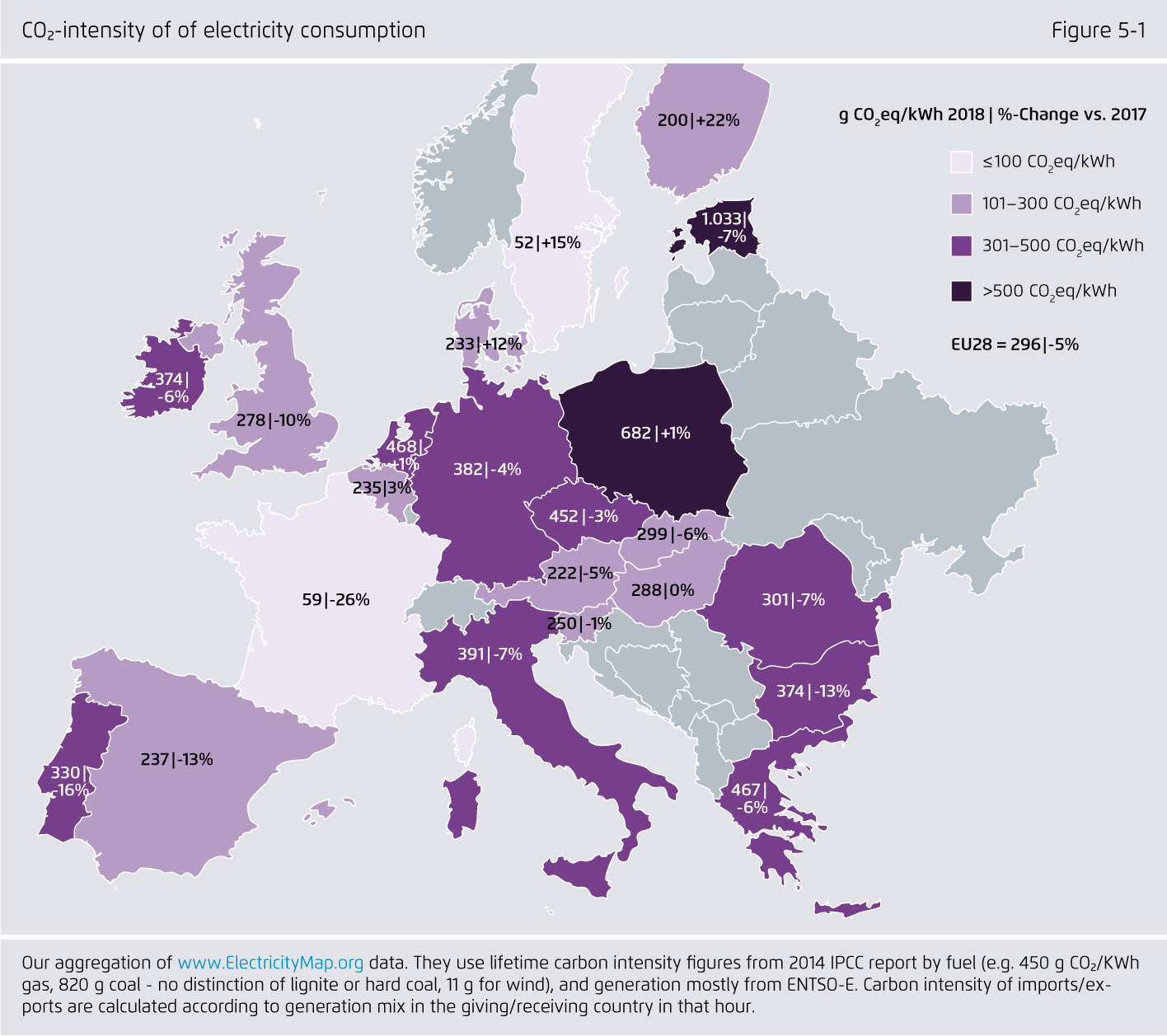

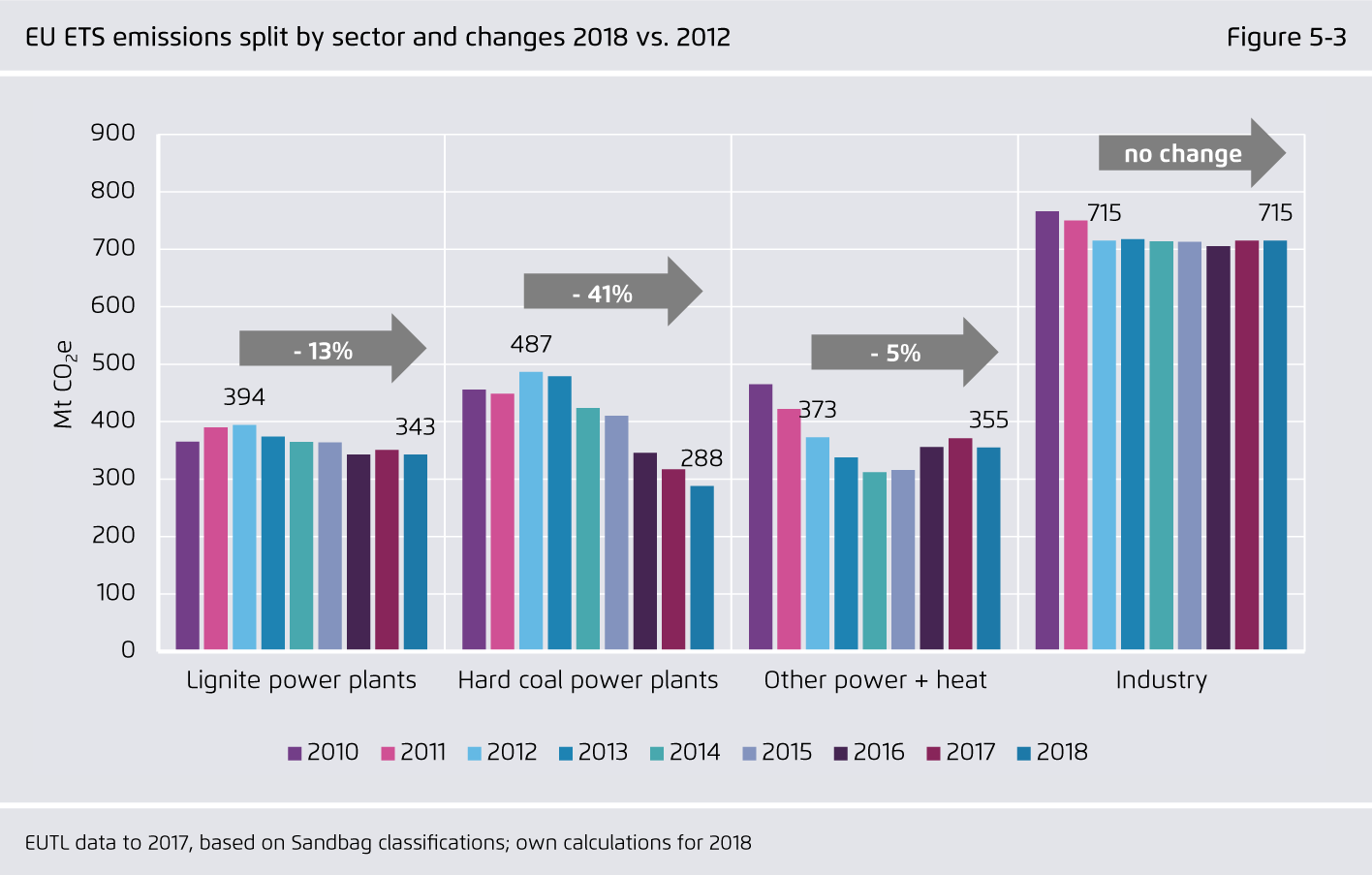

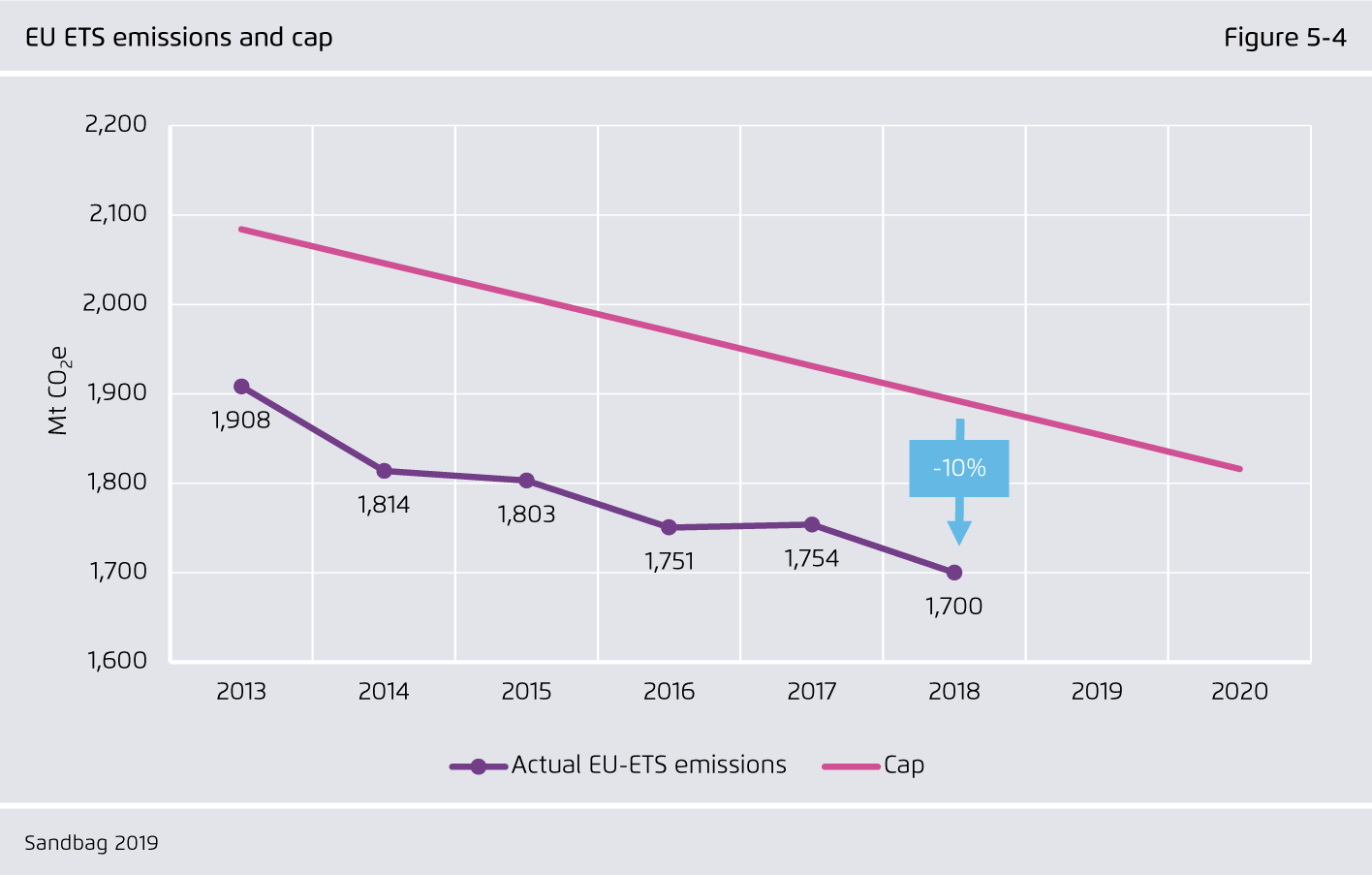

CO₂ emissions in the power sector fell by 5% in 2018.

