-

Europe needs to rethink energy security to reflect the characteristics of an increasingly renewables-based, decentralised and electrified energy systems.

The growing role of minerals, clean technologies and clean-carrier supply chains makes managing the link between security and decarbonisation ever more critical in the mid-transition. A forward-looking, adaptive approach is essential, aimed at maximising synergies while addressing emerging trade-offs.

-

An energy system built on domestic renewables and widespread electrification is more resilient than one reliant on volatile fossil fuel imports.

With the shifting energy landscape, power system stability, cybersecurity and industrial resilience are becoming central to energy security. Unlike fossil fuel security, these goals can largely be met through domestic policy. Doing so effectively and affordably requires coordinated EU-wide infrastructure planning, smart use of green molecules where they are most needed, and stronger circularity.

-

Investing in renewable electricity, modern infrastructure and advanced technologies makes Europe’s energy system increasingly self-sufficient while strengthening the economy.

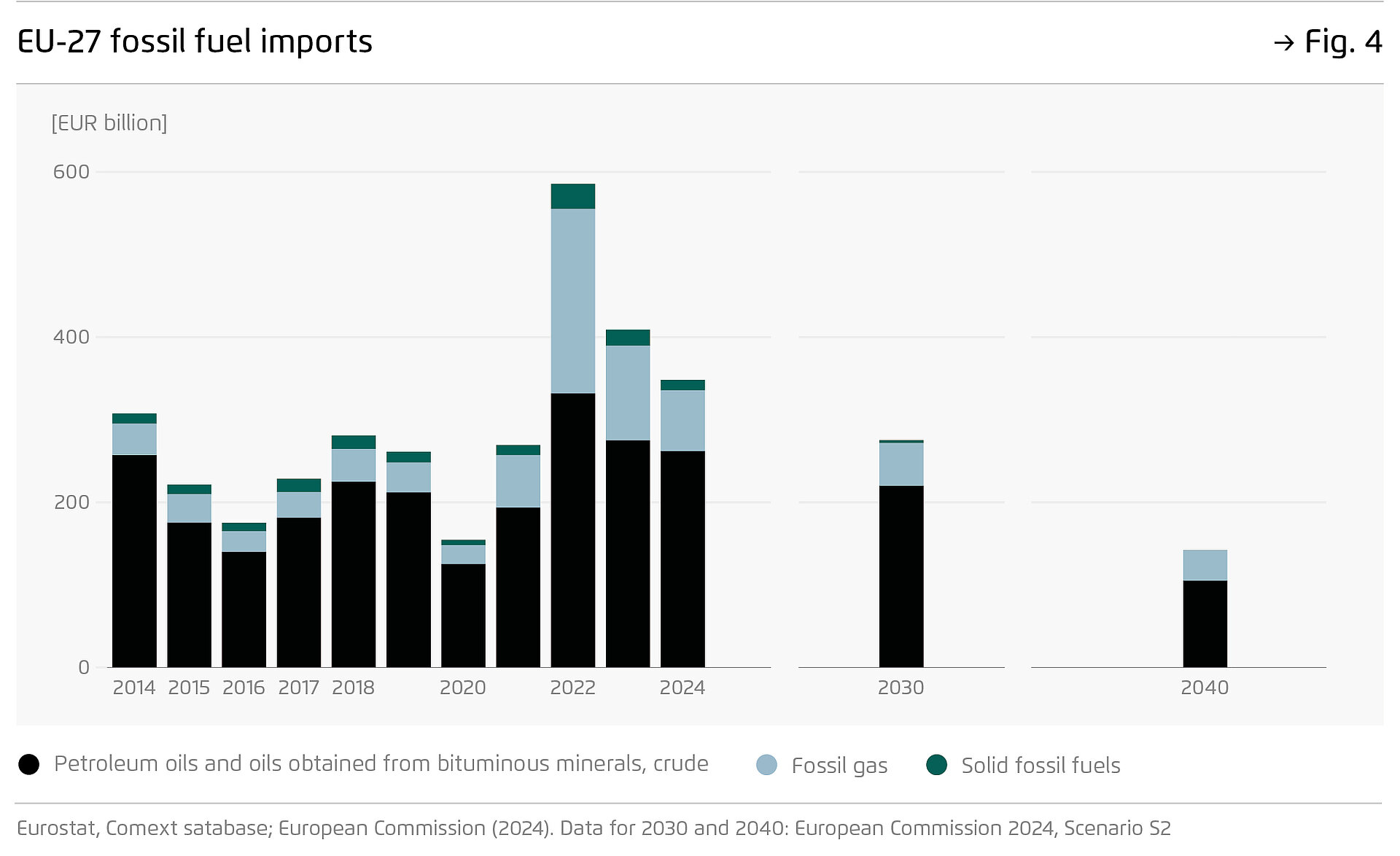

Fossil fuels – the imports of which cost Europe 350 billion euros in 2024 – tie the system to constant import flows, whereas renewables rest on built assets that operate without daily inputs. Shifting from oil and gas imports to these investments delivers lasting energy security and climate benefits.

-

A new energy security strategy should drive decarbonisation and strengthen long-term resilience, offering a blueprint for open strategic autonomy.

Europe’s approach to date – carrier specific, shorttermist, nationally focused and supply-oriented – must give way to a systemic, dynamic and resourceresilient concept. Such a strategy should harness the cost-reducing power of an integrated approach, securing both climate and economic resilience.

Europe’s energy security on the path to climate neutrality

Devising a resilience strategy for the mid-transition

Summary

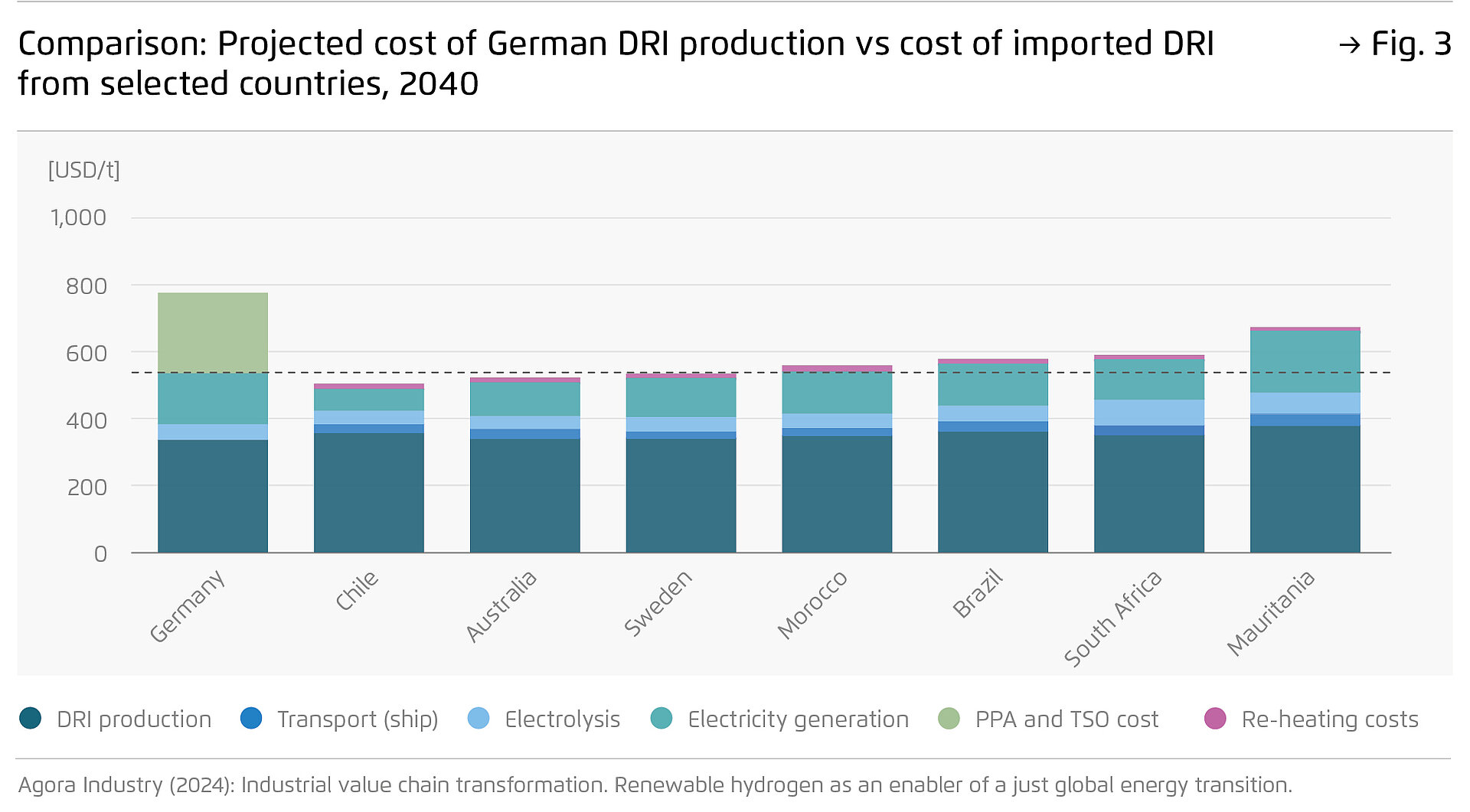

Europe is entering the mid-transition phase of its path to climate neutrality. This period is defined by a rapid ramp-up of new energy technologies and systems, alongside a continued, albeit declining, use of the old ones. This creates opportunities to strengthen energy security alongside innovation and competitiveness, but also brings new challenges.

Unlike the end stage of the transformation, where climate and security goals will fully align, the mid-transition brings temporary but manageable tensions. In this period where while fossil fuel dependency is still significant, higher shares of domestic renewables and electrification reduce dependence on imported fuels but demand new approaches to grid planning, flexibility and resource management. At the same time, new dependencies on critical raw materials and clean technology supply chains emerge amid intensifying geopolitical turbulence, heightening uncertainty and calling for a careful assessment of risks.

This policy brief argues that even in the more complex mid-transition phase, ambitious climate action is delivering strategic benefits for energy security. As the risks shift from external supply volatility to internal system coordination – where EU policy can act with greater agency and foresight – the remaining vulnerabilities will be more manageable overall than those associated with a fossil fuel-based system.

The EU can effectively address remaining vulnerabilities by leveraging critical assets including a large single market, a unified trade policy, a stable regulatory framework, and advanced expertise in managing a decarbonising system. With tools to mobilise capital and abundant renewable resources, the EU can build a more resilient, efficient, and autonomous energy system while supporting global clean industrial growth.

This paper maps key risks and vulnerabilities emerging from mid-transition trends in the move towards a clean energy system and declining fossil fuel interdependence. Based on this mapping, the paper proposes a new agenda for internal and external energy security to maximise synergies while minimising tension between climate and energy security objectives.

By redefining energy security in the EU as systemic, dynamic, and focused on resource-resilience, synergies are leveraged and tensions eased. In the 21st century, energy security extends beyond the legacy of fossil fuel supply and takes shape as an integrated and forward-looking framework. A systemic, dynamic and resource-resilient approach provides the foundation for a secure, sustainable and autonomous energy future. This transformation is more than a reaction to crises. It creates a system designed to thrive amid rapid technological, environmental and geopolitical changes.

Key findings

1. Introduction

As the EU advances towards climate neutrality, structural trends are emerging that mark the bloc’s entry into the mid-transition phase of its energy transformation [1]. This phase is defined by a rapid ramp-up of new energy technologies and systems, creating unprecedented opportunities to strengthen energy security alongside innovation and competitiveness, but also new challenges. It requires the underutilisation, decommissioning or repurposing of fossil infrastructure to be actively managed, as well as an increased focus on power system stability, cybersecurity and green industry resilience.