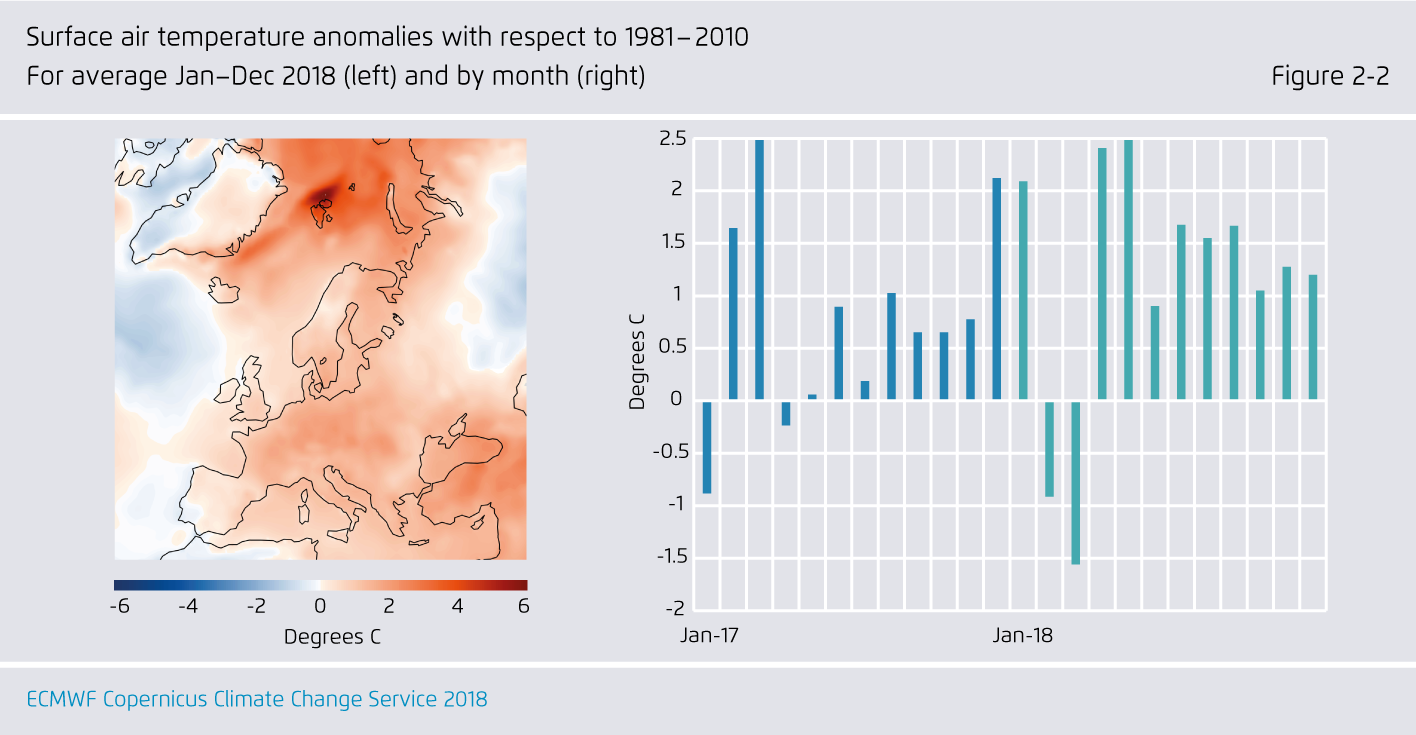

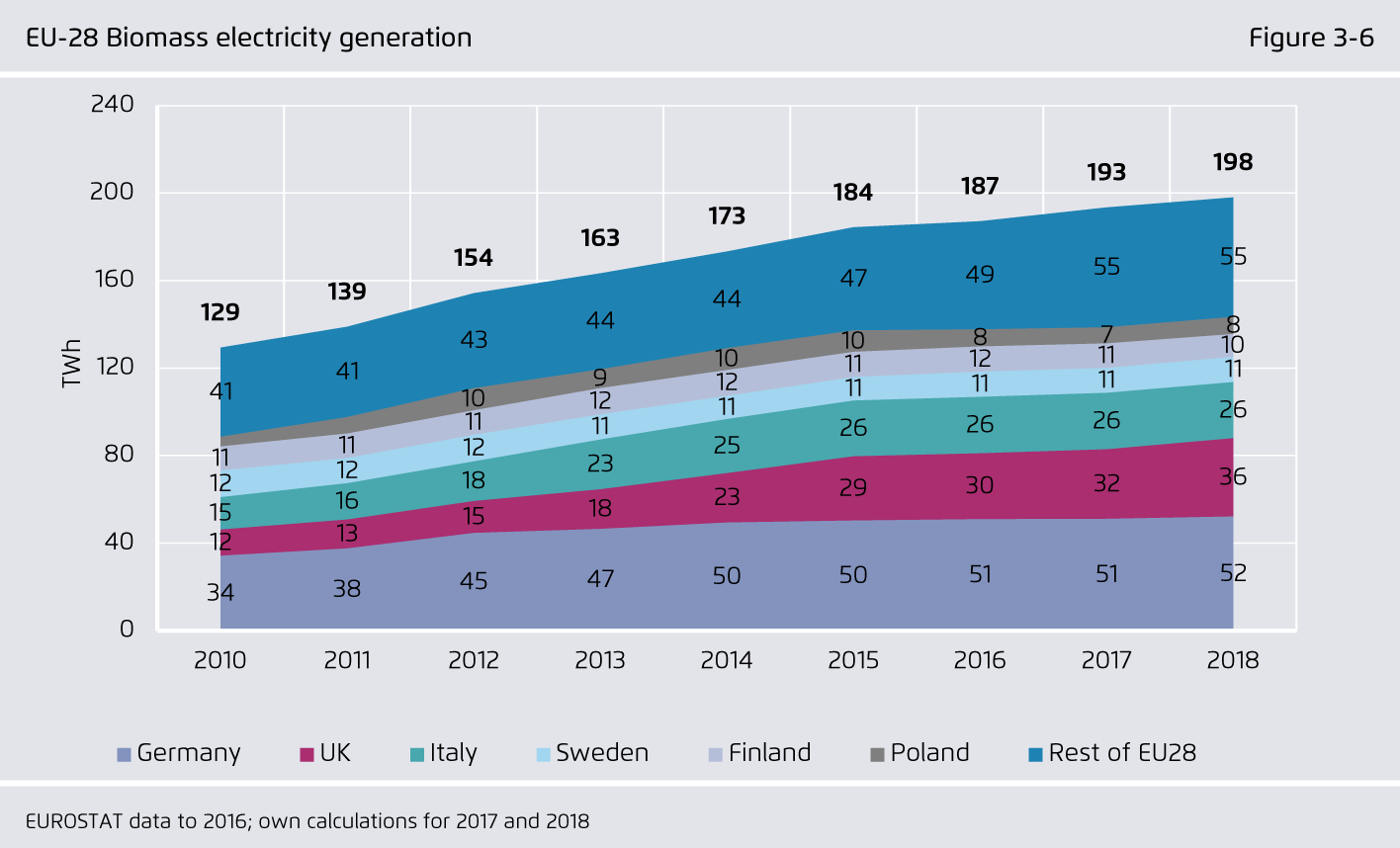

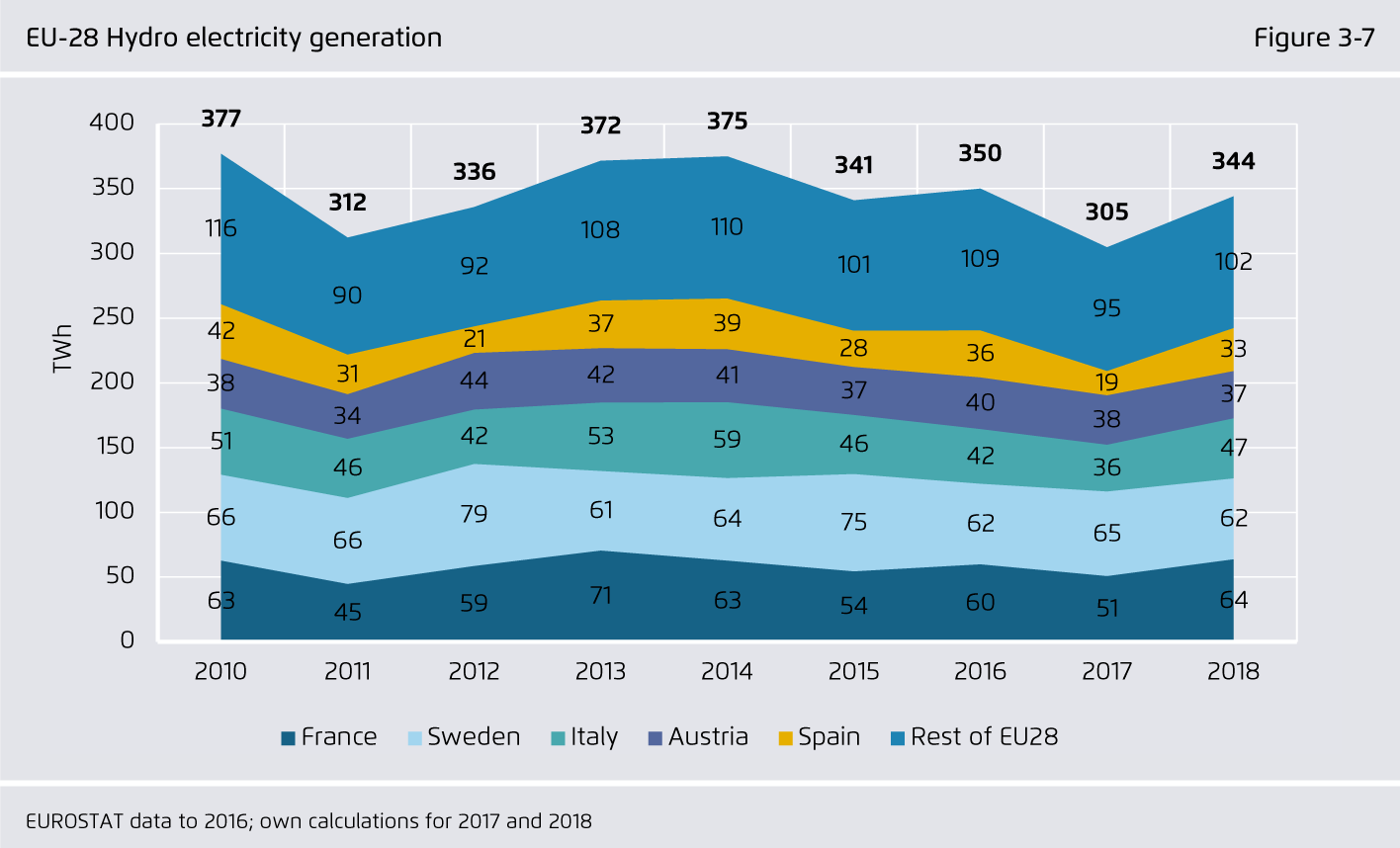

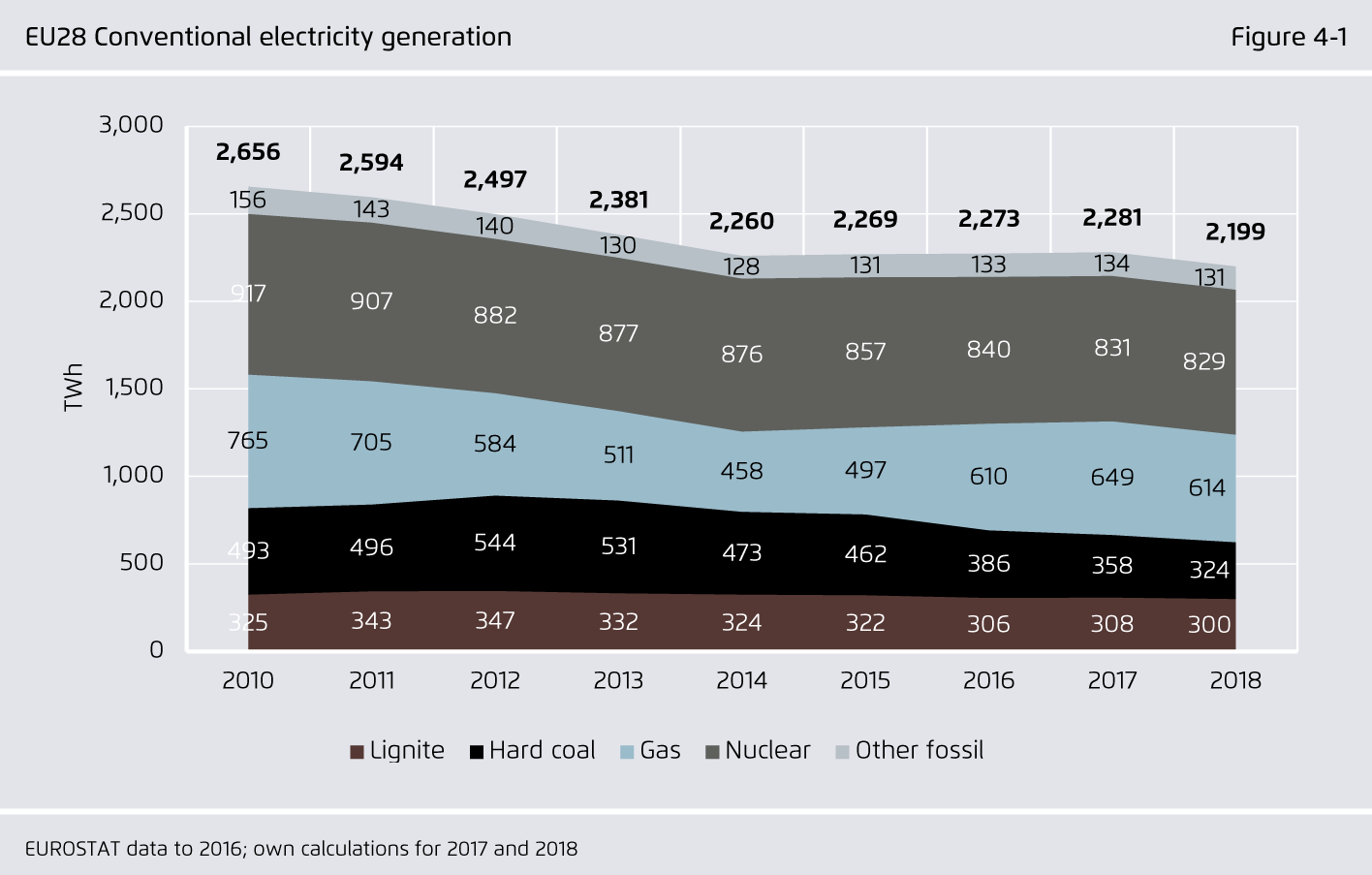

Half of this was structural, from new wind, solar and biomass displacing hard coal. The other half was weather-related, as increased hydro generation reversed