Unlike the final stages of the transition towards climate neutrality, when climate and energy security priorities will align, the mid-transition is characterised by new but manageable (temporary) challenges. Increasingly high shares of domestic variable renewable energy (VRE) require modernised approaches to grid operation, planning and flexibility services, which in turn will reduce reliance on imported fossil fuels and contribute to greater price stability and energy sovereignty. Traditional business models are challenged, digitalisation increases the importance of cyber resilience, and more frequent weather-related disruptions – due to climate change – add further complexities. Emerging dependences on imported clean technologies and materials, often from geopolitically sensitive regions, require strategic management to avoid replicating past vulnerabilities.

This ongoing transformation is unfolding amid escalating geopolitical turbulence. Russia’s invasion of Ukraine reconfigured global gas markets, generating a volatile energy price environment across Europe. In parallel, pressures on supply chains and shifting geopolitical relationships have intensified, while objectives for supply diversification and cost reductions often compete. These trends are emerging in a global trading system that is seeing multilateral rules eroded and increasing fragmentation. Meanwhile, geopolitical divides complicate global cooperation on decarbonisation, calling for more proactive industrial and trade diplomacy.

Yet the mid-transition also creates an opportunity for the EU to redefine its global role through clean energy leadership. The EU is well positioned to turn the energy transition into a source of long-term strategic advantage. It has critical assets that can be used to advance decarbonisation and enhance energy security. These include a large single market with unified external negotiating power; a sophisticated and stable regulatory framework for energy and the climate, backed by the advanced technical expertise of its regulatory authorities and commercial actors in managing a decarbonising energy system, including in its cross-border dimensions; sizeable instruments with which to mobilise capital at scale for infrastructure and technology deployment internally and externally, and strong renewable sources within the EU and its immediate neighbourhood. These foundations will allow the EU to develop a more resilient, efficient and autonomous energy system while supporting global clean industrial development.

At the same time, persistent limitations will need to be overcome if these strengths are to be leveraged. While industrial policy is increasingly recognised as a key geoeconomic asset, the EU’s current resources and frameworks remain insufficiently coordinated and scaled to fully support the external strength of Europe’s trade policy. In addition, political uncertainty is rising, driven by external pressure and growing political forces advocating for weaker policy frameworks and a stronger national focus in key policy areas. Conflicting priorities are becoming more prominent, as is a limited appetite for expanding integrated spending capacity. In this complex environment, aligning cost-effective decarbonisation and resilience goals remains a strategic challenge, but one that must be overcome in order to achieve lasting security, competitiveness and climate stability.

This policy brief aims to map key risks and vulnerabilities emerging from mid-transition trends in the move towards a clean energy system and declining fossil fuel interdependence. Based on this mapping, the paper proposes a new agenda for internal and external energy security to maximise synergies while minimising tension between climate and energy security objectives.

It argues that even in the more complex mid-transition phase, climate action is delivering strategic benefits for energy security. As the risks shift from external supply volatility to internal system coordination – where EU policy can act with greater agency and foresight – the remaining vulnerabilities will be more manageable overall than those associated with a fossil fuel-based system. These challenges can be addressed by coordinating gas demand reduction, ensuring power system stability, and ensuring resource resilience in specific critical material and technological interdependencies.

2. Managing clean energy security in the mid-transition

The mid-transition phase is characterised by the rise of a renewables-based energy system and declining fossil fuel dependencies. This chapter analyses its main features, include the growing share of variable renewable energy (VRE), accelerating electrification and evolving material inputs and energy carriers. Together, these trends offer a historic opportunity to enhance the EU’s energy security, improve system resilience and reduce the economy’s exposure to fossil fuel price volatility and geopolitical pressure.

At the same time, the ongoing shifts entail new operational and strategic challenges. These include the need for greater system flexibility, evolving infrastructure requirements and increased reliance on concentrated clean tech supply chains. While these challenges are significant, the EU largely has the capacity to manage them through coordinated policy, innovation and strategic investment.

Crucially, the mid-transition phase is unfolding within a context of heightened geopolitical confrontation and rapid digital transformation. Digitalisation offers considerable potential to enhance energy system resilience – by improving system management and flexibility, for example – but also introduces new challenges, such as new cybersecurity risks or increased energy demand from data centres. While these dynamics are not intrinsic to the transition itself and therefore lie beyond the scope of this paper, their interplay with the examined mid-transition trends shapes outcomes and is therefore taken into consideration in the following description of key trends in the mid-transition phase.

2.1 A growing share of variable renewable energy

The rising share of VRE in the power system is one of the most distinctive mid-transition trends. If the Fit for 55 package is effectively implemented, the share of renewable energy in the EU power sector will increase to around 70 percent by 2030 and 80 to 95 percent in a climate-neutral power system, depending on the scenario. This will require the speed of yearly installed new VRE to be tripled between today and 2035, compared to the period 2010–2020 (Agora Energiewende, 2024).

Expanding the share of VRE in Europe’s power system brings direct and immediate benefits for energy security by reducing reliance on imported fossil fuels. For instance, the wind and solar capacity added between 2019 and 2024 allowed the EU to avoid the use of 92 billion cubic metres (bcm) of fossil gas and 55 million tonnes (Mt) of hard coal, saving on fuel imports worth 59 billion euros that year (Ember, 2025a). This shift not only lowers the volume of fossil fuels needed for electricity generation but also affects how electricity prices are set. As VRE replaces gas-fired generation during more hours of the day, the role of natural gas in setting marginal prices diminishes, helping to reduce wholesale electricity costs. These benefits are further amplified when VRE is complemented by greater system flexibility, including storage, demand-side response and improved interconnections.

At the same time, a system with a growing share of VRE must evolve to ensure electricity supply security at all times. As VRE replaces conventional generation, system operations need to adapt to new dynamics – particularly in maintaining grid stability, which requires modern grid technologies and advanced control systems to compensate for the loss of inertia traditionally provided by spinning generators. Even with AI-driven advances in forecasting, VRE output will remain imperfectly predictable, requiring dynamic operational security management from minutes to hours and the balancing of flexible resources such as demand response and storage. Over longer timescales – hours to weeks – ensuring adequacy during low renewable output periods remains a challenge. However, with the right strategy, the transformation to a VRE-dominated system becomes not only manageable but indeed a catalyst for a more resilient and sustainable energy future (MPE, 2024). Short-term challenges to grid stability entail second-order effects for energy security. If not managed carefully, the short-term costs associated with grid management and the need for backup can cause political backlash. This could have serious implications for long-term energy security, as the short-term volatility associated with weather patterns might be exploited by political actors and commercial firms – including within the EU – that have an interest in pushing for continued reliance on imported fuels, and by foreign fuel suppliers seeking to preserve their export volumes and geopolitical leverage on Europe.

In addition, volatility can spark calls for energy isolationism if policymakers and the public fail to appreciate – and proactively manage – the network effects and long-term security and economic benefits of interconnected markets. This is something that has already been seen in Norway, Sweden and France. With their significant hydropower, water reservoir and nuclear capacities, Nordic countries are well placed to complement regions with high VRE deployment such as North-West Europe (Graabak et al., 2017). This enables beneficial energy exchange, as Nordic countries can keep the water in the reservoirs during times of high VRE output and export electricity when prices peak in importing regions, generating positive economic returns and increased supply security for Scandinavia. However, the increased price volatility in the Southern regions of Norway and Sweden has led to calls for connectivity plans to be downsized in order to shield Nordic households and business. Energy isolationism risks undermining the energy security of transitioning power systems: lower interconnection capacity would require greater domestic deployment of renewables and back-up capacity, which is associated with higher costs and diminished system stability on both sides of interconnectors.

These concerns however are manageable and should not distract from the strategic gains offered by VRE. Two central mitigating factors stand out. First, the challenges related to grid stability, security and adequacy can be addressed through domestic policy action and technological innovation. This marks a fundamental shift from fossil fuel-dominated systems, which are vulnerable to global market volatility and geopolitical whims beyond Europe’s control. Second, even if investments in the power sector rise temporarily during the early phase of the mid-transition, this will be accompanied by a steady decline in fuel import expenditures. As the system decarbonises, the cost of maintaining security shifts from funding foreign – and often adversarial – actors to domestic investment in the power system, thereby enhancing domestic economic activity and price stability.

The mid-transition phase requires Europe to rethink the foundations of power system security. The reliability of power systems with an increasing share of VRE rests first and foremost on modernised and adapted system management. Traditional stability – to date a byproduct of large spinning generators – must henceforth be ensured by batteries with grid-forming capabilities and synchronous condensers. This shift requires a more deliberate approach in which stability must be actively planned, sourced and financed as a service, with targeted procurement and location-specific investment in stability services where they matter most – namely in weak grid areas or major load centres. Better EU-level coordination is crucial to guide risk preparedness and investment planning.

It is equally important to maintain operational security and adequacy over longer timescales. Currently, balancing supply and demand is still largely supported by fossil gas plants via costly and fragmented national capacity mechanisms. More cost-effective options include the integrated planning of balancing capacities, storage and demand-side response. At the same time, interconnections – including those that cross borders – enable better resource sharing, provide backup, improve balancing efficiency, iron out fluctuations and increase resilience.

Beyond daily balancing, a system with a growing VRE share must ensure adequacy over weeks and different seasons. The electrification of heating will reduce gas demand but intensify winter electricity demand, increasingly transferring the seasonal mismatch between supply and consumption from the gas sector to the electricity sector. A properly diversified clean energy portfolio, robust market design and targeted investments in flexibility options such as renewable and decarbonised molecules, other storage technologies and dispatchable renewables can significantly mitigate these risks.

Digitalisation is a key enabler of flexibility and system management, including when it comes to averting and responding to crises. In addition, digitalisation can support the operation of a distributed energy system, which can enhance resilience by reducing reliance on individual vulnerability points. In the event of massive disruptions, digital technologies can enhance black start capacity [2], without full reliance on centralised dispatch (Pan et al. 2015). At the same time, new areas of concern are emerging. Compared to conventional power systems, a more decentralised system architecture with greater interaction between manifold units multiplies the number of entry points for cyberattacks. Under stressed systems or market conditions, targeted attacks could cause cascading failures with severe consequences. Appropriate cybersecurity measures are therefore critical to effectively mitigate these risks.

None of these challenges can be addressed efficiently in isolation. A fragmented national approach risks duplicating infrastructure and locking in redundant assets. A coordinated EU-level strategy, founded on a high level of trust and political commitment, can pool resources, spread risks and reduce total system costs. Strengthening cross-border interconnections, synchronised adequacy assessments and pan-European flexibility platforms will enable a more secure and cost-effective expansion of VRE across the continent (MPE, 2024).

2.2 Electrification

2.2 Electrification

Direct electrification is a core element of a decarbonised energy system. Under the Fit for 55 policy framework, the European Commission expects the electricity share of final energy consumption to reach around 33 percent by 2030, then increasing to 50 percent by 2040 if an emission reduction target of 90 percent is achieved (European Commission, 2024). Electrification improves efficiency by avoiding the energy losses associated with converting fuels into heat or motion. Greater efficiency narrows the gap between primary and useful energy consumption, with benefits for energy security via a reduced need for energy imports. These opportunities are particularly pronounced in buildings, industry and road transport. In the buildings sector, heat pumps – leveraging ambient heat – could reduce gas demand by 511 terawatt hours (TWh) per year by 2030, compared to 2018 and by further 823 TWh/year by 2040, with only a modest increase in electricity consumption (Agora Energiewende, 2023). This could translate into a decrease in foreign gas purchases equivalent to 21 billion euros in 2030 and 34 billion euros in 2040 [3] for the residential sector, compared to the business-as-usual scenario. In the EU-27 manufacturing sector, increasing electricity’s share of industrial final energy consumption from 29.7 percent (2018) to around 34 percent by 2030 and 43 percent by 2040 [4] could contribute to reducing industry’s gas consumption to 588 TWh/year and 94 TWh/year respectively (Agora Energiewende, 2023), saving on foreign gas purchases amounting to 15.19 billion euros in 2030 and 35.64 billion euros in 2040 compared to the business-as-usual scenario. In Germany alone, electrifying low- and medium-temperature industrial process heat can save 90 TWh/year of natural gas by 2030. This represents up to three quarters of the savings required from industry by the REPowerEU Plan (Agora Industry, 2022), worth 3.72 billion euros at 2023 prices. For most end uses, direct electrification offers better and more immediate energy security benefits than hydrogen-based decarbonisation pathways. Opting for direct electrification rather than electrolytic hydrogen use in industrial and residential heating and transport requires less additional power generation capacity (Fraunhofer ISI, 2024) or less reliance on imported hydrogen. The case is even stronger if the currently slow ramp-up of electrolysers forces continued reliance on fossil-based hydrogen.

Moreover, imported hydrogen can imply logistical and contractual rigidity, as well as probable supply concentration, at least initially. These would entail energy security challenges comparable to those associated with natural gas supply chains (Giuli and Oberthür, 2023). Finally, the broad-ranging electrification of end uses can support power system stability, if deployed in combination with demand-side response and electric and thermal storage, thus reducing the needs – and costs – of grid infrastructure adaptation. On the other hand, deeper electrification leads to greater reliance on a single carrier – electricity – and is therefore a less diverse energy system. These security concerns are compounded by the increasing incidence of critical infrastructure sabotage, which is becoming a prominent hybrid warfare tool. Second, for as long as gas sets the power prices at the margin, electrified end uses remain exposed to the price volatility of imported fossil fuels.

However, these risks can be effectively mitigated. First, high vulnerability to electricity supply shocks is already a feature of today’s fossil-based energy system, with electricity currently accounting for around 23 percent of final energy consumption (Eurostat, 2024). Given electricity’s critical role in society, even many energy services currently met by natural gas or oil would not be available in case of a black-out: for instance, most petrol stations and gas-based heating systems rely on electricity-driven pumps. In addition, the rapid decline in the cost of distributed power generation and storage enables decentralised backup, enhancing resilience. Second, a more rapid deployment of clean power generation, combined with flexible electrification could help greatly to reduce the number of hours when fossil gas sets power prices, and therefore the exposure of end uses to power price volatility. As such, accelerating the electrification of end-uses serves both climate objectives and energy security.

To maximise these synergies, electrification should be more explicitly integrated into Europe’s energy security strategy. The first step would be to incorporate the gas-to-electricity price ratio – a major predictor of consumer preferences for one carrier or another – into energy security assessments, make the barriers to electrification more visible to policymakers and encourage action to be taken to remove them. In addition, generation and demand steering equipment will become critical infrastructure if massively deployed in a highly electrified energy system. Both need close EU-level monitoring and regulation. Importantly, grid development and end-use electrification must be carefully coordinated, as the former is necessary for the secure operation of a highly electrified system while the latter is essential to give appropriate investment signals for grid reinforcement.

The next steps would involve reforming taxes and network charges, phasing out fossil fuel subsidies and rolling out the ETS 2 – a carbon pricing scheme covering gas- and oil-intensive sectors such as buildings, transport and small enterprises. Rebalancing the price ratio in favour of electricity by adjusting taxes and network charges should be a key focus of the Commission’s forthcoming Electrification Action Plan and its dialogue with Member States under existing EU monitoring and governance frameworks. Flanking instruments such as subsidies for rolling out electrification technologies are warranted. For industry, policies that support electrification should include a direct industrial electrification alliance to help match supply and demand, and introduce phase-out targets for fossil-fuelled appliances initially focused on low- and medium-temperature heat to ensure demand visibility, as well as subsidy schemes covering the short-term cost gap – in order to avoid the energy security liabilities that would be caused by another wave of investment in fossil fuel appliances.

2.3 Shifting material inputs

The mid-transition phase involves a significant increase in certain material interdependences. These include critical raw materials (CRMs) for technologies necessary for the energy transitions, and clean energy technologies.

In the post-transition phase, external energy dependencies are set to fall well below those in today’s fossil fuel-based system. Wind, solar, batteries and other key energy transition technologies will largely be in place, with only end-of-life replacements required. A large share of imported CRMs is expected to be replaced by domestically sourced materials via circularity or substitution (CISL and the Wuppertal Institute, 2023). Much of the capital stock build-up will still rely on imports during the mid-transition, however.

From a techno-economic perspective, the material interdependencies associated with the energy transition pose fewer risks to energy security than the energy interdependence that underpins the fossil fuel-based energy order. Even if external dependence on and supply concentration of CRM and clean energy technologies is (or becomes) high, supply disruptions and price spikes will not impact the functioning or operational cost of the energy system. To this extent, the coercive potential of such interdependence is arguably more limited than that associated with fossil energy interdependence (Giuli and Oberthür, 2023).

2.3 Shifting material inputs (Fortsetzung)

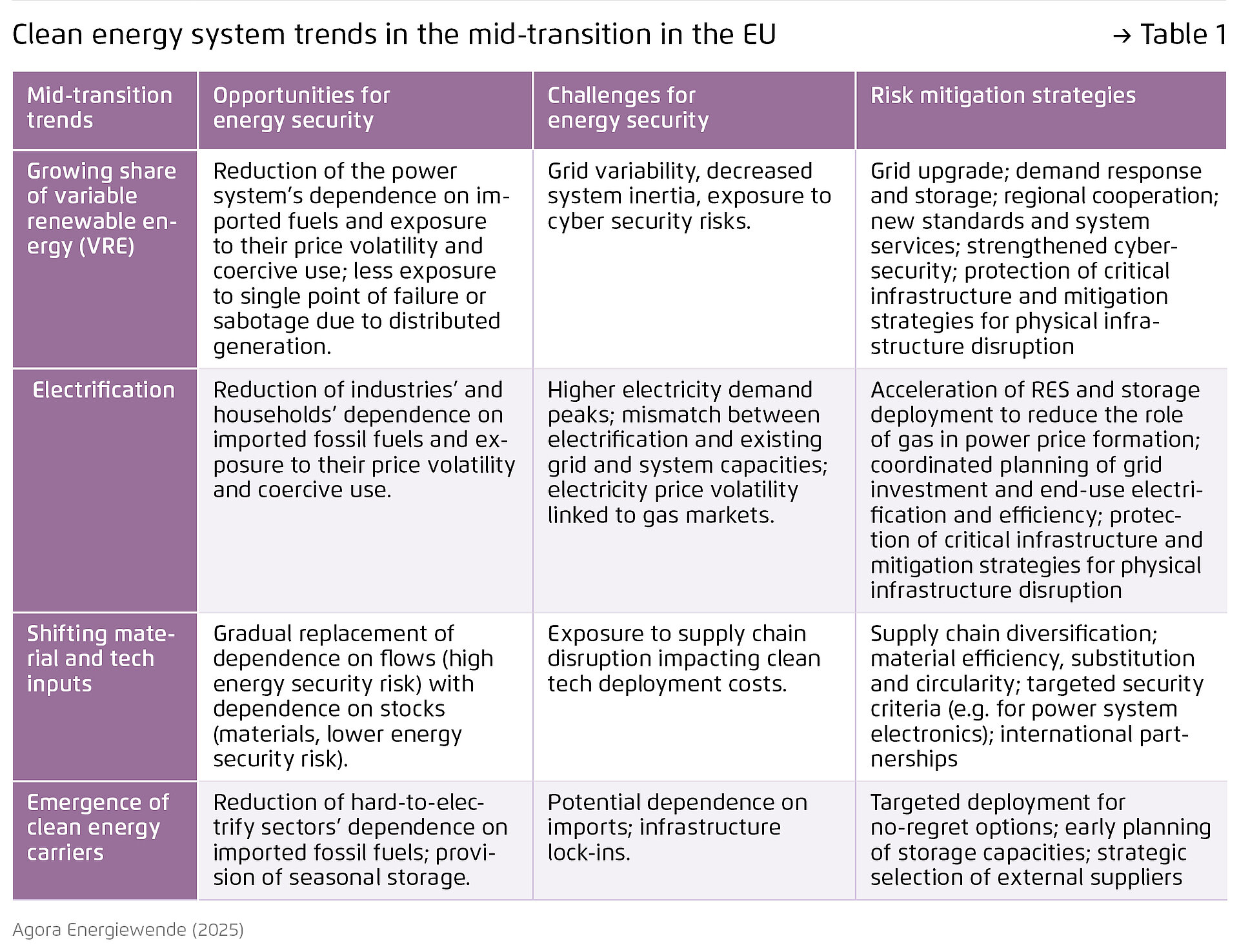

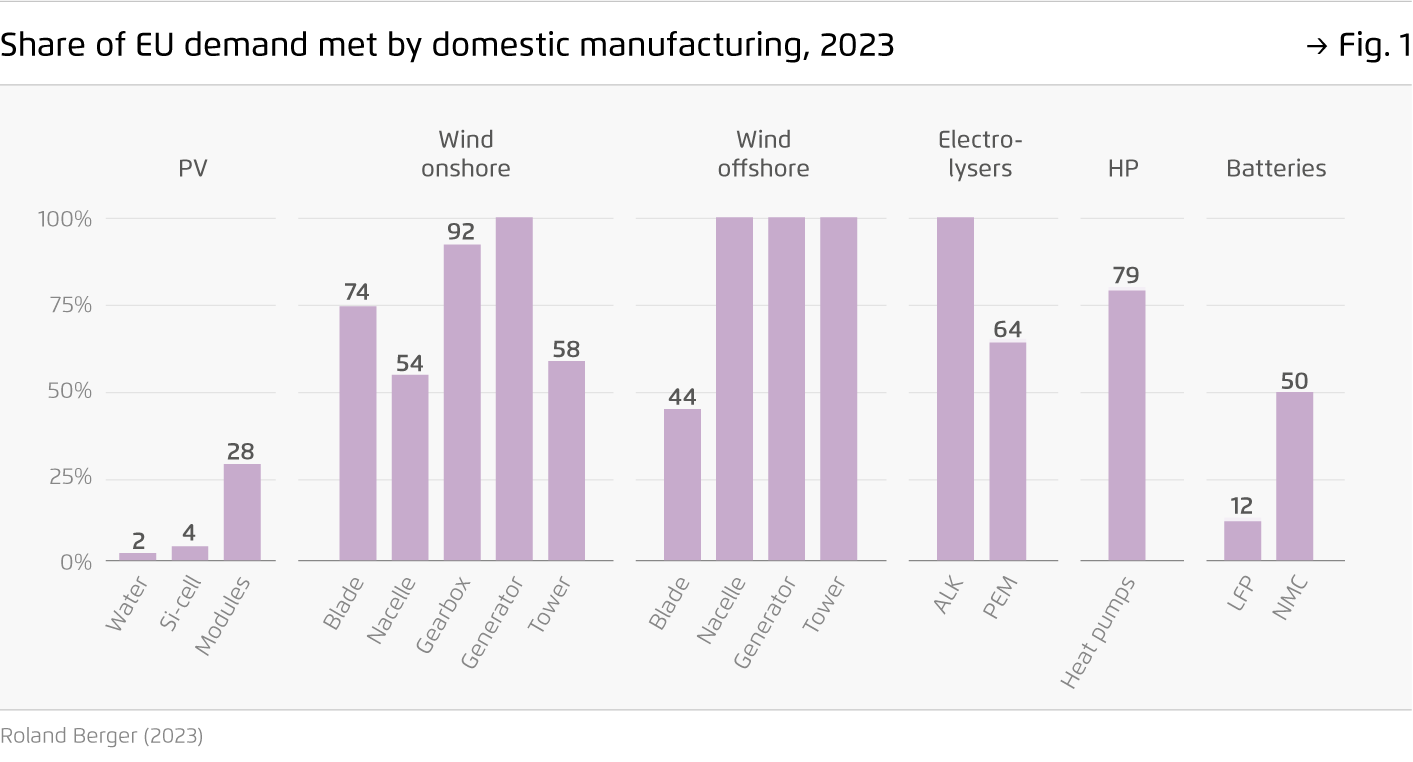

From a geographical standpoint, the requirement for new inputs is making new actors more central to Europe’s energy system. Apart from certain exceptions, such as rare earth elements, CRMs are relatively widely diffused (IEA, 2025; US Geological Survey, 2024). However, the EU is particularly reliant on the import of processed CRMs from China (JRC-Raw Materials Information System, n.d.). Similarly, the EU’s reliance on imported solar PV equipment and batteries – especially from China – is acute (Figure 1). In an increasingly volatile geopolitical environment, this growing dependence on CRMs and clean tech supply chains controlled by Chinese actors presents an industrial and security challenge.