the temporary rise in gas in 2017. Overall EU ETS emissions, we estimate, fell by 3%, from 1754 Mt in 2017 to 1700 Mt in 2018.

-

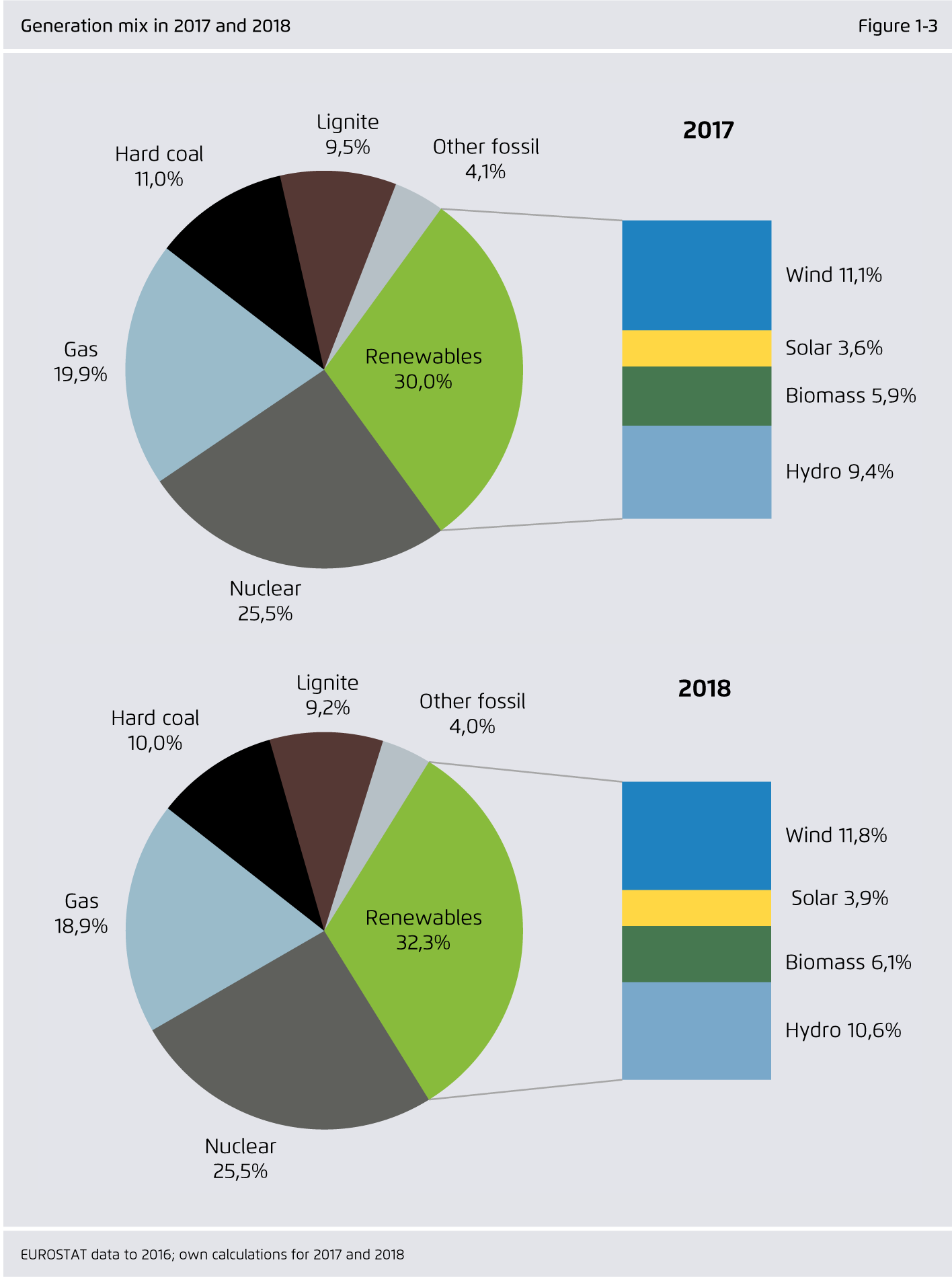

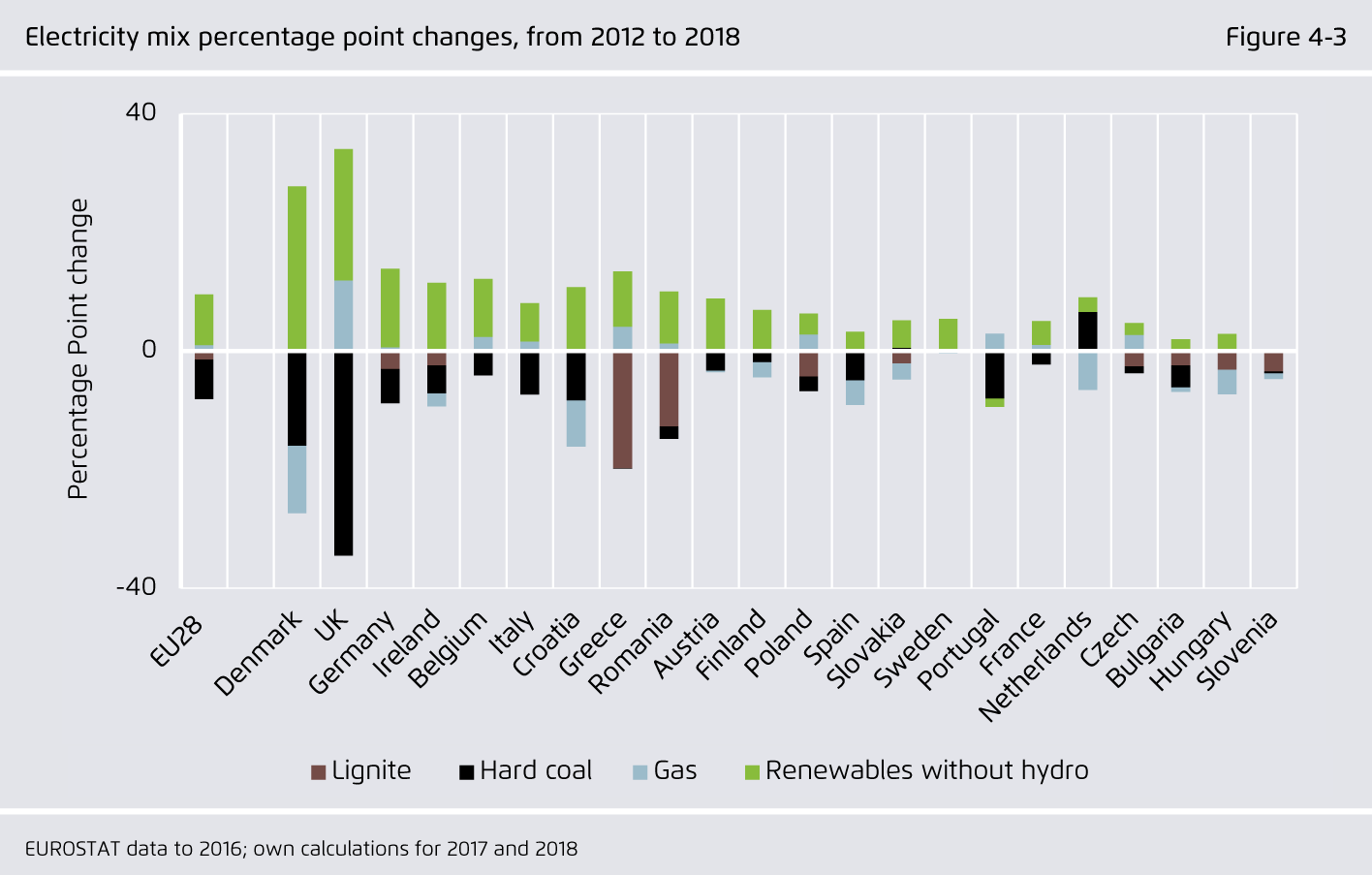

It’s a tale of two types of coal: Europe’s transition from hard coal to renewables is accelerating ...