Even if attempts to manipulate the supply of CRMs and clean tech equipment – e.g. via export controls, sanctions, or market-distortive stockpiling -have limited potential to disrupt an importing economy, they can cause sizeable damage to individual industrial sectors. Security issues might arise with specific strategic materials – such as those essential for defence technologies. The same applies to clean power system electronic components that are remotely controllable or disruptible and pose a risk to power system security. Europe’s reliance on imported digital components and connected devices – e.g. inverters, smart meters, EV chargers – raises the risks of external interference or access to digitalised control systems in energy infrastructure. The same applies to any situation where critical energy system control systems rely on imported software, including operative systems and AI tools.

Beyond energy security, broader political risks must also be addressed. Europe has an interest in attracting foreign investments in clean tech manufacturing to support technology transfer and address technological gaps in areas such as batteries and EVs (Draghi, 2024). Without appropriate safeguards, however, such investments could be concentrated in Member States with looser rules governing the establishment of manufacturing operations. For instance, Hungary has attracted Chinese clean tech investors by offering favourable conditions, including no requirements for joint ventures, technology transfers, local content or management participation.

Overall, the external industrial dimension of the EU’s energy transition presents two key trade-offs: an internal trilemma and an external dilemma. These define the path towards both clean tech and basic material value chains.

Internally, the EU faces a strategic trilemma between three core objectives: ensuring a rapid and affordable energy transition, improving industrial resilience and strategic autonomy amid geopolitical tensions and maintaining fiscal responsibility in light of competing priorities and limited appetite for further increasing the EU’s financial resources (Pisani-Ferry, 2023). Building up and maintaining domestic manufacturing capacity based on security and resilience considerations may require substantial financial support, as the transition otherwise risks becoming slowed or compromised.

Externally, the EU is torn between its growing emphasis on security and strategic autonomy and the economic advantages of and increasing need for international cooperation on CRMs, clean tech and basic materials. Reframing these sectors as areas of high political and security concern could justify greater public investment and more assertive industrial policies. This could revitalise Europe’s manufacturing capacity. However, over-securitising these sectors may increase the short-term cost of the transition and put a strain on bilateral and multilateral cooperation, which remains vital to ensure access to critical inputs for clean tech technologies, secure the technology transfers needed to develop competitive domestic capabilities and build global standards for clean basic and intermediate materials with a view to supporting their global uptake.

In navigating the internal trilemma, a selective industrial policy approach, targeting those materials and supply chain sections where security issues are more pronounced, could help minimise the public spending required to regain control over critical segments of the clean energy supply chains.

To this end, the EU should adopt a tiered prioritisation framework when it comes to supporting domestic production with industrial policy instruments. The top tier should focus on technologies and materials vital to the functioning and security of energy systems. Particular attention should be paid to high-risk areas such as connected power electronics and software deployed to monitor, control and protect energy infrastructure. The next level of priority should be given to technologies and materials underpinning industrial autonomy, e.g. inputs used in wind turbine generators and battery-grade materials for electric vehicles. Joint strategic stockpiling could prove particularly helpful in the short term. In contrast, EU industrial policy efforts may deprioritise mass-market products that do not pose significant risks to energy security or industrial autonomy. If external overcapacity drives prices down, this could benefit European consumers and accelerate deployment.

To address the external trade-off between enhancing security while maintaining international cooperation in key areas, the EU should pursue a balanced external strategy rooted in constructive engagement and strategic partnerships. This should involve the renegotiation of trading terms in sensitive sectors with the goal of securing reciprocal market access, setting boundaries to avoid overdependence, aligning supply chains with environmental and social standards and setting up strategic clean industry partnerships. These partnerships should help to transform supply diversification into opportunities for Europe and to integrate developing countries into clean industrial value chains in a socially just way.

Overall, efforts to improve access to critical inputs should not overlook the fact that the key pathway to material resilience, once sufficient stock of materials and technological capital are available domestically, is circularity. The EU has taken meaningful steps towards a circular economy, notably through the Batteries Regulation, the Critical Raw Materials Act and the End-of-Life Vehicles Directive. These legislations set precedents for recycled content and further recyclability requirements. However, the EU’s circularity efforts still focus too narrowly on waste management. Incorporating circular economy principles more fully into industrial policy would reduce dependence on imported virgin materials and energy requirements, while at the same time bolstering supply chain resilience. Strategic measures should include recycled content mandates in public and private procurement, minimum recycling performance standards, more investment in circular technology through EU funds and safeguards on waste exports and incineration.

2.4 Emergence of clean carriers

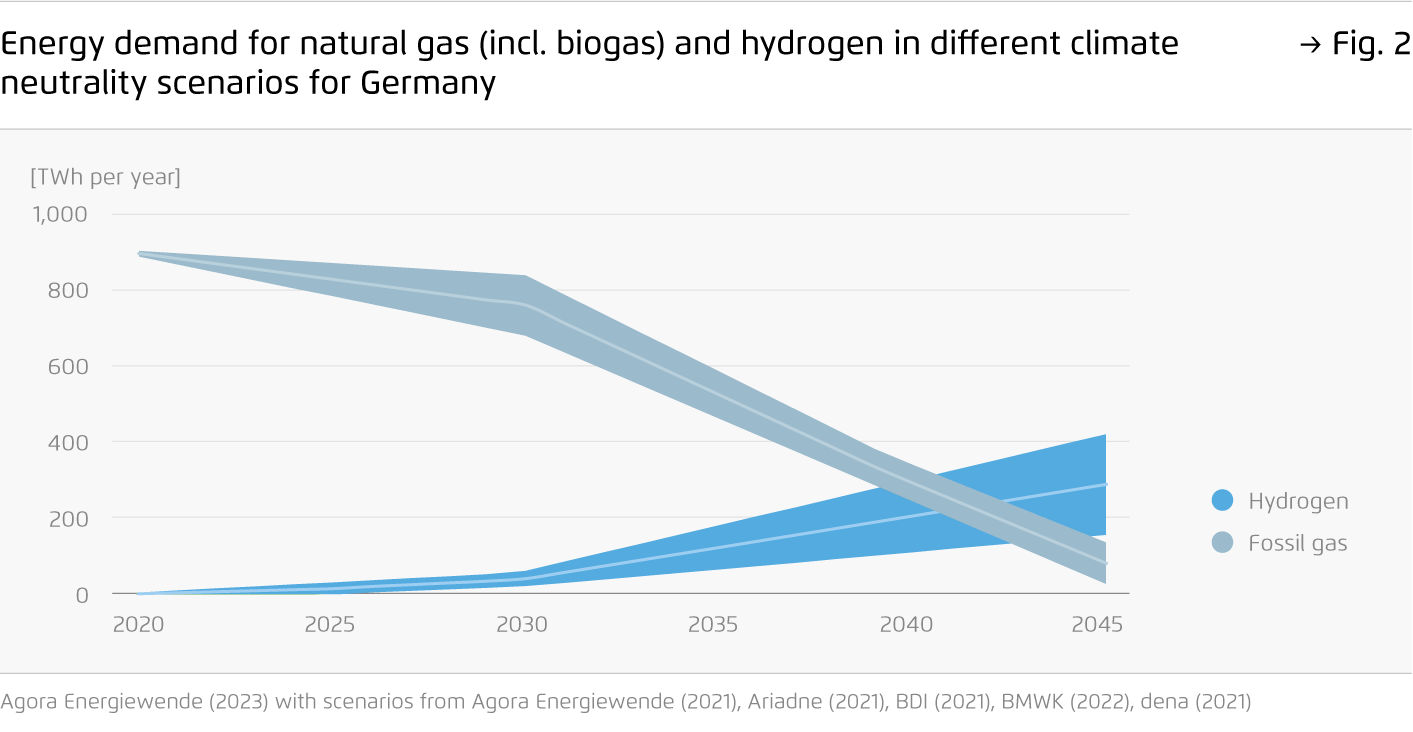

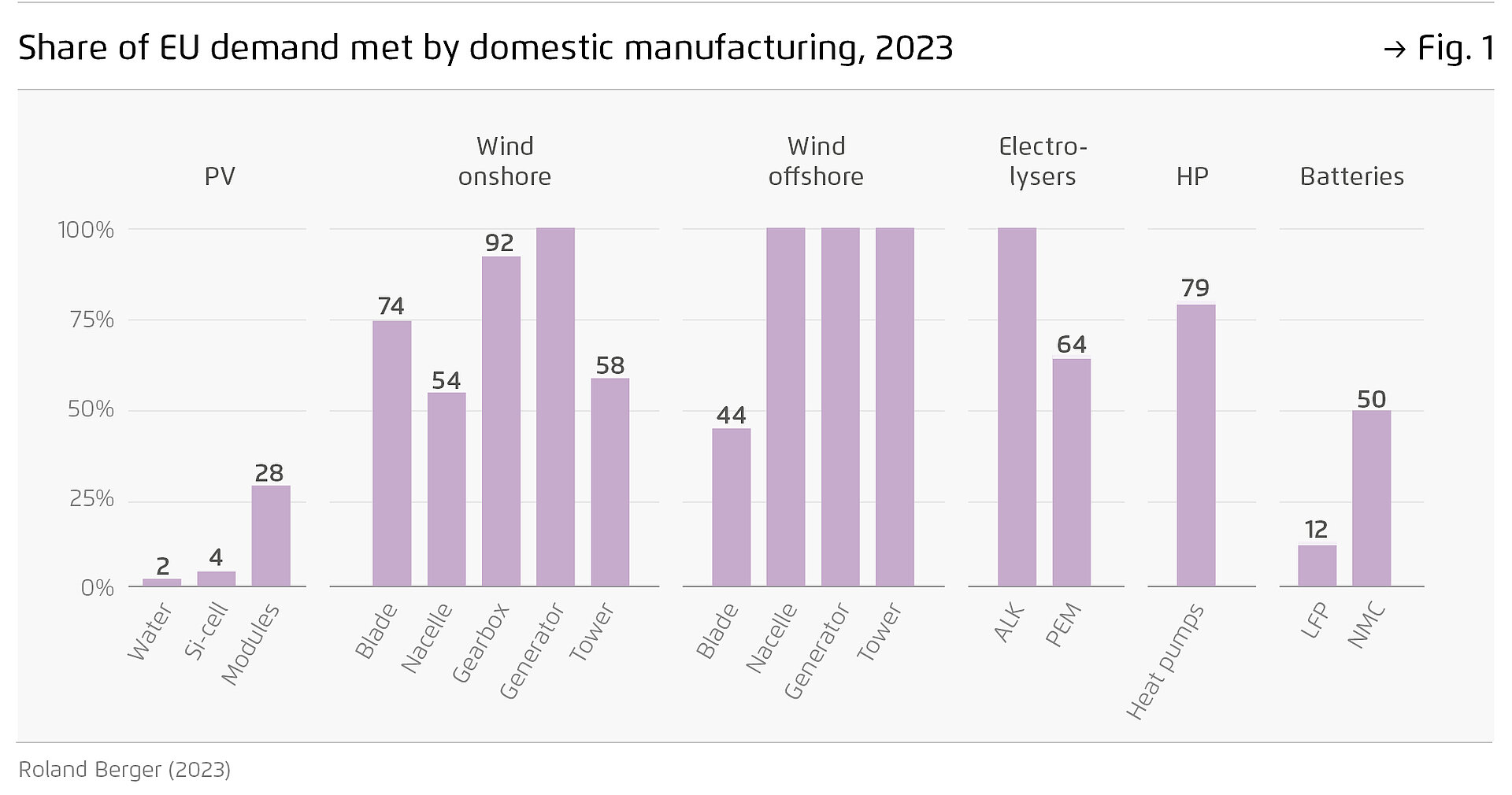

While the mid-transition will enable the EU to substantially reduce its overall energy import needs, demand and imports of clean energy carriers such as hydrogen, hydrogen-based materials and electricity are expected to increase (Figure 2).