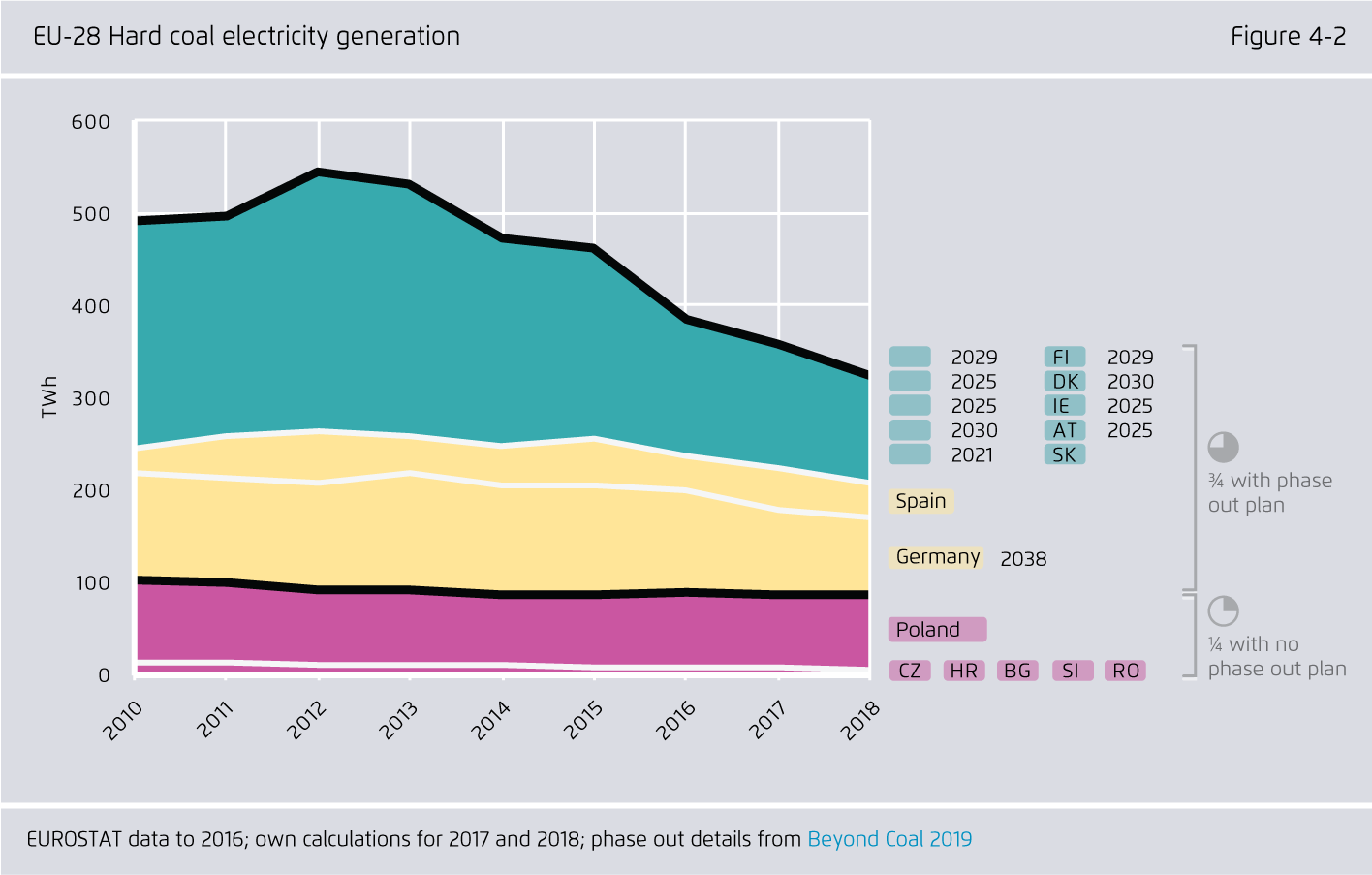

Hard coal generation fell by 9% in 2018, and is now 40% lower than in 2012. In 2018, Germany and Spain announced that coal phase-out plans were imminent. That would now put three quarters of Europe’s 2018 hard coal generation under national coal phase-outs. The remaining quarter is almost all in Poland.

-

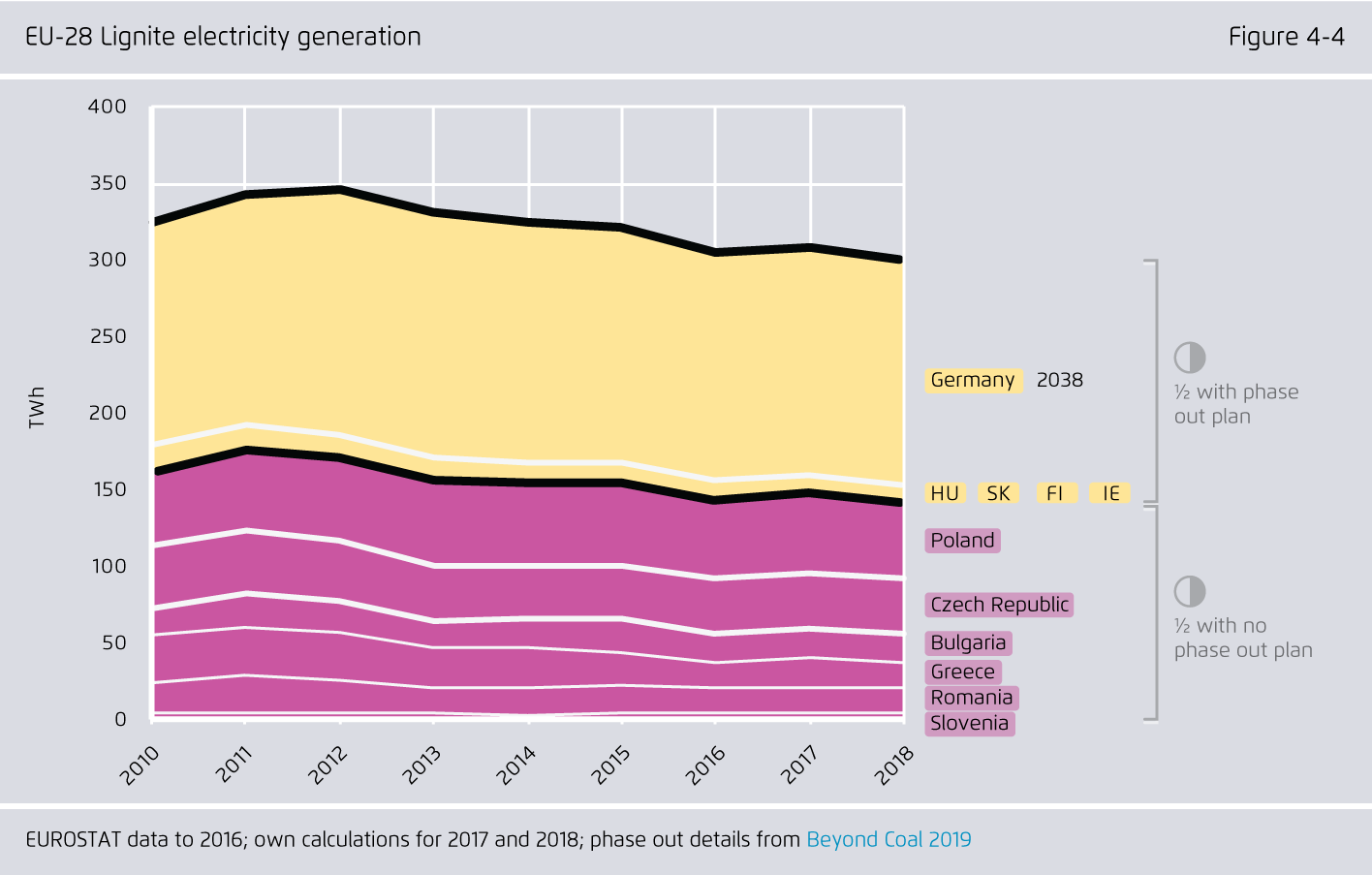

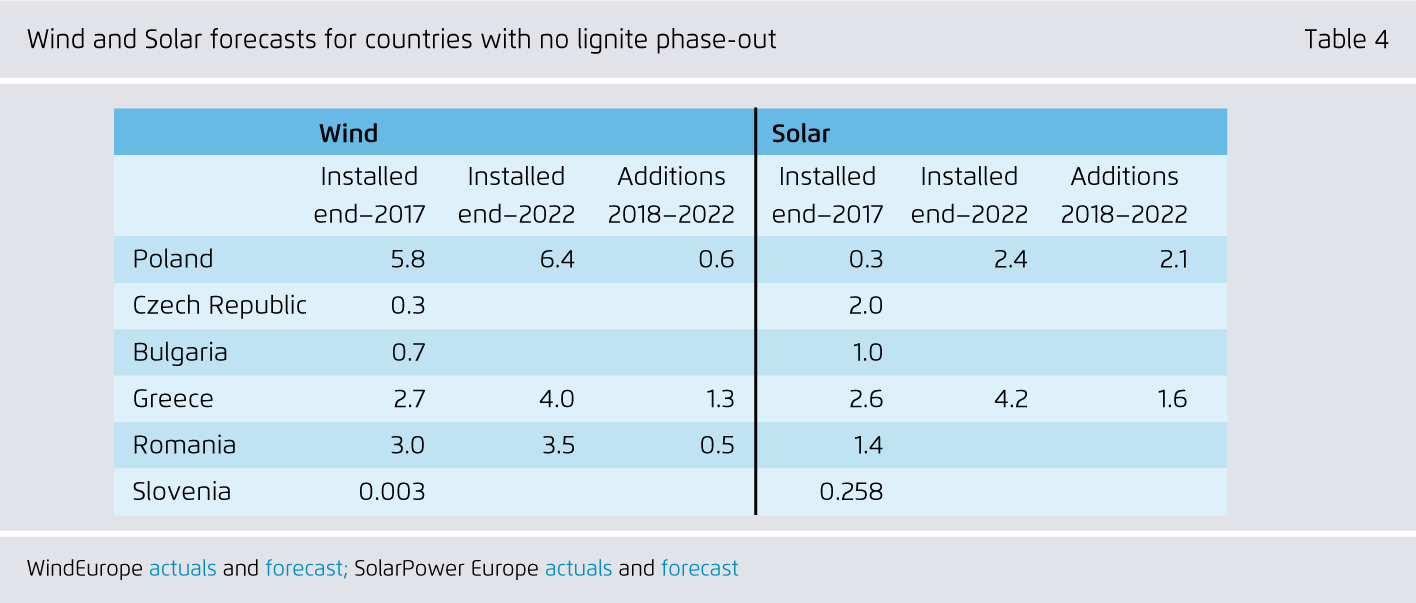

... however, the transition from lignite – the dirtier, brown coal – to renewables proving much harder.

Lignite generation fell by only 3% in 2018. Half of Europe’s lignite generation in 2018 was in Germany; the Coal Commission announcement for a 2038 phase-out includes lignite. The other half is in countries where this is not yet the case: Poland, Czech Republic, Bulgaria, Greece, Romania and Slovenia.

-

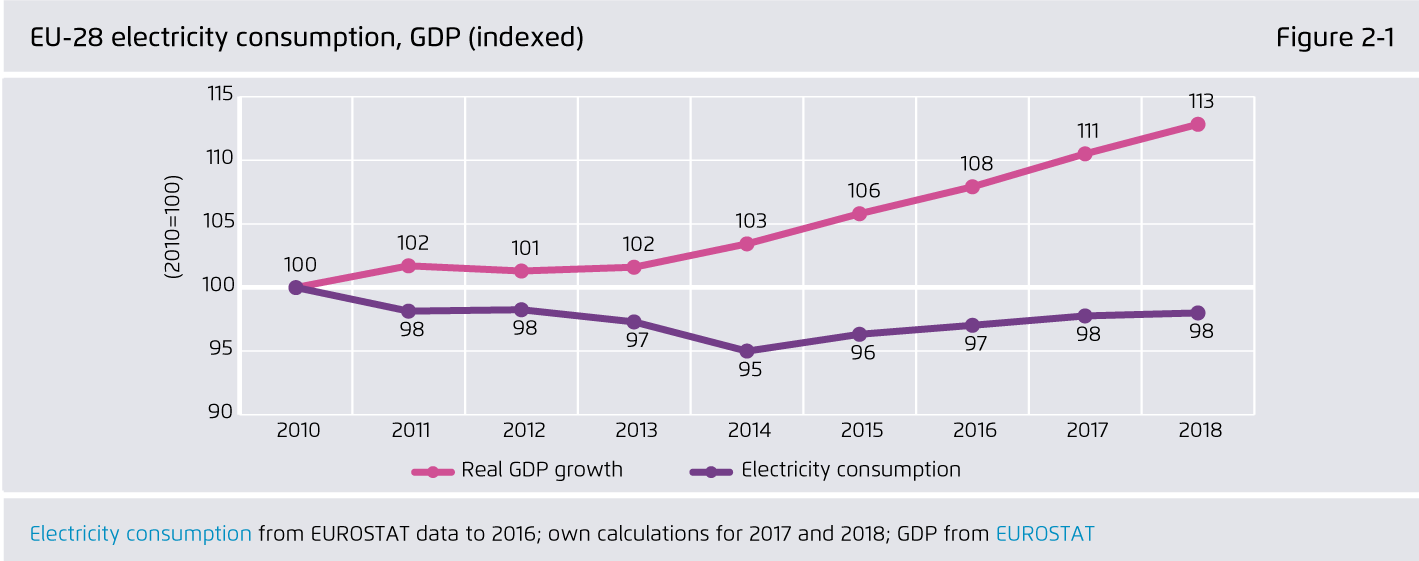

Wind is strong, but get ready for solar!

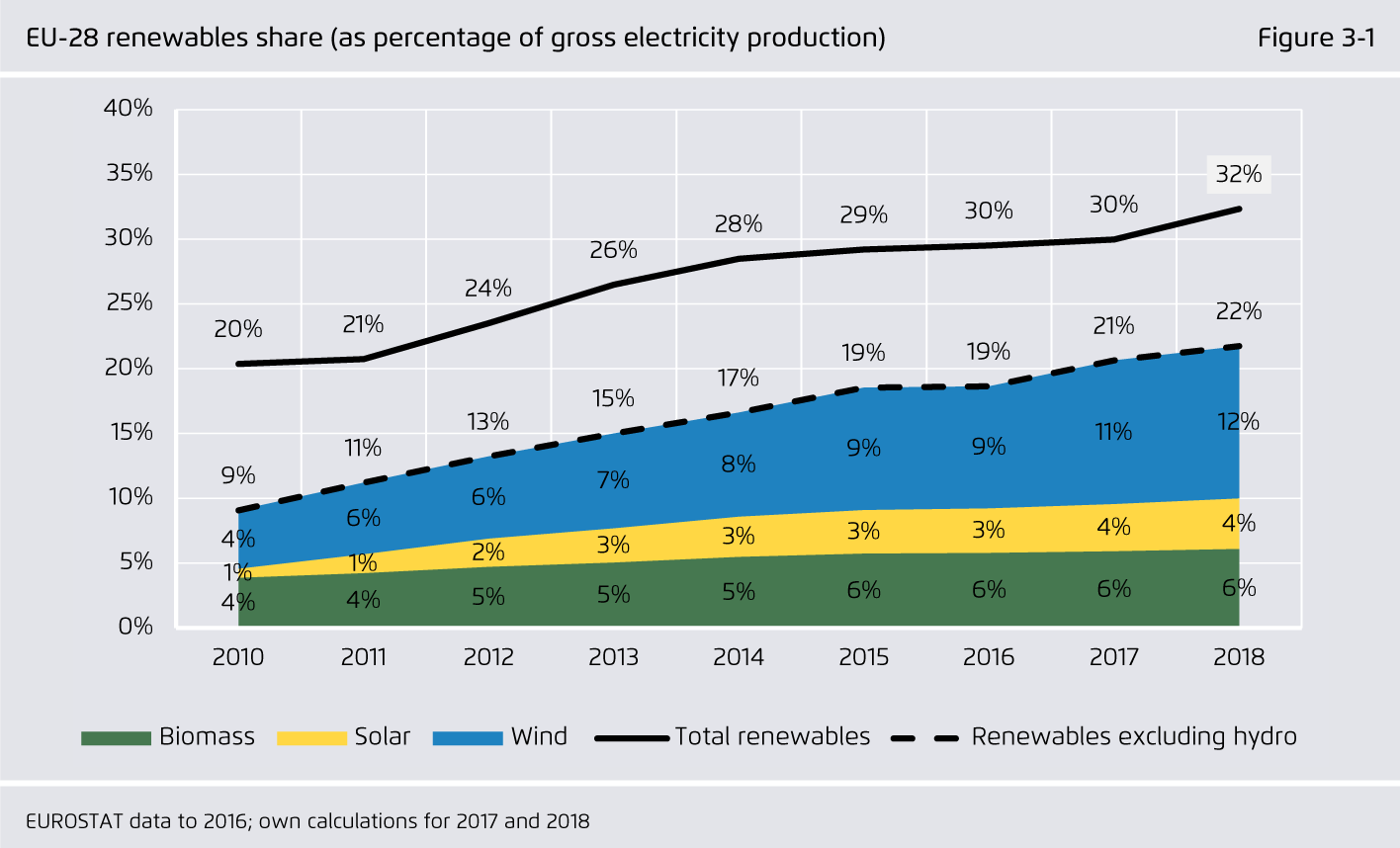

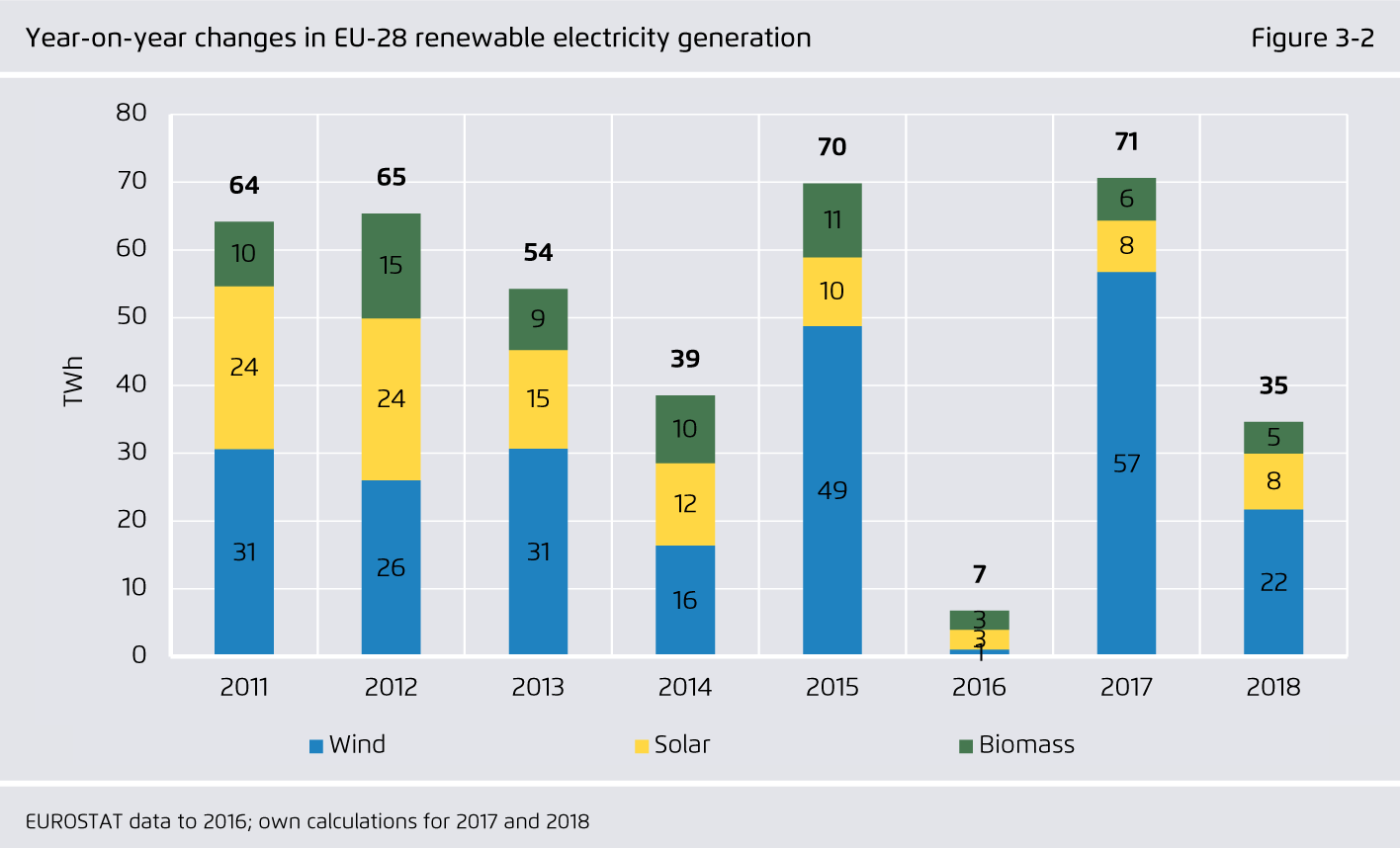

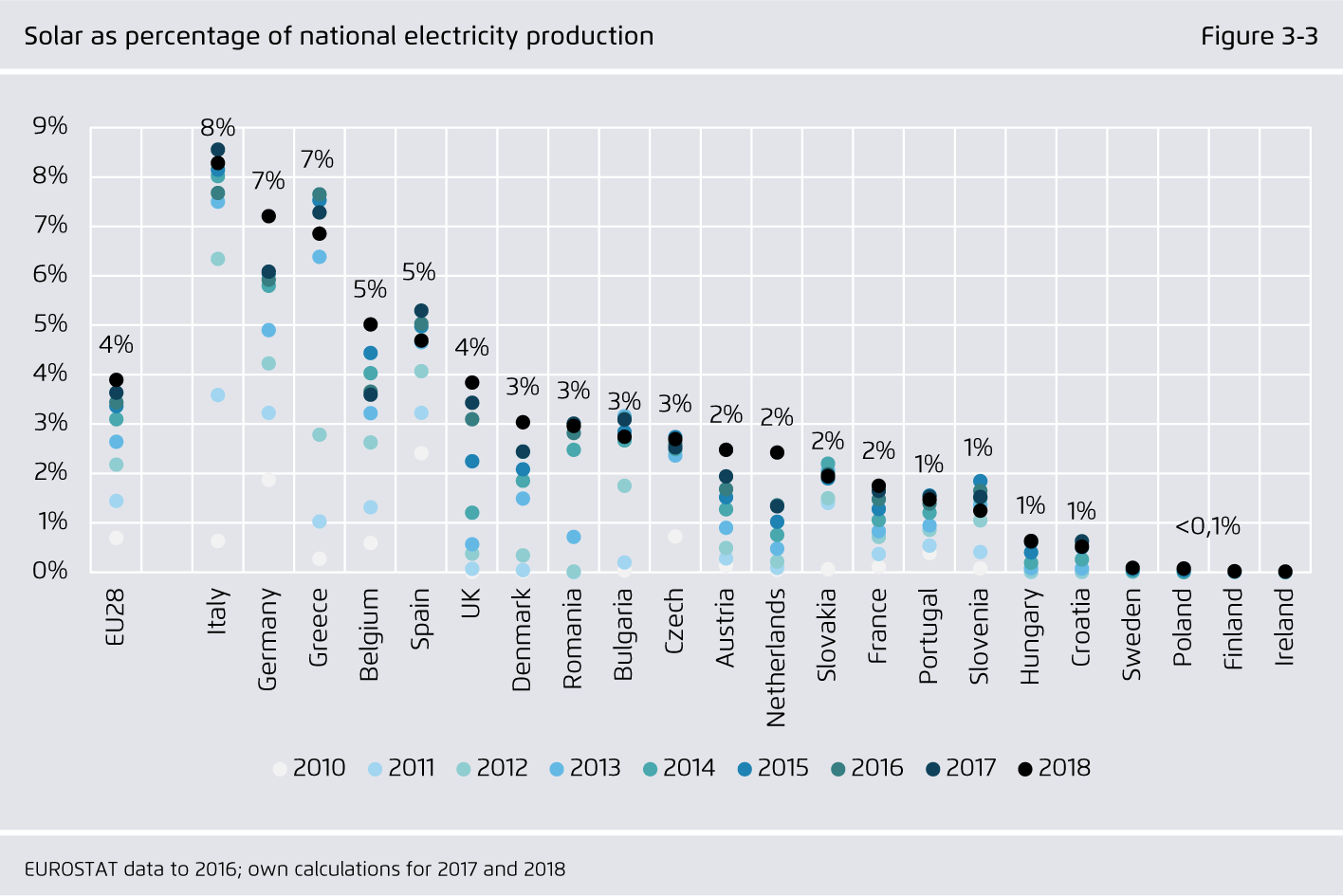

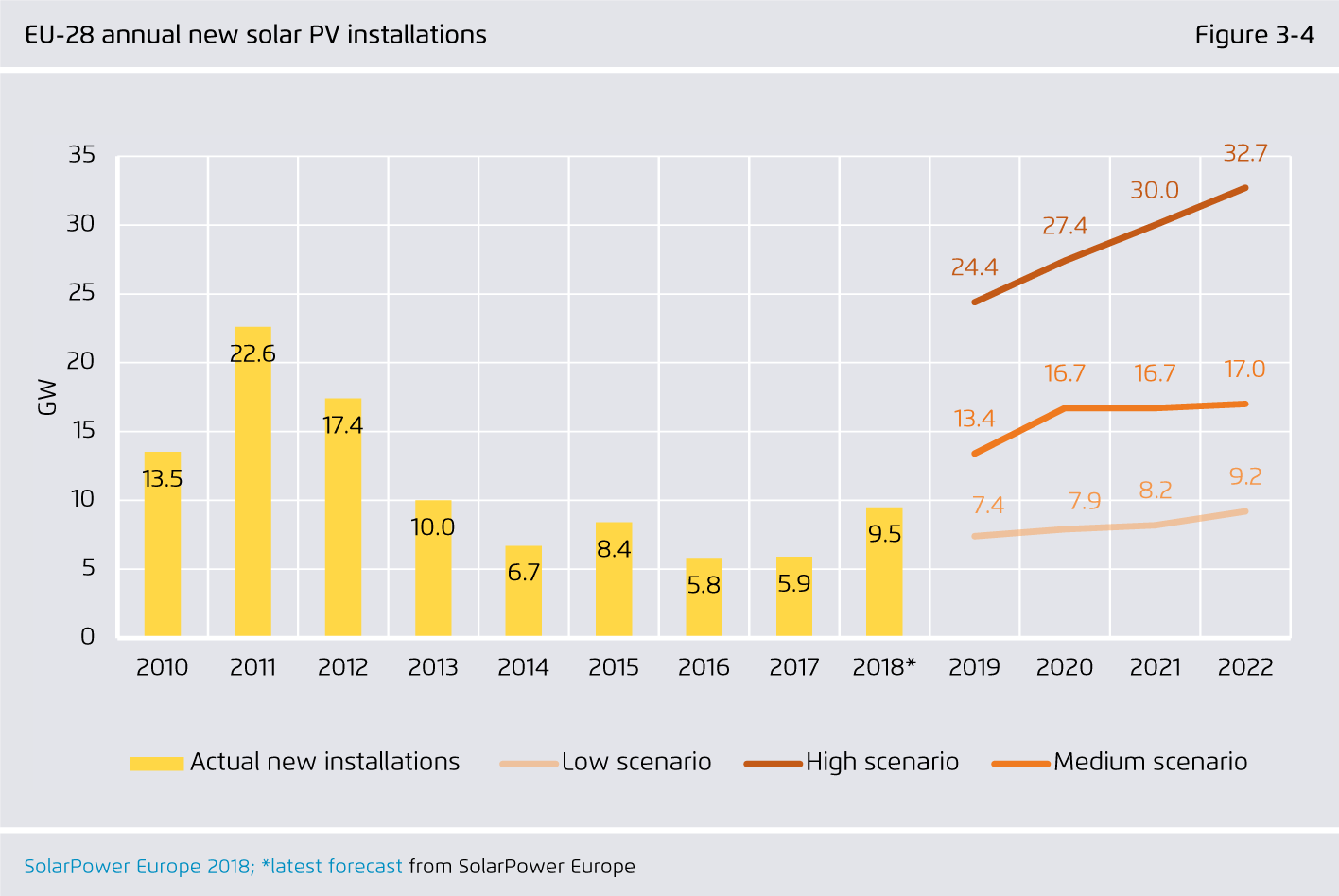

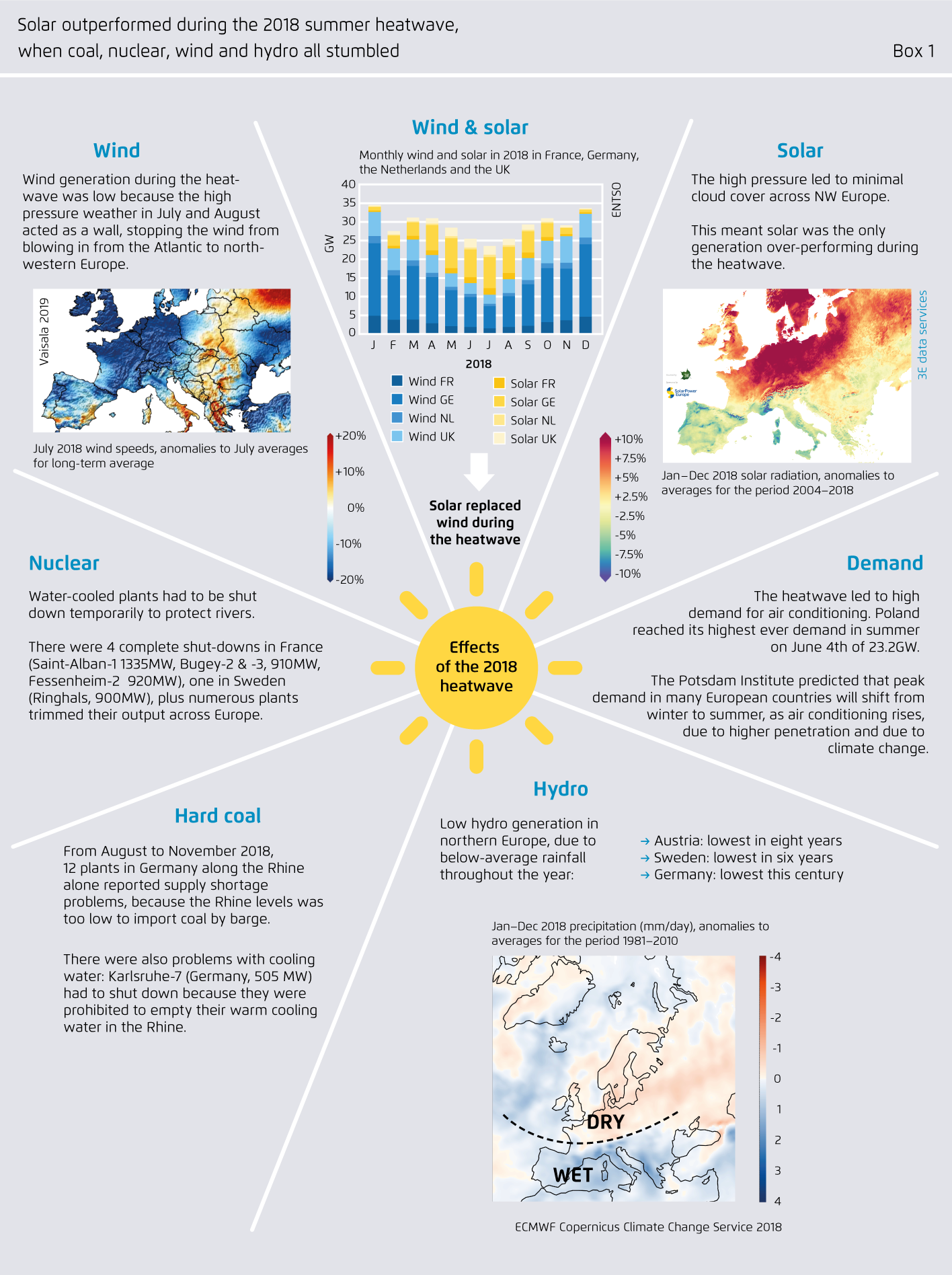

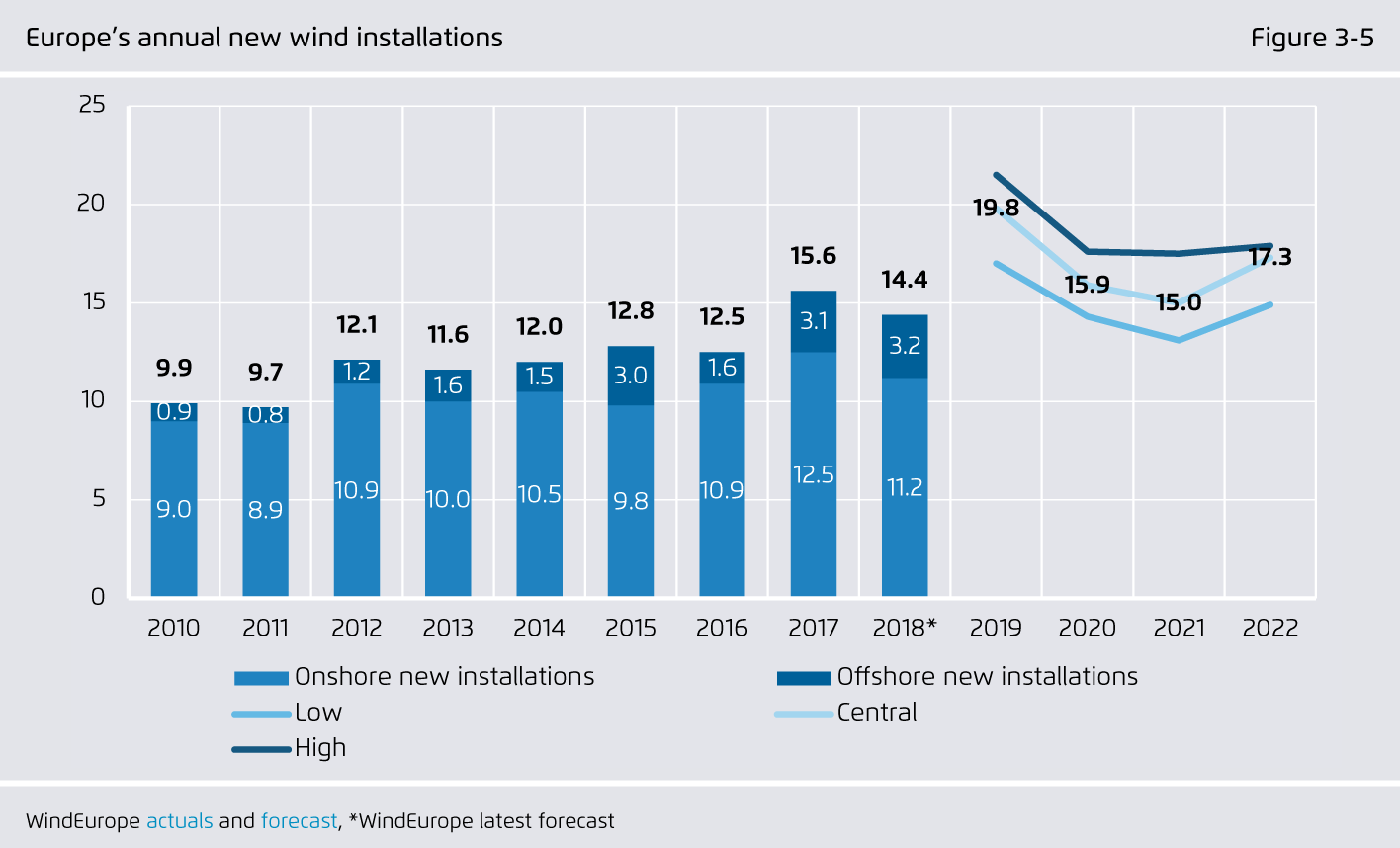

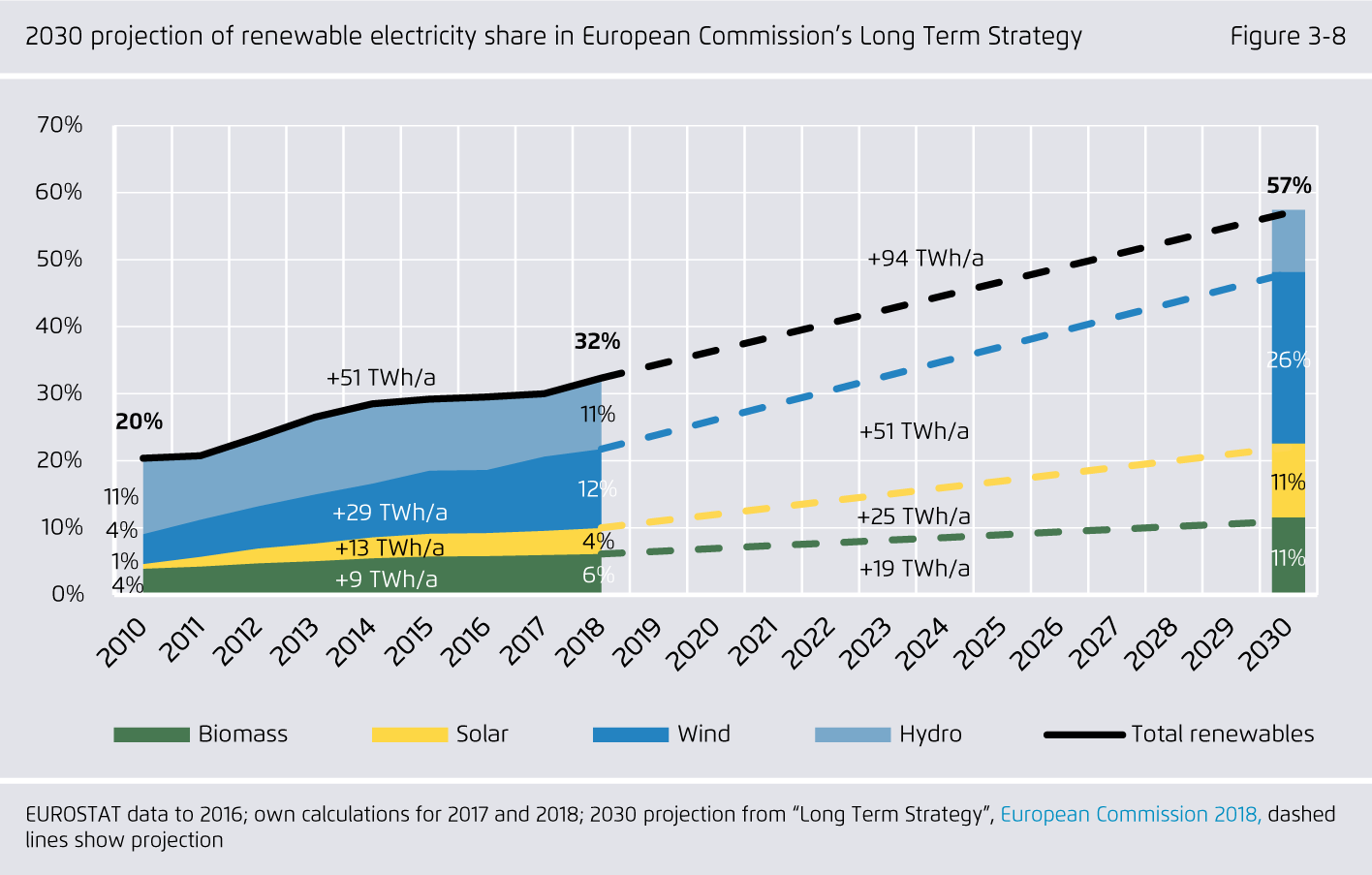

Renewables rose to 32.3% of EU electricity production in 2018. While this