Given the high costs of transporting hydrogen by sea, one option is to import electricity and hydrogen via cables and pipelines from neighbouring regions (Agora Industry et al., 2023). However, using fixed infrastructure to import energy creates deep interdependencies and exposes the EU to geopolitical risks related to the exporting and transit countries, and to the potential sabotage of subsea infrastructure.

2.4 Emergence of clean carriers (Fortsetzung)

In the short term, it would be virtually impossible for the EU to replicate the energy security strategies that have typically been in place for a mature trade and transport system for natural gas and apply them to clean carriers. These strategies have included infrastructural redundancies, strategic stockpiling, intra-EU solidarity mechanisms, a shift from long-term contracts to a higher reliance on spot markets, and diversification of the exporters’ base. These approaches took 25-30 years to develop once Europe started importing gas from abroad. By contrast, hydrogen imports are expected to rely – at least initially – on a limited number of suppliers and import infrastructures, while long-term contracts will ensure the bankability of capital-intensive transmission projects (Agora Industry and TU Hamburg, 2023). As the volumes will be small in the coming years (Agora Energiewende, 2023), it will be possible to manage the associated risks effectively.

The main strategy is to limit hydrogen use to ‘no-regret’ options only (Agora Energiewende and Agora Industry, 2021; Agora Industry et al., 2025). Applications where technological alternatives exist should be excluded from hydrogen-related public support and infrastructural planning. Rather than pursuing unrealistic import targets such as those set in the REPowerEU Plan, the EU should define credible no-regret volumes of hydrogen and other carbon-neutral energy imports, domestic production and the storage capacities likely to be needed from the early 2030s onwards.

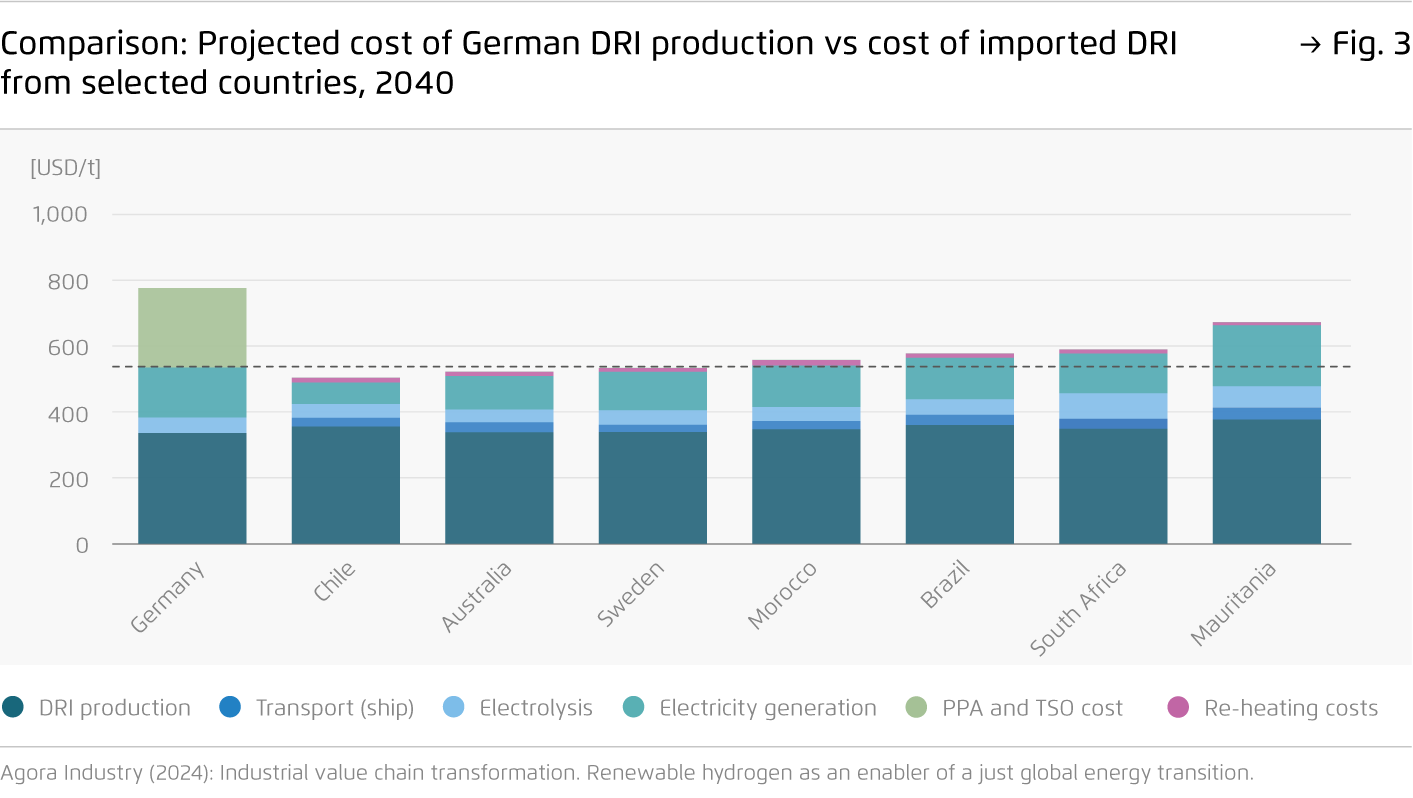

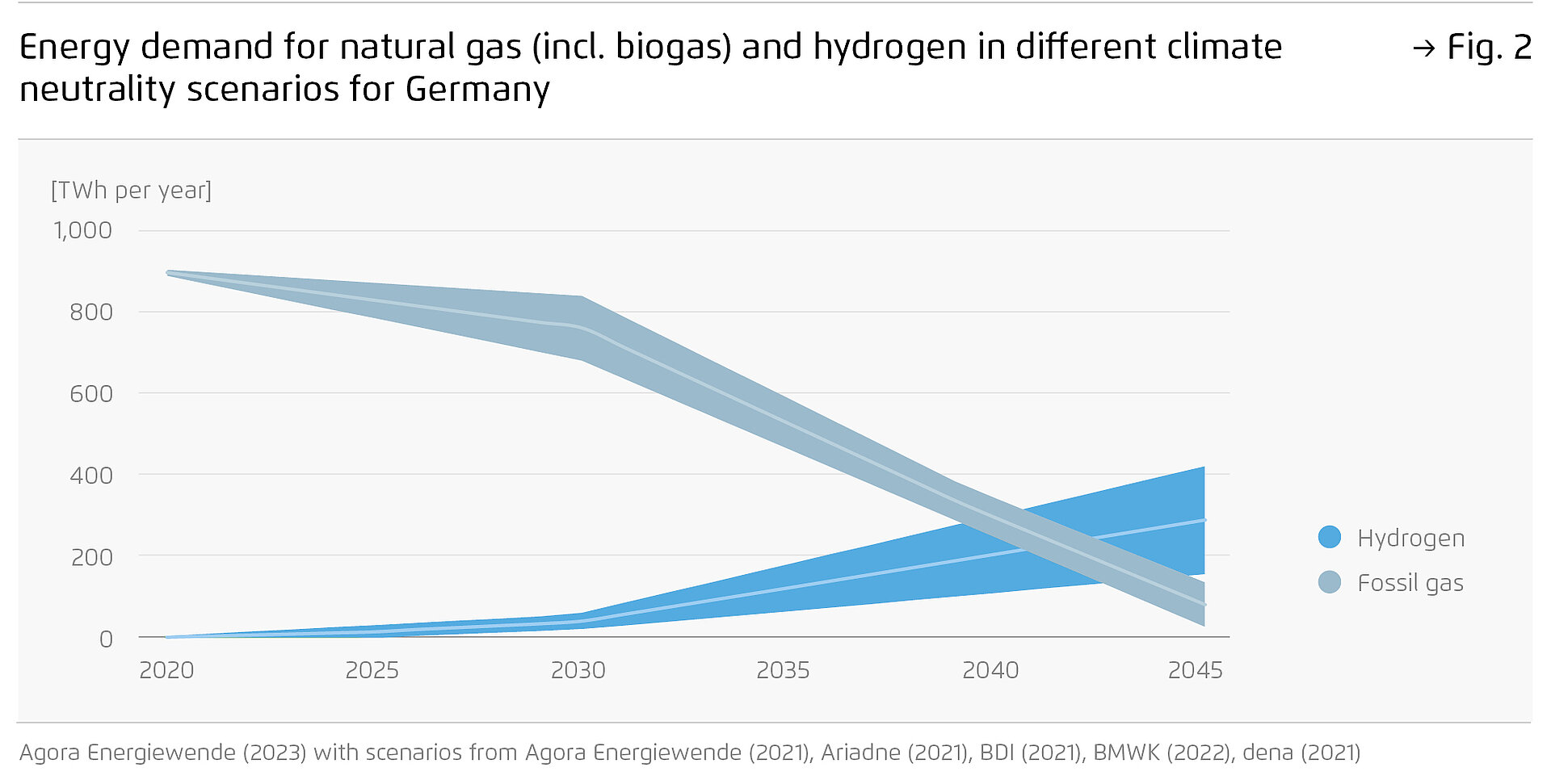

It is possible to further reduce the need for hydrogen imports by prioritising the import of hydrogen embedded in materials such as hot briquette iron (HBI), ammonia or methanol (Agora Industry et al., 2023). The economics of renewable power, hydrogen and derived products (Figure 3) suggest that renewable-rich regions may increasingly attract the most energy-intensive parts of decarbonised industrial value chains (Agora Industry, 2024). Politically stable, resource-rich countries with strong governance and advanced financial and industrial bases may become key locations for such production. As far as Europe is concerned, this shift would support the downstream industrial base by offering access to lower-cost, low-carbon materials rather than producing or importing clean energy to support local primary production. This reconfiguration would enhance energy security by lowering Europe’s direct energy import needs.