year’s rise was mainly due to wind growth picking up and hydro returning back to normal, solar will be the next big thing: solar additions increased by more than 60% to almost 10 GW in 2018 and could triple to 30 GW by 2022. Module prices fell by 29% in 2018. Solar outperformed during the 2018 summer heatwave, when coal, nuclear, wind and hydro all stumbled. Bold national plans for solar in 2030 were drafted in Italy, France and Spain in 2018. The EU’s 2030 RES target, agreed in 2018, will result in even more.

-

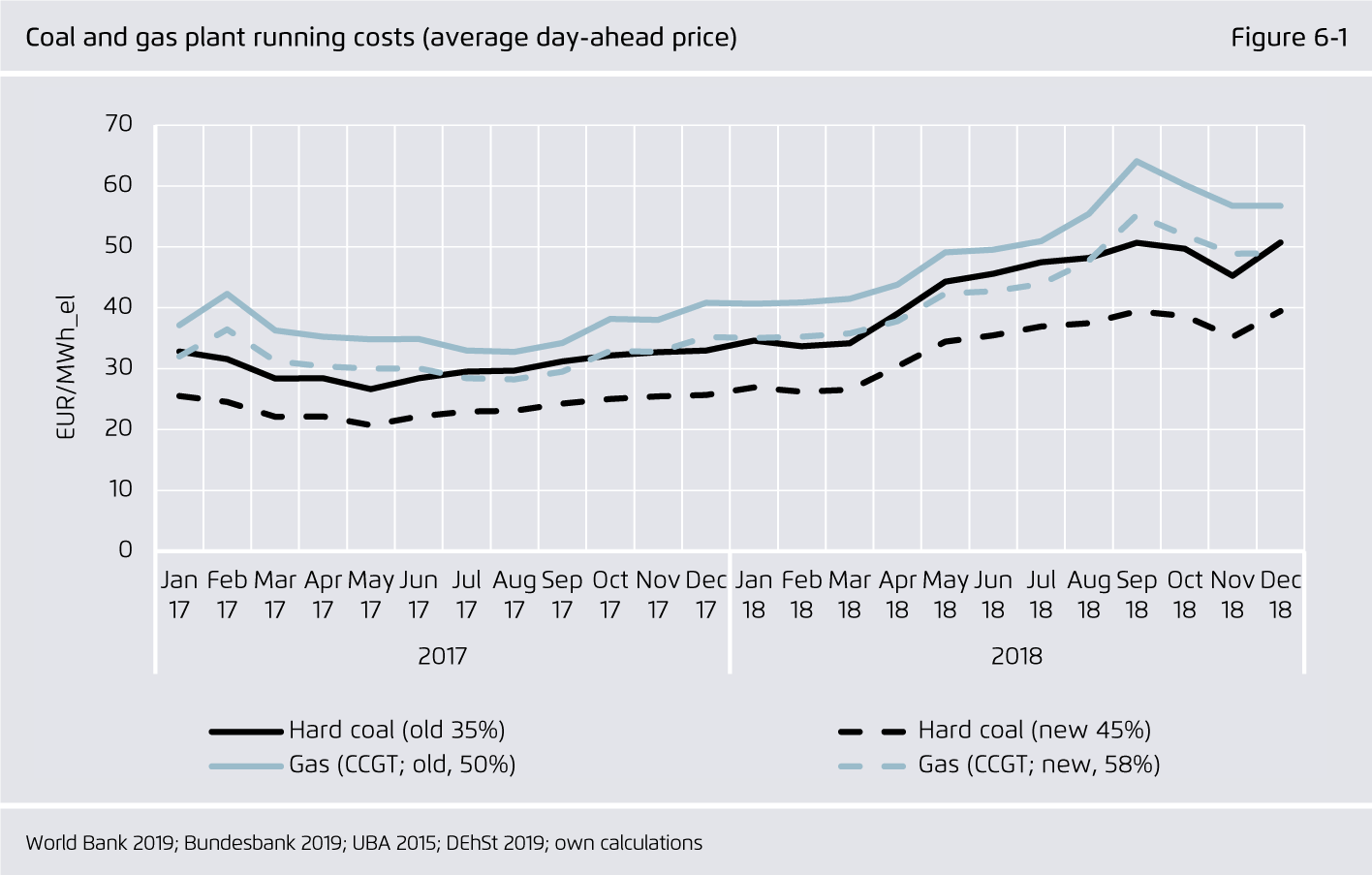

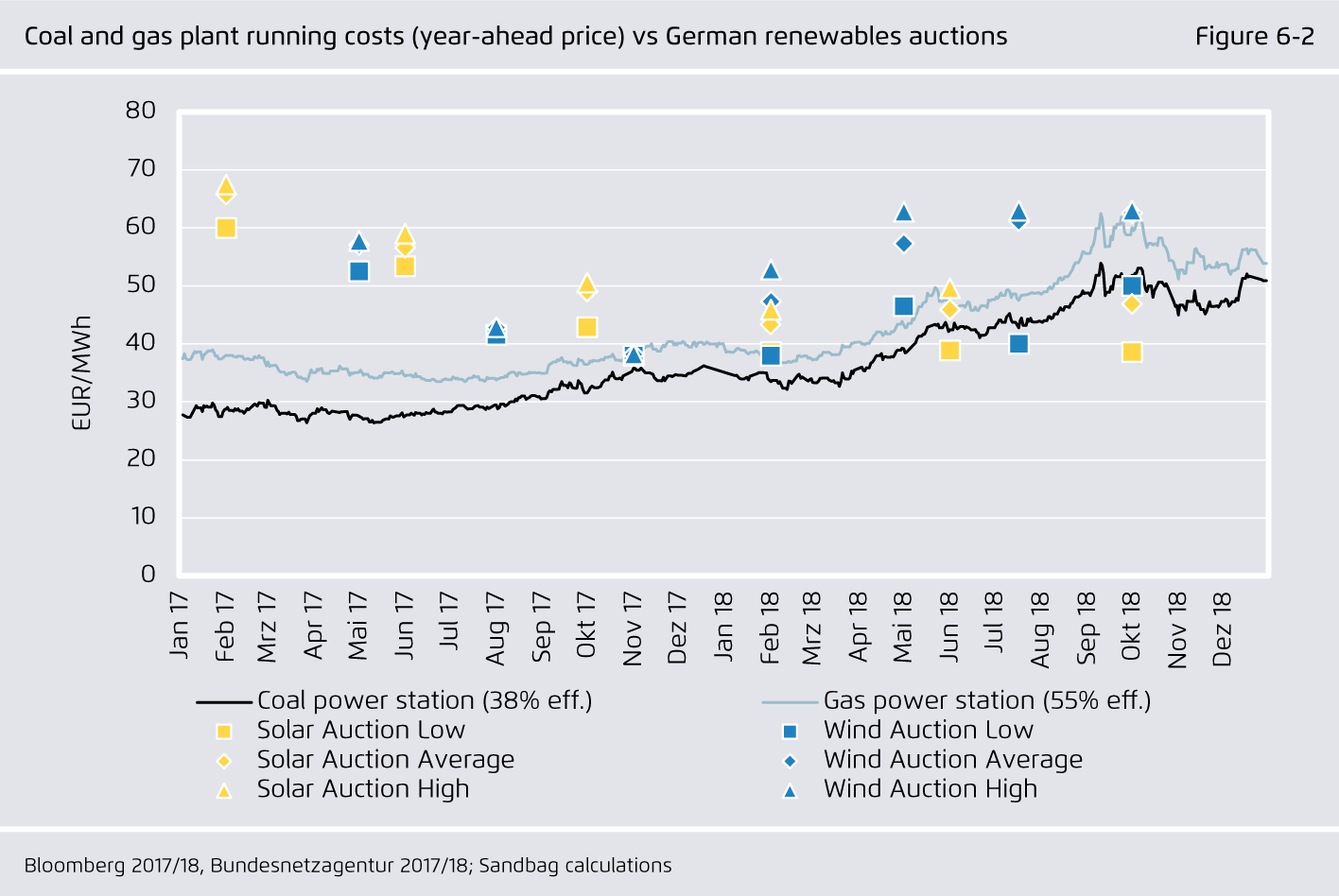

For the first time, the fuel and carbon costs alone for coal and gas plants were on a par with the full cost of wind and solar.