In addition, hydrogen trade partners could be selected not only on the basis of comparative advantages, but also of security considerations. An assessment of the geopolitical risks associated with regions from which the EU can import green energy cost-effectively via pipelines or power cables reveals that the wider North Sea region has the lowest risk profile. As members of the European Economic Area (EEA), Norway and Iceland are closely integrated into the EU’s economic and regulatory framework. Furthermore, the UK continues to maintain strong economic, political, cultural and security ties with the EU. By contrast, North Africa – and to an even greater extent the Eastern Mediterranean and Ukraine – involve higher political risks and capital costs. That said, North Africa also offers immense and highly cost-effective solar and wind potential (Global Solar Atlas, 2025; Global Wind Atlas, 2025). Establishing long-term energy and industrial partnerships with the region, aimed first and foremost at supporting the development of local RES capacity, is therefore warranted.

Infrastructural policy can support sufficient flexibility from the early stages if designed with realistic demand assessments in mind. This holds true even if a mature global market does not emerge in the near future. Ammonia can be traded over long distances from a wider number of suppliers and re-converted into hydrogen, though this does entail substantial conversion losses and costs. Nevertheless, it could provide a flexible backup solution for end users of hydrogen. It therefore makes sense to support the development of hydrogen clusters overseas to achieve redundancies in global capacity.

Domestic hydrogen storage should also be prioritised in view of the expected partial shift of seasonal storage from fossil gas to hydrogen. This includes developing large-scale salt caverns or repurposing natural gas storage, as the latter will become underutilised as gas use decreases. Such storage capacities could also be used to meet seasonal clean power storage needs, thus constituting a no-regret option that provides energy security beyond the hydrogen subsystem.

2.4 Emergence of clean carriers (Fortsetzung)

Finally, other renewable carriers are also set to play a role in Europe’s energy security equation. Biogas and biomethane can increase energy security as domestic resources that replace limited amounts of imported natural gas (up to 38 bcm of biomethane by 2050, according to IEA’s Announced Pledges Scenarios (IEA, 2025)). They can support several end uses, such as contributing to power system balancing and seasonal storage or serving as a feedstock in plastic production. When combined with high rates of circularity, this reduces sectoral dependence on imported fuels. However, limited domestic availability and certain security challenges must be addressed. For instance, manure storage may need to be adapted to the seasonal requirements of the power system. In addition, careful infrastructural planning is required to ensure that the limited density of production sites does not lead to an oversized network whose construction and maintenance costs are borne by too few consumers.

3. Managing fossil interdependence in the mid-transition

As clean energy generation increases, the transition will necessarily entail a decline in the use of all fossil fuels. This chapter focuses specifically on natural gas, given that it has been at the core of Europe’s energy security concerns over the last two decades.

In 2023, the EU imported 89 percent of its gas (Eurostat, 2025a) with a value of 154 billion euros, while total fossil fuel imports amounted to 448.7 billion euros. Historically, gas imports have relied on rigid contracts and logistics, making them more prone to disruptions and political manipulation. This vulnerability has been repeatedly exposed in EU-Russia energy relations. More broadly, Europe’s high degree of external dependence and supply concentration has acted as a major barrier to the emergence of unified external positions, as Member States’ energy policy preferences have often diverged according to their degree of exposure, market size and foreign policy orientations (Schmidt-Felzmann, 2011).

Over the last few decades, Europe has reduced its gas supply security predicament by investing in interconnection and other system redundancies. This is evident in improvements in the N-1 index, which measures Member States’ ability to withstand supply shocks [5]. However, physical redundancies can do little to shield the EU from price volatility in a tight global market. Structural resilience requires a fundamental reduction of import dependence.

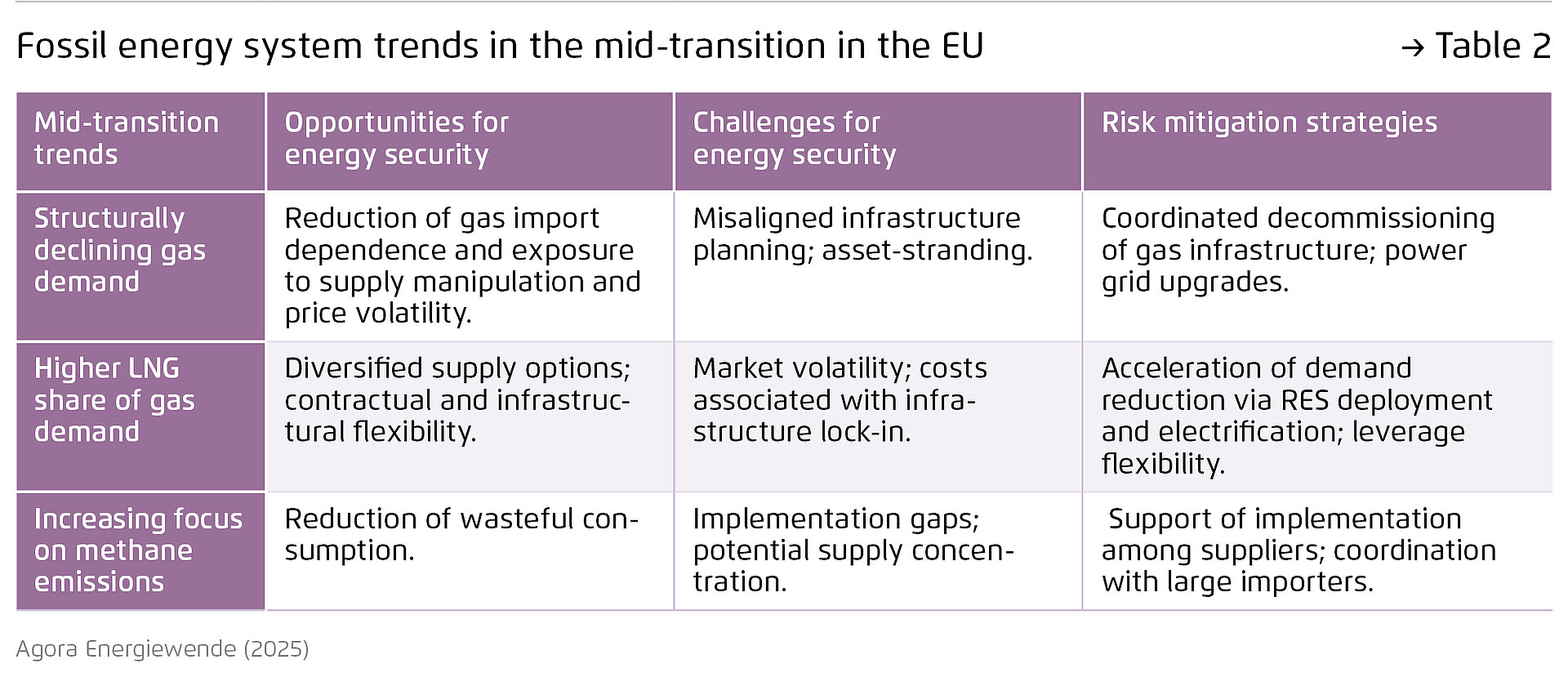

Europe has recently started getting natural gas consumption and imports onto a trajectory of structural decline by deploying renewable energies and increasing energy efficiency. Between 2019 and 2023, gas, coal and oil use in the EU-27 fell by 16, 27 and 7 percent respectively, despite 4 percent growth in GDP (Eurostat, 2025b). Even if part of this reduction was driven by the price elasticity of industrial demand and mild winters, additional wind and solar capacity saved 92 bcm of fossil gas between 2019 and 2024 (Ember, 2025b), accounting for 41.2 percent of the cumulative gas demand reduction over the same period. While the shift from fossil fuels to renewables and growing electrification delivers significant strategic advantages – such as reduced geopolitical vulnerability – it also introduces a number of operational and planning challenges that need to be carefully managed. Key trends include structural demand decline, growing LNG reliance and a policy focus on methane emissions. These intersect with energy security in complex ways, requiring coordinated phase-out planning, demand-side strategies and smarter regulation to ensure long-term resilience and policy credibility.

3.1 Structurally declining gas demand and sectoral demand shifting

To achieve the EU climate targets for 2030 and the proposed 90 percent emission reduction target for 2040, it will be necessary to accelerate the structural decline of domestic gas demand by further stepping up the deployment of renewables, widespread electrification and energy efficiency (European Commission, 2024). Based on the announced policies, gas demand should decline to 184-264 bcm in 2030 and then reach 90-116 bcm by 2040 (IEA, 2024; European Commission, 2024). Under the policy pathway targeting a 90 percent emission reduction by 2040, residential heating’s share of final energy consumption is expected to decline over the next decade. As a result, industrial furnaces, the use by the chemical industry of carbon as a feedstock and power generation balancing are likely to account for a larger share of gas use during the mid-transition period, until such time as residual gas demand is gradually replaced by alternative fuels and feedstocks such as hydrogen, hydrogen derivatives and biomass (European Commission, 2024).