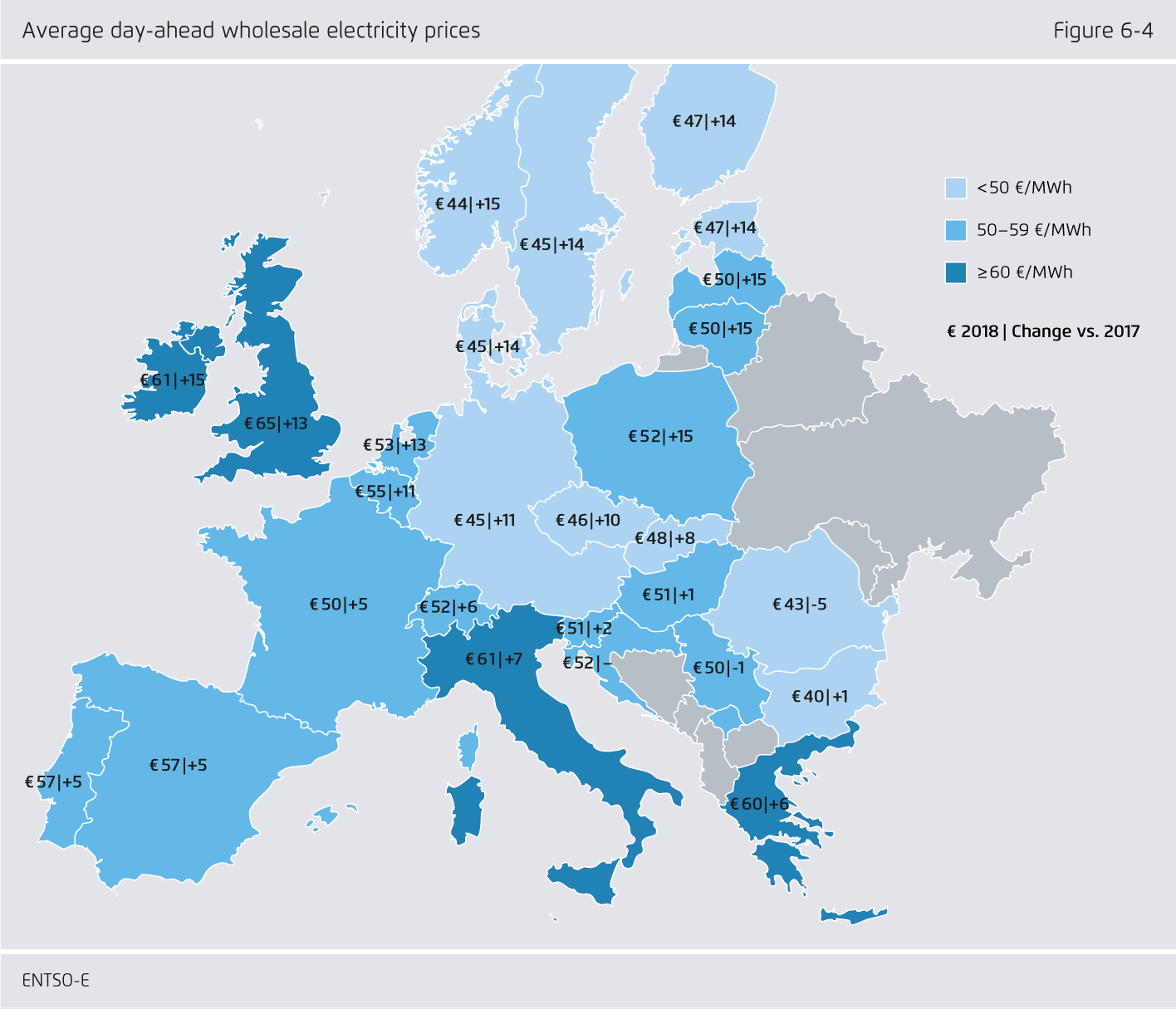

Coal and gas generation costs rose in 2018: coal price rose 15%, gas rose 30%, and the CO₂ price rose 170%. Consequently, electricity prices rose to 45–60 €/MWh in Europe. This is the level at which the latest wind and solar auctions cleared in Germany.

The European power sector in 2018

Up-to-date analysis on the electricity transition

Preface

The power sector is playing a leading role in the decarbonisation of Europe, so it is critical to track the progress of the electricity transition as accurately and timely as possible.

For the third year in a row, Sandbag and Agora Energiewende have joined forces to update on the European electricity sector transition. Key topics include renewables growth, conventional power generation, electricity consumption, and CO₂ emissions.

We provide our best-view of 2018 electricity consumption, generation and emissions by country. This data is available to download in order to enable others to also perform up-to-date analysis.

Key findings

Bibliographical data

Downloads

-

Main Report

pdf 2 MB

The European Power Sector in 2018

Up-to-date analysis on the electricity transition

-

Slide Deck

pdf 2 MB

The European power sector in 2018

Slides for up-to-date analysis on the electricity transition

-

Data Attachment

xlsx 536 KB

The European power sector in 2018

This Excel file lists the generation, production and emissions data that were used for the development of the study.

All figures in this publication

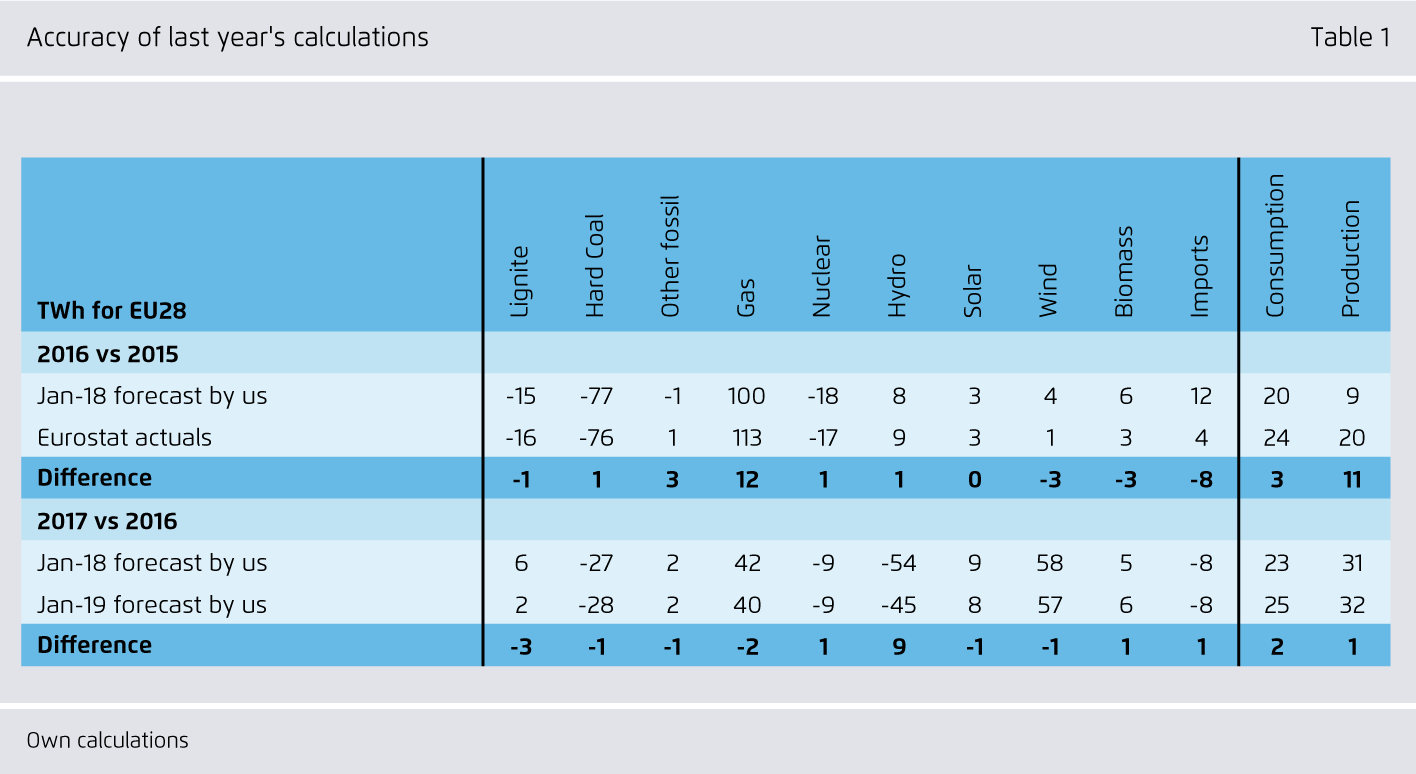

Accuracy of last year's calculations

Figure Table 1 from The European power sector in 2018 on page 5

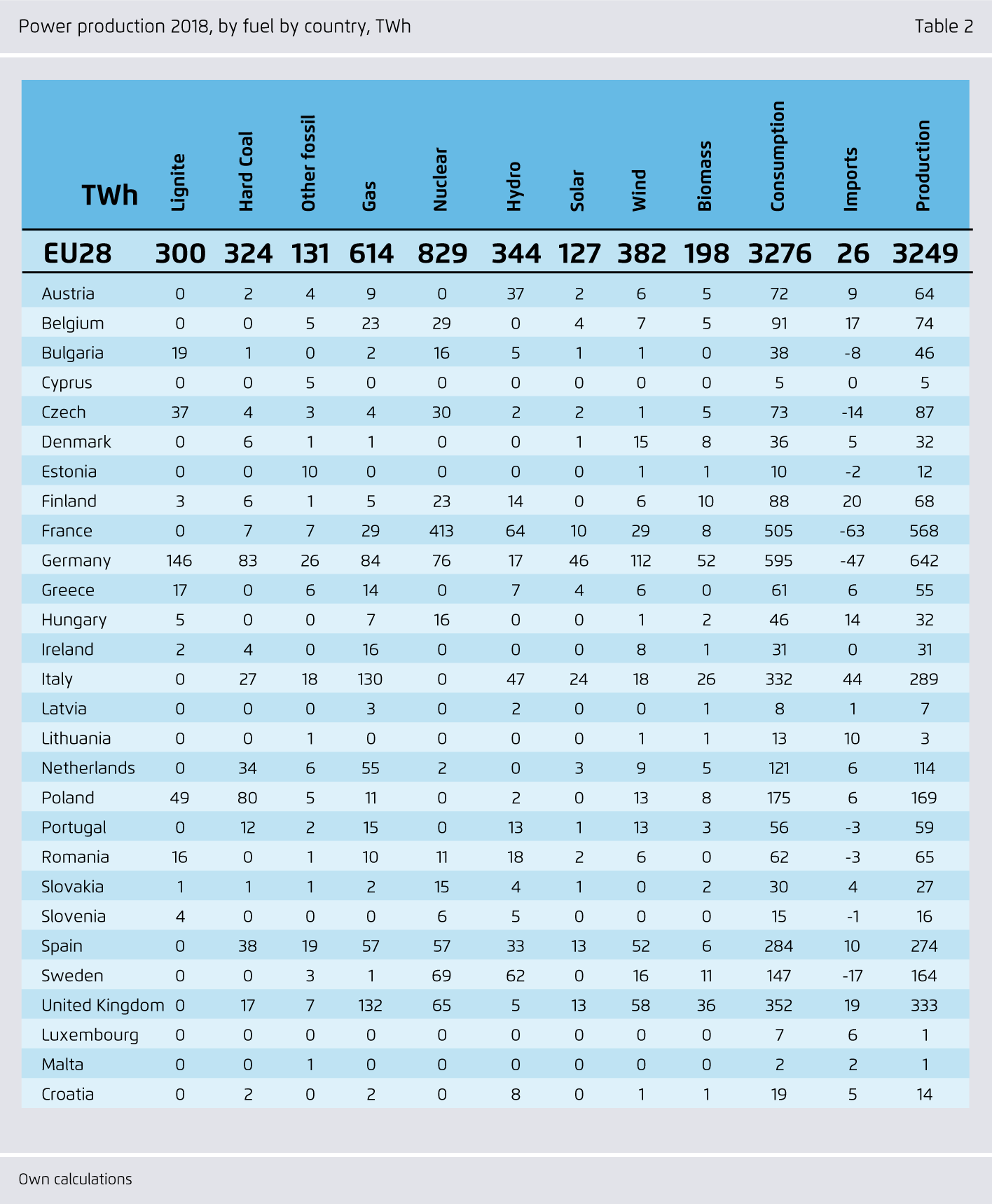

Power production 2018, by fuel by country, TWh

Figure Table 2 from The European power sector in 2018 on page 7

![[Translate to English:] Erneuerbare Energien reduzierten CO2-Emissionen des EU-Stromsektors im Jahr 2018 um 5 Prozent und verdrängten Kohle](/fileadmin/_processed_/2/4/csm_news_eu_jaw_2018_a6afba8db0.png)