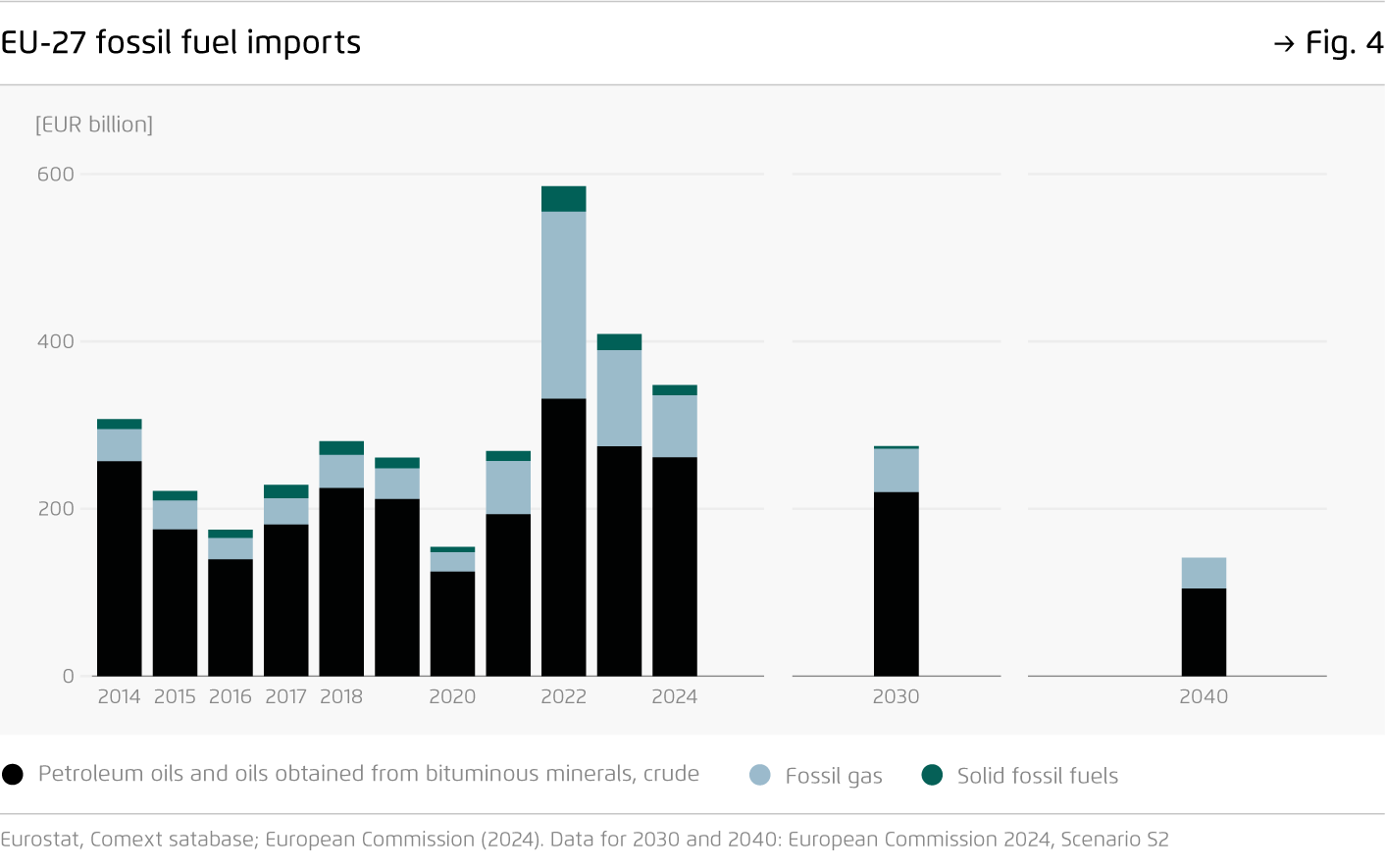

Declining gas demand, and indeed declining fossil fuel demand in general, reveals synergies between decarbonisation and energy security. The implementation of the Fit for 55 package would bring the EU’s energy import dependence down to 50 percent by 2030. Achieving a 90 percent emission reduction by 2040 would further reduce it to around 30 percent (European Commission, 2024). By reducing imports, the shift towards domestic renewables and electrification would redirect the significant economic resources that have traditionally gone into funding foreign – and often adversarial – fuel exporters (around 295 billion euros annually between 2014 and 2024 – roughly equalling the estimated annual investment required in grid and power sector transformation between 2031 and 2040, according to the European Commission (2024)) into investing in domestic system resilience and cost reduction, especially after 2030 (Figure 4). Remarkably, the massive price fluctuations seen over the last decade have had a profound impact on Europe’s households and businesses. This volatility was caused predominantly by external factors, including the US shale gas revolution (from 2014 onwards), OPEC’s supply cuts (2016), Covid (2020) and Russia’s supply manipulations and war (2021-2022). Reduced reliance on fuel imports would support Europe’s quest for strategic autonomy and increase the predictability of energy costs, as upfront investment accounts for the lion’s share of the overall costs of a renewables-based energy system.

However, mid-transition trade-offs may arise, particularly pertaining to infrastructure planning. While some gas distribution system operators are planning ahead, announcing for example phase-out dates, others are still basing their system planning on gas demand projections based on past growth. This misalignment gives rise to supply security risks by undermining the investment certainty for necessary alternatives – such as the expansion of power networks, district heating networks, power and heat storage – which arguably constitute the backbone of energy security in decarbonised systems. It also introduces price risks. Declining demand needs a planned, orderly phase-out of gas infrastructure, as high fixed costs will otherwise be left spread over a shrinking customer base. This could raise the costs of maintaining gas supply security for those consumers still dependent on gas supplies for longer.

To minimise this trade-off, action should include the planned decommissioning of gas infrastructure wherever feasible, as well as a targeted focus on end-use sectors that might need natural gas for longer or have no viable alternatives to clean molecules.

Crucially, such action requires a high degree of cross-border coordination, namely at the level of the regional gas groups identified by Regulation (EU) No. 994/2010. Certain EU countries still face a significant mismatch between gas system planning and the rapidly decreasing demand anticipated during the energy transition (RAP and Öko Institut e.V., 2024). In a highly interconnected system based on the free flow of gas across borders, an uncoordinated phase-down risks creating costly redundancies in parts of the gas system while simultaneously undermining the EU’s ability to develop critical redundancies in the electricity grids where they are most needed. A common timeline for gas infrastructure decommissioning will allow for better planning of power system upgrades across regions.

3.2 Higher dependence on LNG

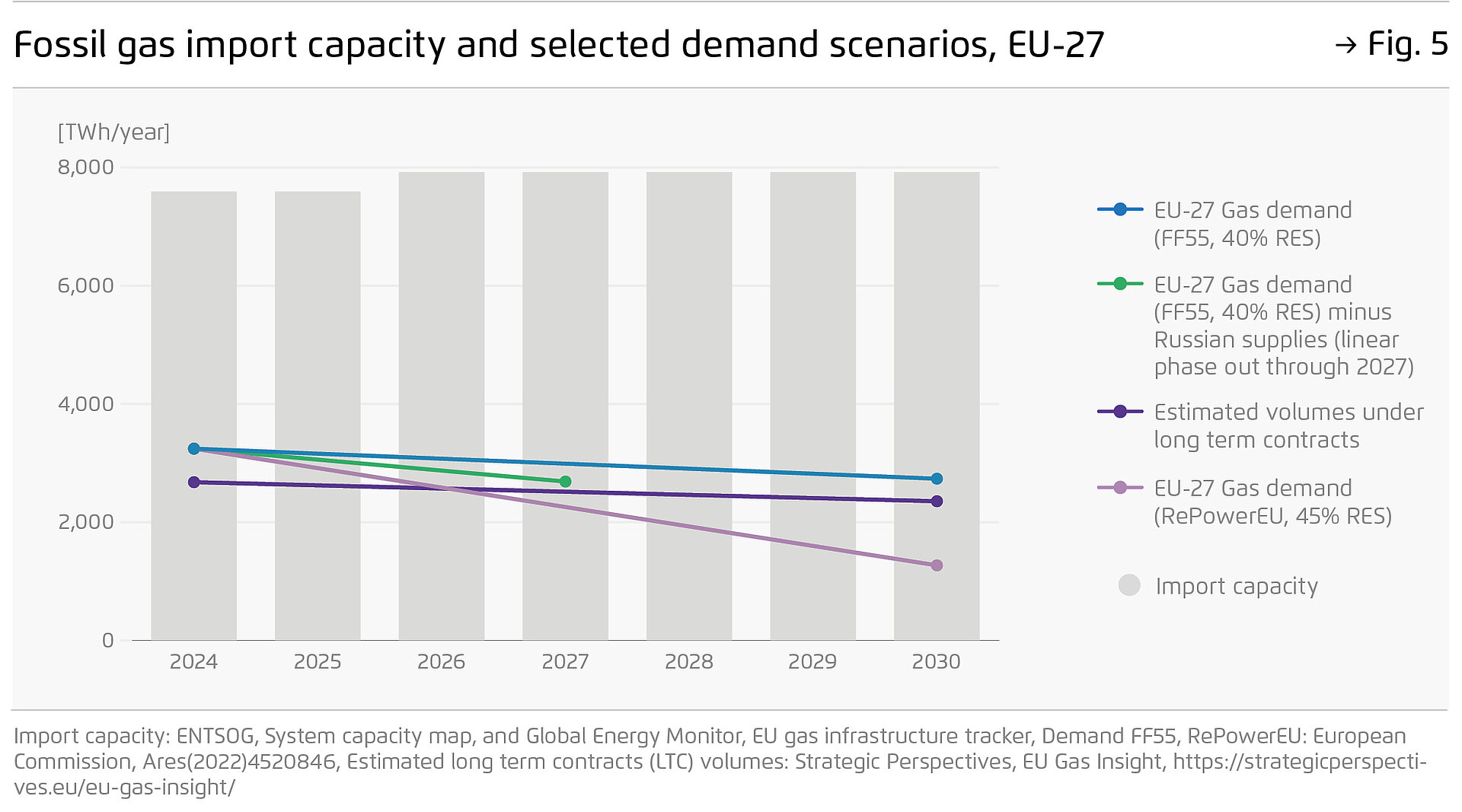

As the EU enters the mid-transition phase, its reliance on LNG supplies is increasing. Between 2021 and 2024, LNG’s share of the EU’s natural gas imports rose from 20 to 37 percent (European Commission, 2025c).

Greater reliance on global LNG markets exposes European buyers to higher prices and volatility. While market conditions are set to become less tight in the coming years as new LNG export capacity comes onstream (IEA, 2024), the expected price relief is subject to mid-term uncertainties. These include the demand outlook in Asia, a slower-than-expected RES deployment and the application or withdrawal of secondary sanctions on Russia. Under tighter market conditions, unpredictable events such as unforeseen supply outages, attacks on physical infrastructures, natural disasters, nuclear accidents or capacity withdrawals can trigger instability on spot markets. On a more strategic level, it should be noted that Russia is set to expand its presence in global LNG markets, largely as a result of its losing the European market outlet for West Siberian gas. As such, even once an intended ban on Russian gas has been adopted, Europe’s increasing reliance on LNG might still benefit Russia indirectly – or even directly if triangulations develop in the future as was the case following the recent reconfiguration of oil supply chains.

How such volatility might affect the climate-energy security interplay in Europe is difficult to predict. In principle, elevated gas prices would incentivise consumers to accelerate the transition to alternative energy sources. However, the continued role that gas plays in marginal price-setting within electricity markets means that higher gas prices tend to inflate power prices overall. Consequently, the economics of electrification will remain challenging in the short term, underscoring the need for policy action to address barriers (see Section 3.1.2). In its turn, a low-price outlook – while seemingly positive for energy security in the short term – may encourage reinvestments in gas-burning appliances. This could result in a carrier being locked in that may become more expensive at a later stage [6], and indeed over a time horizon that is incompatible with decarbonisation efforts. That said, such volatility can take a huge toll on households and businesses. Efforts to accelerate the phasedown of fossil gas thus constitute a no-regret action for both climate and energy security priorities.

3.2 Higher dependence on LNG (Fortsetzung)

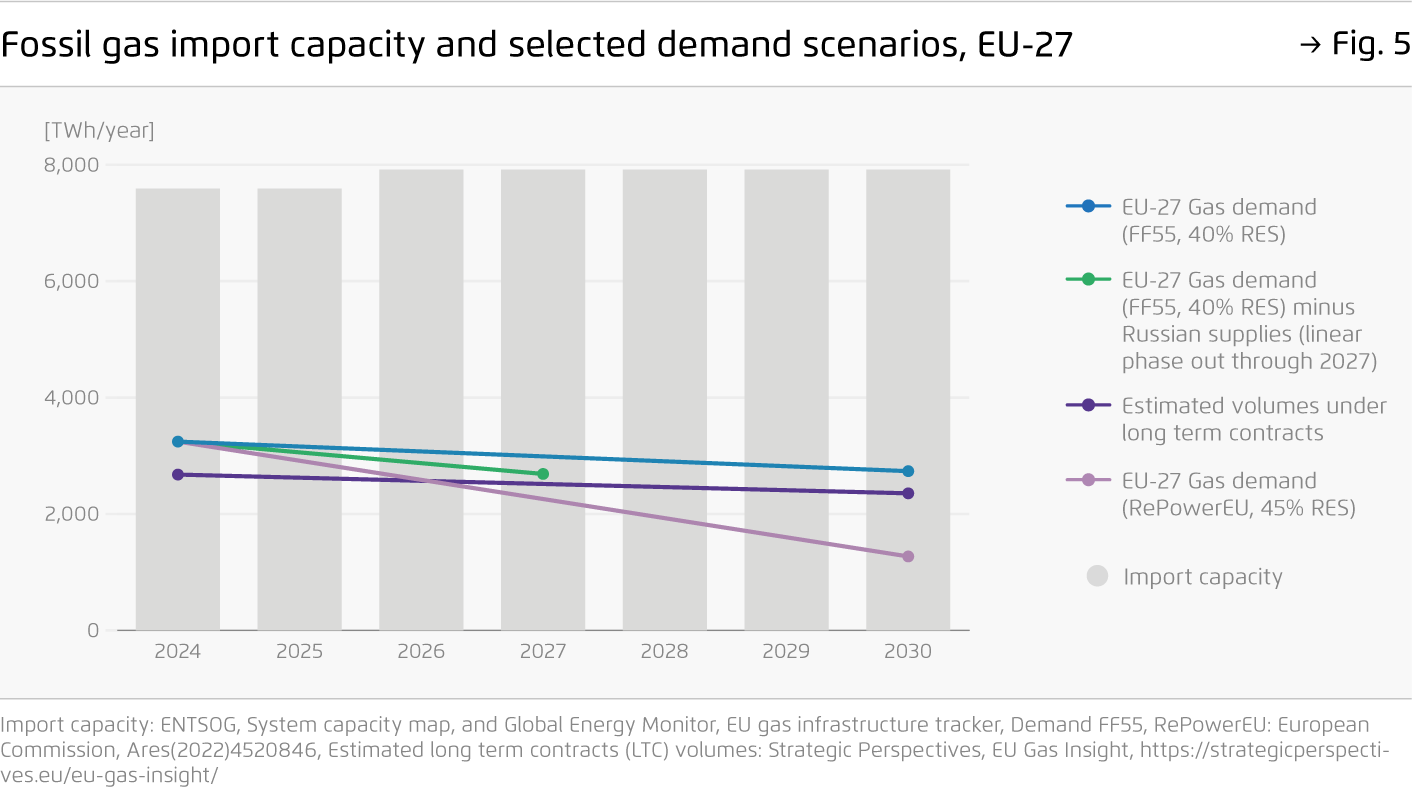

Against this backdrop, a supply-side approach to gas security has been resurfacing in Europe as a result of the 2022 energy crisis, which sparked investment in new gas import infrastructure beyond the level of projected demand (Figure 5). Meanwhile, policymakers often regard the consolidation of EU-US LNG trade as vital to mitigate the current account imbalance and defuse the risk of a trade war arising under the Trump administration. As part of a recent agreement between the EU and the US, the EU made an indicative commitment to buy US energy products worth 750 billion euros in the coming three years. This sum appears deeply unrealistic given US supply capacities and EU demand realities; what is more, it is not yet clear which mechanisms would be used to support this objective, though they could include, for gas, EU-backed investment in liquefaction capacity (European Commission, 2025b), greater mobilisation of joint gas procurement and member states or companies committing to long-term supply contracts with American partners.

The aforementioned renewed focus on gas supply risks compromising both energy security and climate objectives. It threatens to lock in expensive supplies just as market conditions are expected to ease. It may inadvertently incentivise investments in gas assets with limited long-term viability. This would expose consumers to stranded costs or lock in gas-fired appliances. In the process, it would increase external dependence on actors that are showing a growing propensity to employ economic coercion. In addition, adopting more of a supply side approach would erode the EU’s credibility as a global climate leader, weakening one of its main negotiating levers in international climate diplomacy.

A better option for mitigating the aforementioned risks is to focus on demand-side measures. The EU’s stated goal of phasing out Russian LNG supplies – which amounted to 22.8 bcm in 2024 – could be more effectively achieved via the demand side. This volume represents 11.2-43.8 percent of the expected reduction in gas consumption between 2024 and 2030, depending on modelled renewables deployment scenarios to achieve a 55% emission reduction by 2030 (Figure 5) [7]. The EU should therefore fully incorporate demand side projections into its energy security considerations. Crucially, for long-term contracts likely to be signed in the coming years, flexibility options (reduced duration, resale possibility) should be fully explored. Given the oversupply forecast as of 2026/27, the coming years will offer a favourable context for such terms.

3.3 Increased awareness of methane emissions

A third key trend concerns the growing awareness of the global warming potential of fugitive methane emissions across the natural gas supply chain. The EU has established a regulatory framework to mitigate domestic methane emissions and, from 2030 onwards, to enforce maximum methane intensity thresholds for imported fossil fuels (Regulation (EU) 2024/1787).

It is not clear exactly how this increasing focus on methane leaks interacts with energy security considerations. On the one hand, improving the collection of fugitive methane is synergistically beneficial when it comes to achieving climate and energy security objectives. On the domestic level, a less wasteful supply chain means a reduced need for imports. Externally, the improved collection of fugitive emissions could increase suppliers’ available resources and ability to fulfil long-term contractual obligations with foreign gas buyers (IEA, 2024b). On the other hand, the external dimension of the EU Regulation – introducing a system to monitor the methane intensity of energy imports and, at a later stage, an intensity threshold for new supply contracts – could give rise to energy security concerns, especially if such high standards were to restrict Europe’s supply base, thus leading to increased supply concentration. While Europe relies on some suppliers with a low methane emission intensity record such as Norway, it is also dependent on countries with a worse record, such as the US, Qatar and Algeria (IEA, 2024b).

The present geopolitical context may present challenges for the Regulation’s implementation. This applies in particular to the US, where the Trump administration is dismantling US policies to mitigate methane emissions and pressuring the EU to water down the Regulation and import more LNG from the US (Argus, 2025). In addition to these implementational challenges, the idea of adjusting EU rules was also floated in the context of broader trade negotiations with the US (Reuters 2025).

However, delaying or weakening the implementation of EU methane rules would not necessarily be beneficial for EU security of supply. Concerns about the impact of the Regulation on EU gas security may stem from misunderstandings about its actual requirements. Methane intensity thresholds will not be defined before 2029 and will apply only to contracts signed after July 2030. By that time, LNG forecasts envisage a situation of market oversupply, which should ease concerns around supply security. In addition, any weakening of the framework would create an uneven playing field for both European producers and foreign suppliers – including in the US (Reuters, 2025) – that have already invested in procedures to align with EU standards.

Increasing regulatory and technical assistance to developing countries with a view to supporting their efforts to curb methane emissions is thus a better option when it comes to aligning climate and energy security. In a parallel step, the EU should step up its cooperation with other major LNG-importing countries – such as Japan, South Korea and China – to share best practices and form a buyer alliance with the aim of preventing substitution effects.

4. Conclusions: redefining energy security for the mid-transition

In the mid-transition, a distinct set of challenges for the EU’s domestic and external energy security is set to emerge. These challenges relate to the functioning of a more electrified and digitalised energy system, the emergence of new material and clean energy interdependences and the decline of fossil fuel interdependences.

Overall, these challenges are more manageable for Europe than those more closely associated with a fossil fuels-based energy order. Notably, they require domestic action and policy measures in areas where the EU has important power resources – in contrast to its more fragmented agency in securing foreign fuel supplies.

However, to effectively navigate an energy order shaped by technological change and geopolitical uncertainty such as that which characterises the mid-transition, the EU’s energy security concept requires modernisation. According to the International Energy Agency’s widely cited definition, energy security means the “uninterrupted availability of energy sources at an affordable price” (IEA, n.d.). This view is echoed in foundational EU policy documents such as the European Energy Security Strategy of 2014 (European Commission, 2014), which reflects a supply-centric, static and foreign fuels-focused approach. By contrast, a concept adapted for the mid-transition requires three main characteristics: systemic, dynamic and focused on resource-resilience.

Systemic – Traditional energy security has prioritised access to large volumes of fossil fuels at affordable prices. However, energy carriers are not an end but a means of delivering energy services. Given that electrification, renewable energy and efficiency measures reduce and alter the total amount of primary energy required to meet these needs, security should be redefined in terms of securing energy services to final consumers rather than specific fuel supplies. It should incorporate the role played by both the demand and the supply side. A future-proof energy security concept must adopt a system perspective that values low vulnerability at the systemic level. This approach involves a broader range of policy areas encompassing trade, development aid, industrial, defence and digital policy, alongside more traditional energy policy tools, bringing to the fore the challenge of policy integration as these policy areas have their own set of competing incentives.

Dynamic – Europe is entering the most complex phase of its energy transition. Energy security must therefore evolve into a dynamic concept that anticipates vulnerabilities and adapts accordingly. In this evolving context, not all redundancies are equal. Investments in fossil infrastructure provide counterproductive incentives to final users and economic actors and may soon prove obsolete, as RES and electrification can rapidly reduce gas demand. By contrast, carefully targeted redundancies in clean energy, such as transmission upgrades, battery storage and digital controls, increase energy security and are likely to prove essential over time. Dynamic energy security requires emerging gaps to be identified early on and temporary challenges to be differentiated from structural shifts. The growing reliance on electricity for heating for example will reduce gas needs while simultaneously increasing seasonal and weekly fluctuations in electricity demand. System-wide foresight and investment can help address this.

Focused on resource-resilience – Since 2022, the external dimension of the EU’s energy security policy has been driven by the urgent need to reduce dependence on Russian gas imports. While short-term supply diversification addressed immediate vulnerabilities, it did not reduce structural import dependencies. A resource-resilient approach reduces exposure to geopolitical shocks by enhancing the EU’s capacity to meet its energy needs with domestic renewable energy sources. This entails developing robust supply chains that leverage strategic partnerships and the growing share of critical material stocks already embedded in EU energy systems. In summary, a resource-resilient energy system is one that is less dependent on any single external actor, more capable of absorbing shocks and more autonomous in achieving its energy objectives.

Energy security in the 21st century must move beyond the legacy of fossil fuel supply and embrace a more integrated, forward-looking framework. A systemic, dynamic and resource-resilient approach provides the foundations for a secure, sustainable and autonomous energy future. This shift is not only about reacting to crises. It is about building a system capable of thriving in the face of rapid technological, environmental and geopolitical change.

Footnotes

1 As originally defined by Gruber and Hastings-Simon, the mid-transition period is defined as “the time span during which low-carbon and fossil-based energy and industrial socio-technical regimes are both undergoing rapid transformation, co-exist on a large scale, and operate in a highly contested space, which causes new or exacerbates existing instabilities and volatility of global energy markets, with knock-on effects on the global economy” (Grubert and Hastings-Simon, 2022). In the EU context, which constitutes the geographical scope of this paper, we consider this phase to mean spanning the period 2025 to 2045, based on existing policy frameworks.

2 The black start capacity refers to a power generation unit’s ability to restart after a complete shutdown without external sources.

3 Assumed gas prices based on 2023 TTF price: 41.40 euros per MWh.

4 Modelled final energy consumption includes ambient and waste heat; fuel consumption includes both energy and non-energy use.

5 Regulation (EU) No. 994/2010 on security of gas supply requires Member States to comply with the infrastructure standard (N-1 formula). The N-1 formula is used to estimate whether the gas infrastructure in an area of study has sufficient technical capacity to satisfy total gas demand in the event of disruption of the single largest gas infrastructure during a day of exceptionally high gas demand occurring with a statistical probability of once in 20 years. To comply with the standard, a result equal to or greater than 100% is required.

6 Under current policy scenarios and investment pipelines, the global LNG market may become tight again between 2035 and 2040, and undersupplied thereafter (IEA, 2024).

7 Scenarios range from the Fit for 55 scenario with 40% RES deployment to a RePowerEU scenario with 45% RES deployment. Intermediate scenarios include RePowerEU with the REDIII target of 42.5% RES deployment and Agora’s own GEXIT scenario (Source: Ares (2022) 4520846, “Non paper on complementary economic modelling undertaken by DG ENER analysing the impacts of overall renewable energy target of 45% to 56% in the context of discussions in the European Parliament on the revision of the Renewable Energy Directive”; Agora Energiewende, 2022).

Bibliographical data

Downloads

-

Policy Brief

pdf 518 KB

Europe’s energy security on the path to climate neutrality

Devising a resilience strategy for the mid-transition

All figures in this publication

Share of EU demand met by domestic manufacturing, 2023

Figure 1 from Europe’s energy security on the path to climate neutrality on page 10

Energy demand for natural gas (incl. biogas) and hydrogen in different climate neutrality scenarios for Germany

Figure 2 from Europe’s energy security on the path to climate neutrality on page 13